Question

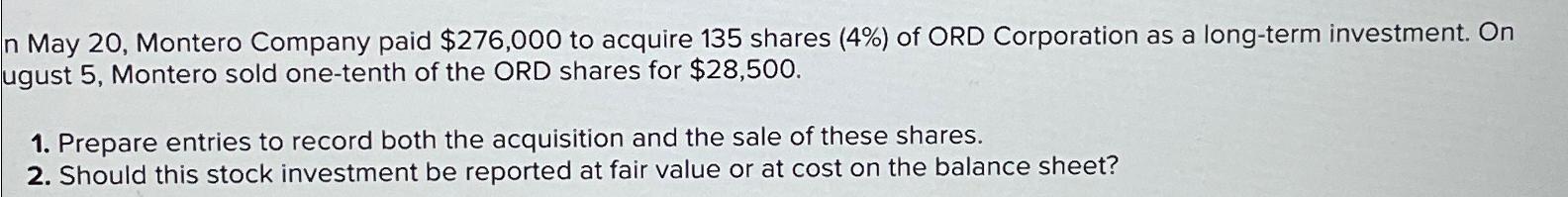

n May 20, Montero Company paid $276,000 to acquire 135 shares (4%) of ORD Corporation as a long-term investment. On ugust 5, Montero sold

n May 20, Montero Company paid $276,000 to acquire 135 shares (4%) of ORD Corporation as a long-term investment. On ugust 5, Montero sold one-tenth of the ORD shares for $28,500. 1. Prepare entries to record both the acquisition and the sale of these shares. 2. Should this stock investment be reported at fair value or at cost on the balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Entries to record the acquisition and sale of shares Date Account Debit Credit May 20 Investment in ORD Corporation 276000 Cash 276000 August 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John Wild, Ken Shaw, Barbara Chiappett

23rd edition

1259536351, 978-1259536359

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App