Question

my research question- How does inflation impact salary dynamics and the standard of living in North African and Middle Eastern countries, and what are the

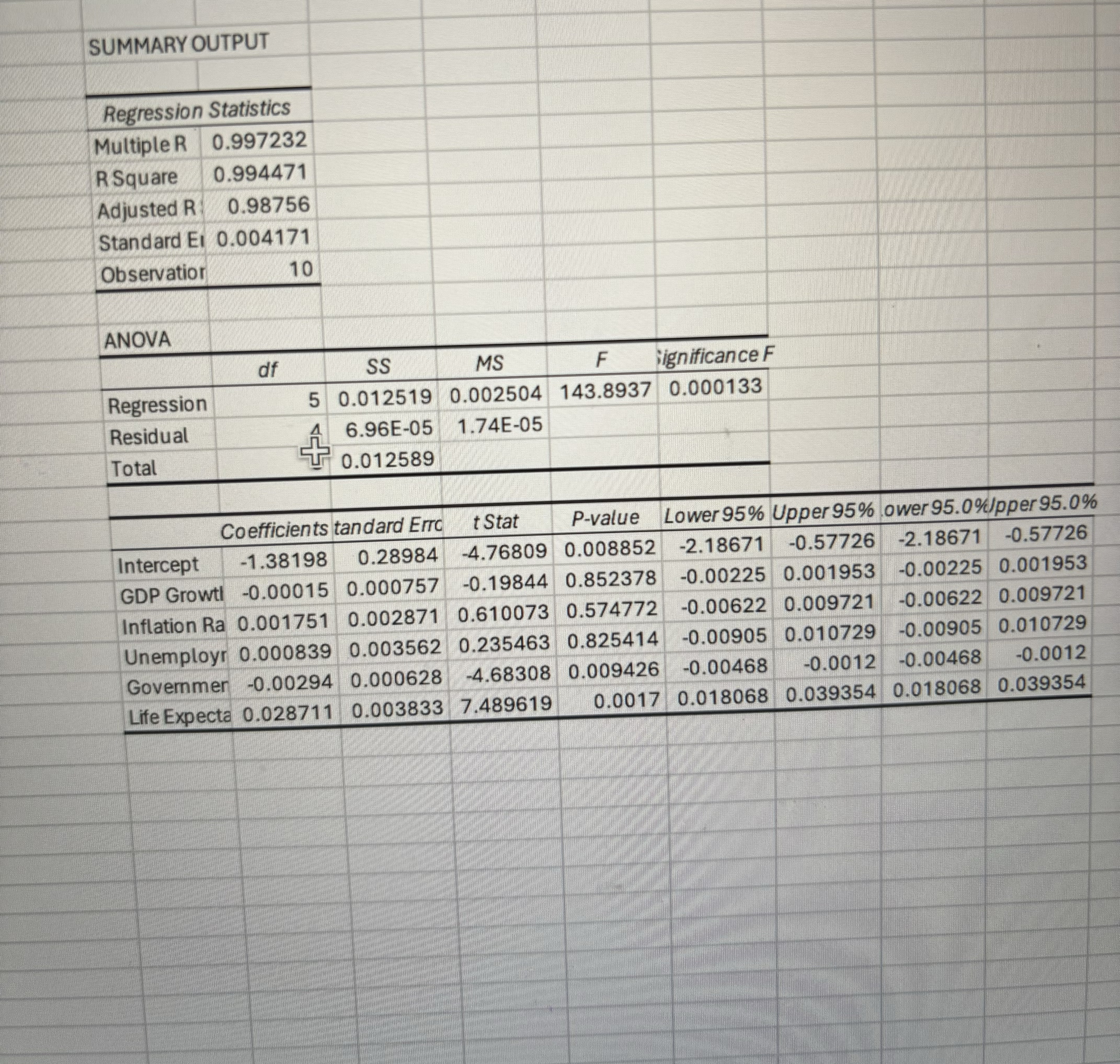

my research question- "How does inflation impact salary dynamics and the standard of living in North African and Middle Eastern countries, and what are the socio-economic implications of these effects on overall economic stability in both regions?" the subtitles below is to guid you to make a detailed regression paragraph. Please don't answer under each subtitle operate from one another. I want a detailed paragraph about regression analysis. for this regression model can you in really good detail analyse the regression:

- what does it mean

- what is its significance to the research question?

