Question: My question is on how to do 26- finding the efn if the firm wants too keep d/e ratio constant. The information is commimg from

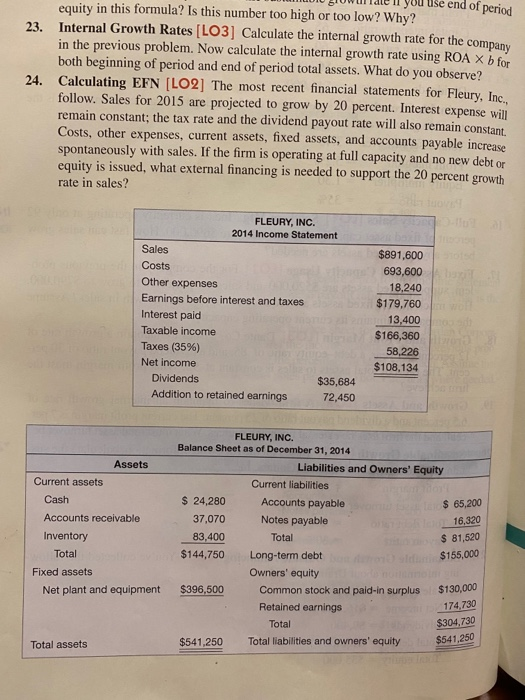

23. Juul Liu un period equity in this formula? Is this number too high or too low? Why? Internal Growth Rates (LO3] Calculate the internal growth rate for the companu in the previous problem. Now calculate the internal growth rate using ROA X b for both beginning of period and end of period total assets. What do you observe? Calculating EFN (LO2] The most recent financial statements for Fleury. Inc follow. Sales for 2015 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debtor equity is issued, what external financing is needed to support the 20 percent growth rate in sales? FLEURY, INC. 2014 Income Statement Sales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Net income Dividends $35,684 Addition to retained earnings 72,450 $891,600 693,600 18.240 $179,760 13,400 $166,360 58,226 $108,134 Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment FLEURY, INC. Balance Sheet as of December 31, 2014 Liabilities and Owners' Equity Current liabilities $ 24,280 Accounts payable $ 65,200 37,070 Notes payable 16,320 83,400 Total $144,750 Long-term debt Owners' equity $396,500 Common stock and paid-in surplus $130,000 Retained earnings 174.730 Total $541.250 Total liabilities and owners' equity $ 81,520 $155,000 $304,730 $541,250 Total assets Chapter 4 Long Term Financial Planning and Growth 25. Capacity Usage and Growth [LO2] In the previous problem, suppose the firm was operating at only 80 percent capacity in 2014. What is EFN now? X 26. Calculating EFN [LO2] In Problem 24, suppose the firm wishes to keep its debt- equity ratio constant. What is EFN now? X 27. EFN and Internal Growth [LO2, 3] Redo Problem 24 using sales growth rates CHALLENG of 15 and 25 percent in addition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, and use this graph to determine the relationship (Questions 2 between them. At what growth rate is the EFN equal to zero? Why is this internal growth rate different from that found by using the equation in the text? 28. EFN and Sustainable Growth [LO2, 3] Redo Problem 26 using sales growth rates of 30 and 35 percent in addition to 20 percent. Illustrate graphically the re- lationship between EFN and the growth rate, and use this graph to determine the relationship between them. At what growth rate is the EFN equal to zero? Why is this sustainable growth rate different from that found by using the equation in the text? Constraints on Growth (LO3) Volbeat, Inc., wishes to maintain a growth rate of 12 percent per year and a debt-equity ratio of 35. Profit margin is 6.1 percent, and the ratio of total assets to sales is constant at 1.80. Is this growth rate possible? To answer, determine what the dividend payout ratio must be. How do you interpret the result? 30. EFN [LO2] Define the following: S = Previous year's sales A = Total assets E = Total equity g = Projected growth in sales PM = Profit margin b = Retention (plowback) ratio Assuming all debt is constant, show that EFN can be written as follows: EFN = -PM(S) + (A - PM(S)) Xg Hint: Asset needs will equal A X g. The addition to retained earnings will equal PM(S) X (1 + g). 31. Growth Rates [LO3] Based on the result in Problem 30, show that the internal and sustainable growth rates are as given in the chapter. Hint: For the internal growth rate, set EFN equal to zero and solve for g. Sustainable Growth Rate [LO3] In the chapter, we discussed the two versions of the sustainable growth rate formula. Derive the formula ROE X b from the formula given in the chapter, where ROE is based on beginning of period equity. Also, derive the formula ROA X b from the internal growth rate formula. ADICA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts