Question

Myers, who is single, reports compensation income of $77,400 in 2023. He is an active participant in his employer's qualified retirement plan. Myers contributes

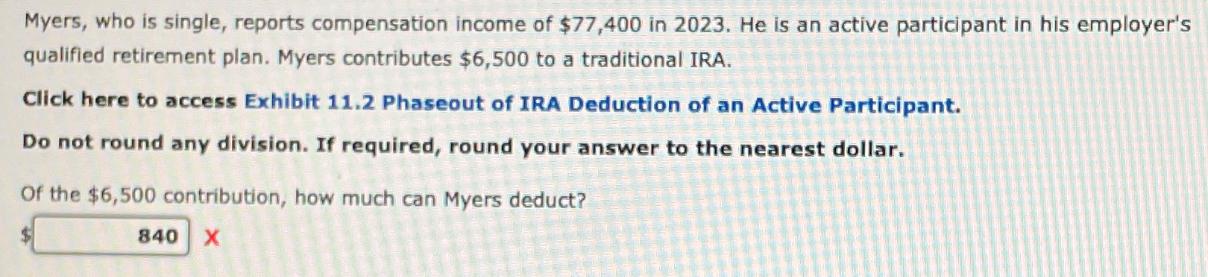

Myers, who is single, reports compensation income of $77,400 in 2023. He is an active participant in his employer's qualified retirement plan. Myers contributes $6,500 to a traditional IRA. Click here to access Exhibit 11.2 Phaseout of IRA Deduction of an Active Participant. Do not round any division. If required, round your answer to the nearest dollar. Of the $6,500 contribution, how much can Myers deduct? 840 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the deductible amount for Myers traditional IRA contribution we need to consider the ph...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2018 Essentials Of Taxation Individuals And Business Entities

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

21st Edition

978-0357109175, 978-1337386173

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App