Question

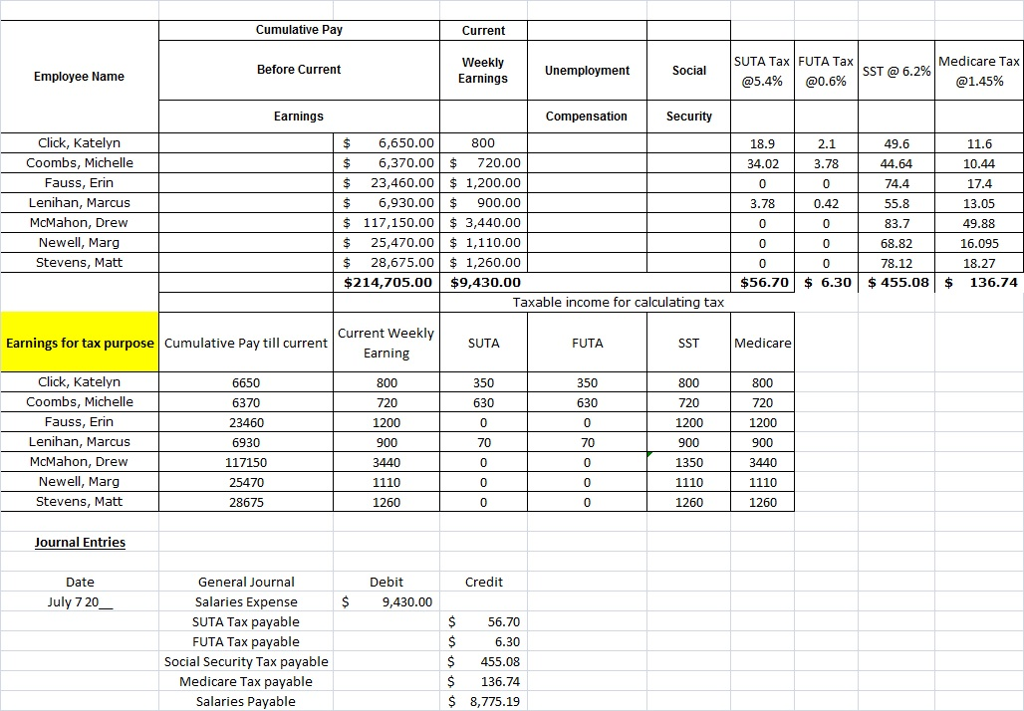

My question comes from the previous posting, I don't understand the calculations for mcmahon,m drew for the social security tax? home / study / business

My question comes from the previous posting, I don't understand the calculations for mcmahon,m drew for the social security tax?

home / study / business / finance / questions and answers / calculating payroll taxes expense and preparing ...

Your question has been answered

Let us know if you got a helpful answer. Rate this answer

Question: Calculating Payroll Taxes Expense and Preparing Jo...

Bookmark

Calculating Payroll Taxes Expense and Preparing Journal Entry

1. Calculate the total employer payroll taxes for these employees. Round all your calculations, including your answer, to the nearest cent.

2. Prepare the journal entry to record the employer payroll taxes as of July 7, 20--. Round your answers to the nearest cent. If an amount box does not require an entry, leave it blank.

Selected information from the payroll register of Ebeling's Dairy for the week ended July 7, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. Social Security tax on the employer is 6.2% on the first $118,500 of earnings, and Medicare tax is 1.45% on gross earnings.

| Taxable Earnings | |||||

| Employee Name | Cumulative Pay Before Current Earnings | Current Weekly Earnings | Unemployment Compensation | Social Security | |

| Click, Katelyn | $6,650 | $800 | |||

| Coombs, Michelle | 6,370 | 720 | |||

| Fauss, Erin | 23,460 | 1,200 | |||

| Lenihan, Marcus | 6,930 | 900 | |||

| McMahon, Drew | 117,150 | 3,440 | |||

| Newell, Marg | 25,470 | 1,110 | |||

| Stevens, Matt | 28,675 | 1,260 | |||

Required:

i don't understand how to get the unemployement amount for each person?

Expert Answer

Anonymous answered this

Anonymous answered this

Was this answer helpful?

0

0

269 answers

View comments (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started