Answered step by step

Verified Expert Solution

Question

1 Approved Answer

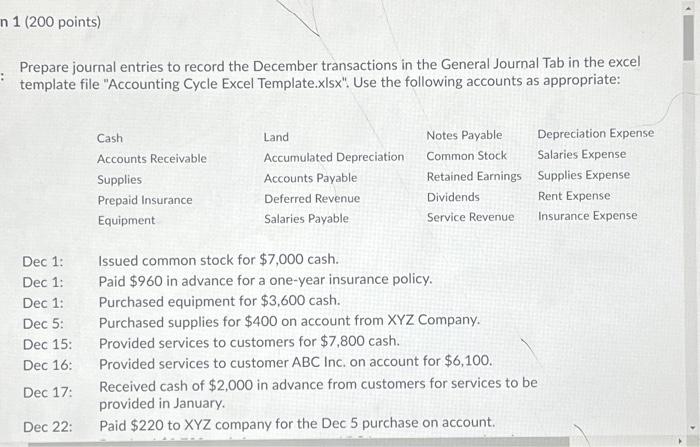

n 1 (200 points) : Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file Accounting Cycle

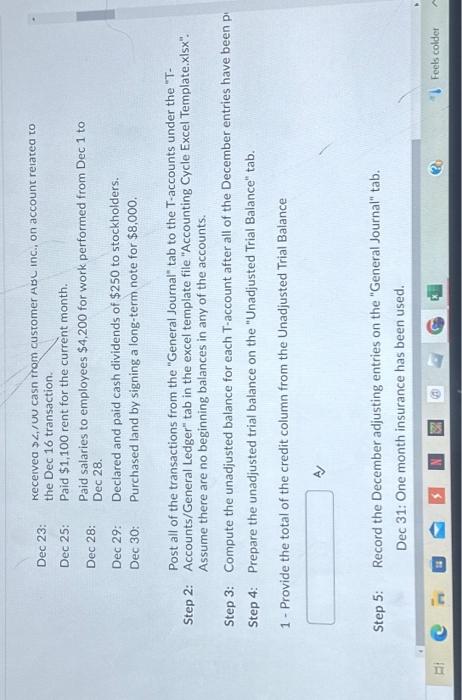

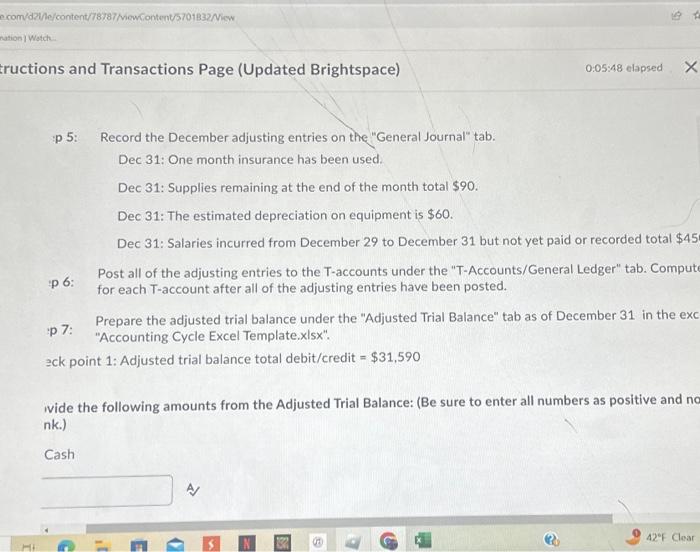

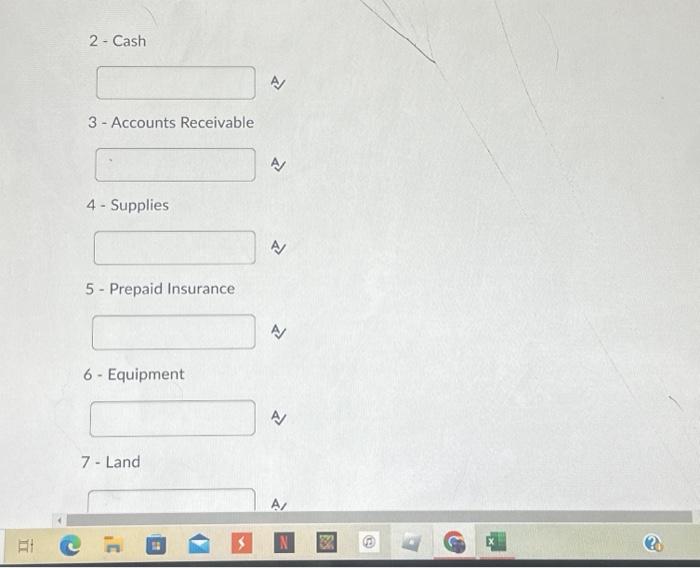

n 1 (200 points) : Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file "Accounting Cycle Excel Template.xlsx". Use the following accounts as appropriate: Dec 1: Dec 1: Dec 1: Dec 5: Dec 15: Dec 16: Dec 17: Dec 22: Cash Accounts Receivable Supplies Prepaid Insurance Equipment Land Accumulated Depreciation Accounts Payable Deferred Revenue Salaries Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Issued common stock for $7,000 cash. Paid $960 in advance for a one-year insurance policy. Purchased equipment for $3,600 cash. Purchased supplies for $400 on account from XYZ Company. Provided services to customers for $7,800 cash. Provided services to customer ABC Inc. on account for $6,100. Received cash of $2,000 in advance from customers for services to be provided in January. Paid $220 to XYZ company for the Dec 5 purchase on account. Depreciation Expense Salaries Expense Supplies Expense Rent Expense Insurance Expense A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started