- what are its flaws in the data and why?

- what is accurate/reliable about it? is it enough to use as an indicator to answer my research question?

A comprehensive analysis of a regression model involves assessing its performance, reliability, and appropriateness for the given data. Here are key elements to include in your discussion/analysis:

Model Summary:

- Begin by providing a concise summary of the regression model, including the dependent variable, independent variables, and the type of regression used (linear, multiple, polynomial, etc.).

Model Assumptions:

- Discuss the assumptions of the regression model, such as linearity, independence, homoscedasticity, and normality. Assess whether these assumptions hold for your data and mention any potential violations.

Model Fit:

- Evaluate the overall fit of the model using metrics like R-squared, adjusted R-squared, or other relevant goodness-of-fit measures. These statistics quantify the proportion of variance explained by the model.

Significance of Coefficients:

- Analyze the significance of the coefficients for each independent variable. Use p-values to determine whether the coefficients are significantly different from zero. Include confidence intervals to provide a range of plausible values.

Interpretation of Coefficients:

- Interpret the coefficients in the context of the problem you are addressing. Explain the effect of a one-unit change in each independent variable on the dependent variable, considering the scale of the variables.

Multicollinearity:

- Assess the presence of multicollinearity among independent variables. High collinearity can lead to unstable coefficient estimates. Use variance inflation factor (VIF) or other diagnostics to identify and address multicollinearity if necessary.

Residual Analysis:

- Examine the residuals (the differences between observed and predicted values). Check for patterns, outliers, and heteroscedasticity. Residual plots, histograms, and Q-Q plots are useful for this purpose.

Model Validation:

- Validate the model by using techniques like cross-validation, splitting the data into training and testing sets, or utilizing other validation methods. Assess whether the model generalizes well to new data.

Outliers and Influential Points:

- Identify any outliers or influential points that may have a significant impact on the model. Consider sensitivity analysis to evaluate the model's stability in the presence of these points.

Model Limitations:

- Acknowledge and discuss the limitations of the regression model. This might include assumptions that may not hold, the potential for overfitting, or restrictions in the applicability of the model.

Practical Implications:

- Discuss the practical implications of the model results. What do the coefficients mean in the real-world context? How can the model be used to make predictions or inform decision-making?

Comparisons with Alternative Models:

- If relevant, compare the performance of your regression model with alternative models (e.g., different regression techniques or machine learning algorithms). Justify your choice of the regression model.

Conclusion and Recommendations:

- Summarize your findings, emphasizing the strengths and weaknesses of the model. Provide recommendations for further research or improvements to the model if necessary. you should address the regression and what the numbers means: similar to an explanation like this about another regression I did for a different country: Model Assumptions:

I assume that there is a linear relationship between the independent variables and the dependent variable. Additionally, I assume that the observations are independent, meaning that one observation does not influence another. I also assume homoscedasticity, which means that the variance of the errors is constant across all levels of the independent variables. However, it's essential to note that these assumptions may not hold perfectly in real-world data.

Model Fit:

The model has a very high coefficient of determination (R-squared) of approximately 0.998, indicating that 99.8% of the variability in the HDI can be explained by the independent variables. The adjusted R-squared, which adjusts for the number of predictors in the model, is also high at 0.995, suggesting that the model's explanatory power remains strong even after considering the number of predictors.

Significance of Coefficients:

Looking at the coefficients, we can see that the p-values associated with inflation rate, average salary, GDP growth rate, unemployment rate, and government debt are 0.175, 0.015, 0.063, 0.368, and 0.988 respectively. A p-value below 0.05 is typically considered statistically significant. In this model, the average salary appears to be the most significant predictor of HDI, followed by GDP growth rate.

Interpretation of Coefficients:

For every one unit increase in inflation rate, on average, the HDI is expected to increase by 0.000302 units, but this relationship is not statistically significant at the conventional significance level of 0.05. Similarly, for every one unit increase in average salary, the HDI is expected to increase by 0.0000207 units, and this relationship is statistically significant at the 0.05 level. The interpretation of coefficients for other variables follows a similar pattern.

use the above as an example of what im looking for. I also don't want it in the structure you did. I Ould like a paragraph linking it all together titled 'regression analysis' remember, I want my answer in a whole praragraph format that includes all these subtitles in its analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started