Answered step by step

Verified Expert Solution

Question

1 Approved Answer

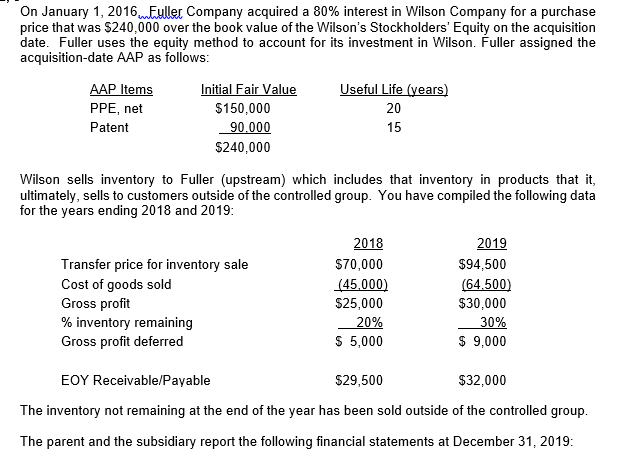

My question is how do you get the $75,000 in the NCI Income, net Amort of AAP? On January 1, 2016,Euler Company acquired a 80%

My question is how do you get the $75,000 in the NCI Income, net Amort of AAP?

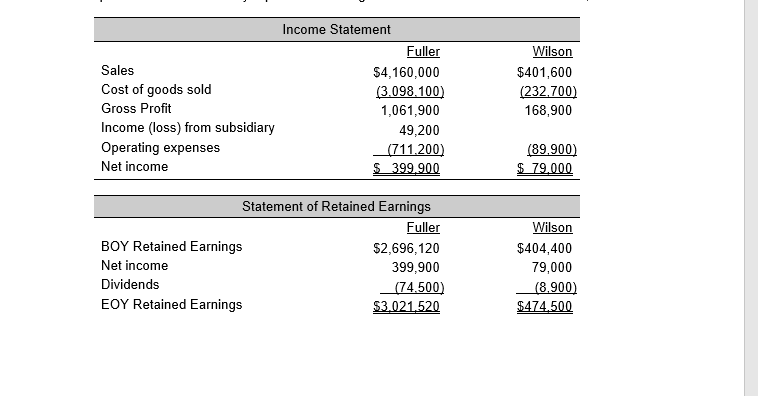

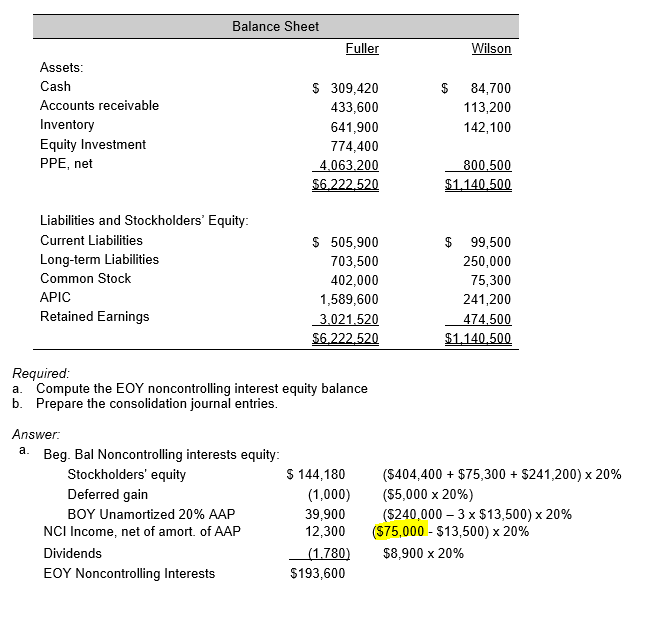

On January 1, 2016,Euler Company acquired a 80% interest in Wilson Company for a purchase price that was $240,000 over the book value of the Wilson's Stockholders' Equity on the acquisition date. Fuller uses the equity method to account for its investment in Wilson. Fuller assigned the acquisition-date AAP as follows AAP Items PPE, net Patent $150,000 90,000 $240,000 Useful Life (years) 20 Wilson sells inventory to Fuller (upstream) which includes that inventory in products that it, ultimately, sells to customers outside of the controlled group. You have compiled the following data for the years ending 2018 and 2019 Transfer price for inventory sale Cost of goods sold Gross profit % inventory remaining Gross profit deferred 2018 $70,000 (45.000) $25,000 2019 $94,500 (64.500) $30,000 $ 5,000 $ 9,000 EOY Receivable/Payable $29,500 $32,000 The inventory not remaining at the end of the year has been sold outside of the controlled group The parent and the subsidiary report the following financial statements at December 31, 2019 Income Statement Fuller Wilson $401,600 (232.700) 168,900 Sales Cost of goods sold Gross Profit Income (loss) from subsidiary Operating expenses Net income $4,160,000 1,061,900 49,200 (89.900) Statement of Retained Earnings BOY Retained Earnings Net income Dividends EOY Retained Earnings Fuller $2,696,120 399,900 (74,500 $404,400 79,000 Balance Sheet Fuller Wilson Assets Cash Accounts receivable Inventory Equity Investment PPE, net $ 309,420 433,600 641,900 774,400 $ 84,700 113,200 142,100 Liabilities and Stockholders' Equity Current Liabilities Long-term Liabilities Common Stock APIC Retained Earnings $ 505,900 703,500 402,000 1,589,600 $99,500 250,000 75,300 241,200 Required. a. Compute the EOY noncontrolling interest equity balance b. Prepare the consolidation journal entries Answer: Beg. Bal Noncontrolling interests equity Stockholders' equity Deferred gain BOY Unamortized 20% AAP $ 144, 180 (1,000) 39,900 12.300 -(1780) $193,600 ($404,400 + $75,300 + $241,200) x 20% ($5,000 x 20%) ($240,000-3 x $13,500) x 20% NCI Income, net of amort, of AAP Dividends EOY Noncontrolling Interests ($75.000-$13.500) x 20% $8,900 x 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started