Answered step by step

Verified Expert Solution

Question

1 Approved Answer

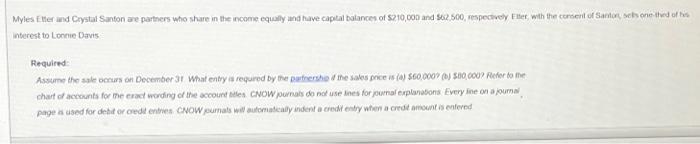

Myles Etter and Crystal Santori are partners who share in the income equally and have capital balances of $210,000 and $62,500, respectively Etter, with the

Myles Etter and Crystal Santori are partners who share in the income equally and have capital balances of $210,000 and $62,500, respectively Etter, with the consent of Santori, sells one-third of his interest to Lonnie Davis. Required: Assume the sale occurs on December 31. What entry is required by the partnership if the sales price is (a) $60,000? (b) $80,000? Refer to the chart of accounts for the exact wording of the account titles. CNOW joumals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started