Question

**MY QUESTION** Why is the $200 dollar difference from 'wages payable' taken into account when completing the statement of cash flows but the $13,000 spent

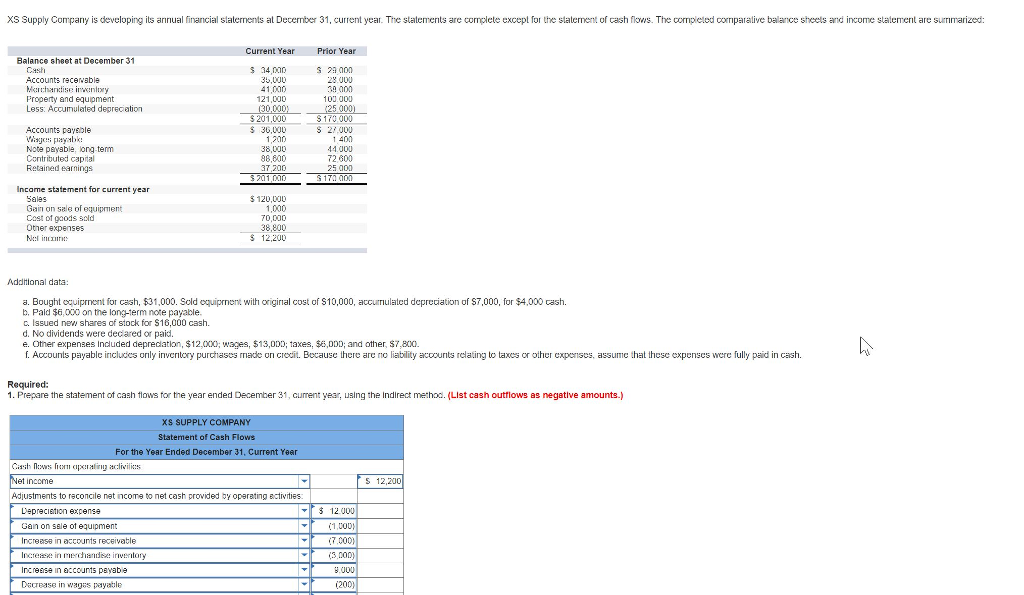

**MY QUESTION** Why is the $200 dollar difference from 'wages payable' taken into account when completing the statement of cash flows but the $13,000 spent in wages (under other expenses), does not seem to be? This appears to contradict the 'depreciation expense', which in the balance sheet amounted to $5,000 of accumulated depreciation plus $7,000 from equipment in the footnote, and thereby totaling $12,000. (In other words, the depreciation expense described in the Income Statement was $12,000 and this matched the $12,000 from the balance sheet ($5,000 plus $7,000).

XS Supply Cmpany is developing its annual financial stalenents al December 31, crreyear. The statements are complete except for the statee of cash ows. The onpeted corniparalive balance sheels and income statement are suimarize: Current Year Prior Year Balance sheet at December 31 Cash Accounts rece able 2000 28 00 34 M0 3,00 41,000 121,000 hase ixnly Property and equipment Less: Accumulated deprecation 102 00 25 000 170 000 S 22 000 1400 44 00 72,600 000 201,000 36,00 Accounts payeble Nota psyable, long tem Contributed capital Retained earnings 98,800 37,200 Incame statement for current year alas Gain on sale of equipment Cost of gcods sold Other expenses 5 120,000 1,000 70,000 S 12,200 Addtional data: a. Bought qipt for cash, $31,000. Scld quiprnen with origirnal cost of S10,000, accurulated depreciation of S7,000, for $4,000 cash. b. Pald $6,000 on the long-term note payable c. Issued neww shares of stock for $16,000 cash. d. No dividends were dec ared or paid. e. Other expenses Indluded depredation, $12,00 wages, $13,00; axes, $,0DD; and other, S7,800. f. Accounts payable incluces ornly inveritery purchases ade on crecit. Bocause there are liability aouts relating to taxes or other cxpeses, assume hat thesc expenses were fully peid in cash. Required: 1. Prepare the statement ot cash flows for the year ended December 31, currenty ng the Indirect method. (List cash outflows as negative amounts.) XS SUPPLY COMPAN Staterment of Cash Flows For the Year Ended December 31, Current Year income S 12,200 Adiustments to raconcile net income to net cash provided by operating ectivities Leprecietion excense Gan on sele ot equipment Increase in accounts receivatle 12 000 oD 70O0) 000) Increese in accounts payabe Dacrease in wages payatle 200)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started