Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A construction company is planning their projects for the year 2023. The company is considering the construction of 20 buildings, each is 3,000 m.

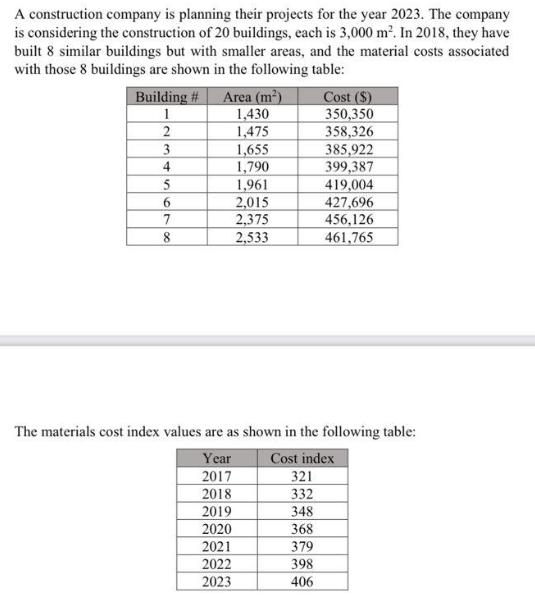

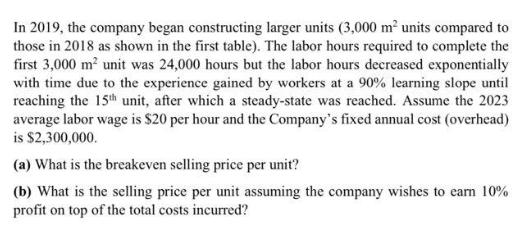

A construction company is planning their projects for the year 2023. The company is considering the construction of 20 buildings, each is 3,000 m. In 2018, they have built 8 similar buildings but with smaller areas, and the material costs associated with those 8 buildings are shown in the following table: Building # Area (m) 1 2 3 4 5 6 7 8 1,430 1,475 1,655 1,790 1,961 2,015 2,375 2,533 The materials cost index values are as shown in the following table: Year Cost index 2017 321 2018 332 2019 2020 2021 2022 2023 348 368 379 Cost ($) 350,350 358,326 385,922 399,387 419,004 427,696 456,126 461,765 398 406 In 2019, the company began constructing larger units (3,000 m units compared to those in 2018 as shown in the first table). The labor hours required to complete the first 3,000 m unit was 24,000 hours but the labor hours decreased exponentially with time due to the experience gained by workers at a 90% learning slope until reaching the 15th unit, after which a steady-state was reached. Assume the 2023 average labor wage is $20 per hour and the Company's fixed annual cost (overhead) is $2,300,000. (a) What is the breakeven selling price per unit? (b) What is the selling price per unit assuming the company wishes to earn 10% profit on top of the total costs incurred?

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started