Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MyCarCorp produces car parts and is considering opening a new factory in Russia (assume now is beginning of 2002 and the factory would open

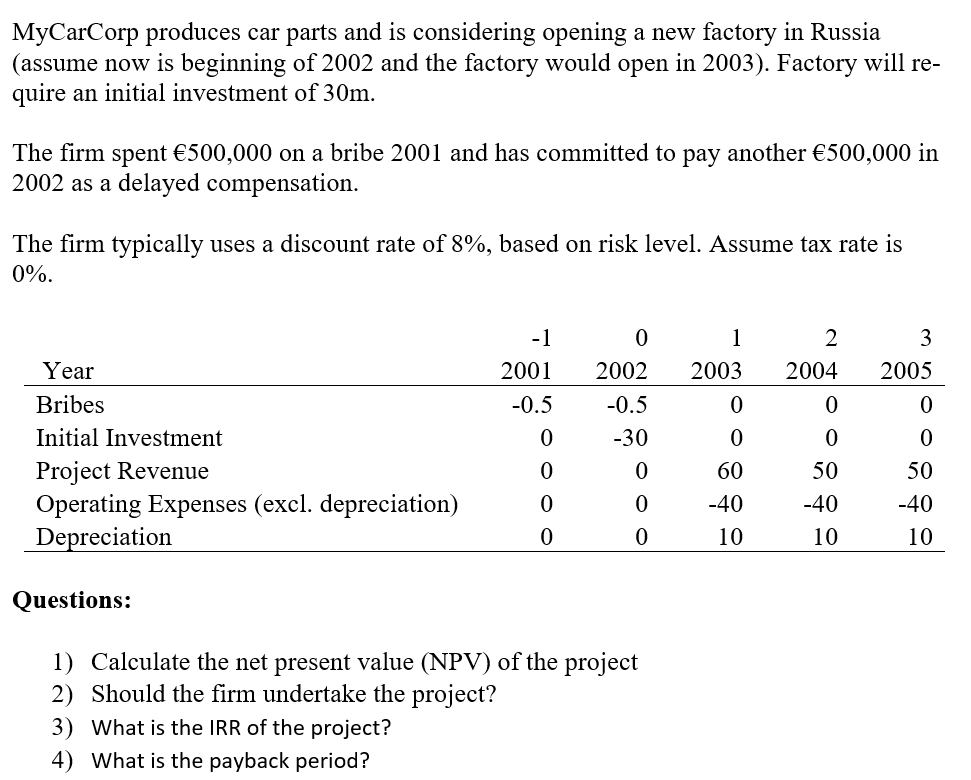

MyCarCorp produces car parts and is considering opening a new factory in Russia (assume now is beginning of 2002 and the factory would open in 2003). Factory will re- quire an initial investment of 30m. The firm spent 500,000 on a bribe 2001 and has committed to pay another 500,000 in 2002 as a delayed compensation. The firm typically uses a discount rate of 8%, based on risk level. Assume tax rate is 0%. -1 0 1 2 3 Year Bribes 2001 2002 2003 2004 2005 -0.5 -0.5 0 0 0 Initial Investment 0 -30 0 0 0 Project Revenue 0 0 60 50 50 Operating Expenses (excl. depreciation) Depreciation 0 0 -40 -40 -40 0 0 10 10 10 Questions: 1) Calculate the net present value (NPV) of the project 2) Should the firm undertake the project? 3) What is the IRR of the project? 4) What is the payback period?

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started