Answered step by step

Verified Expert Solution

Question

1 Approved Answer

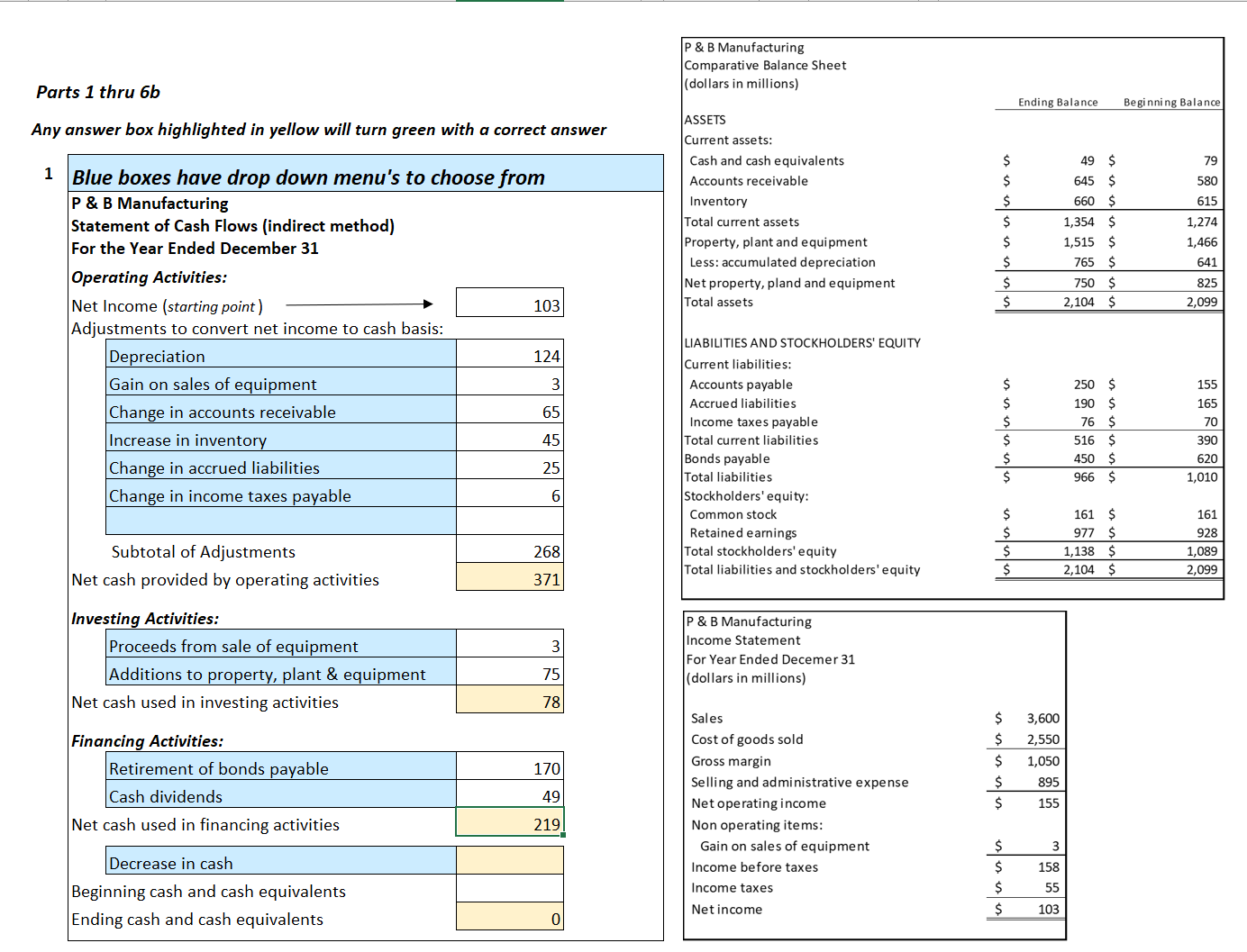

P & B Manufacturing Comparative Balance Sheet (dollars in millions) Parts 1 thru 6b Any answer box highlighted in yellow will turn green with

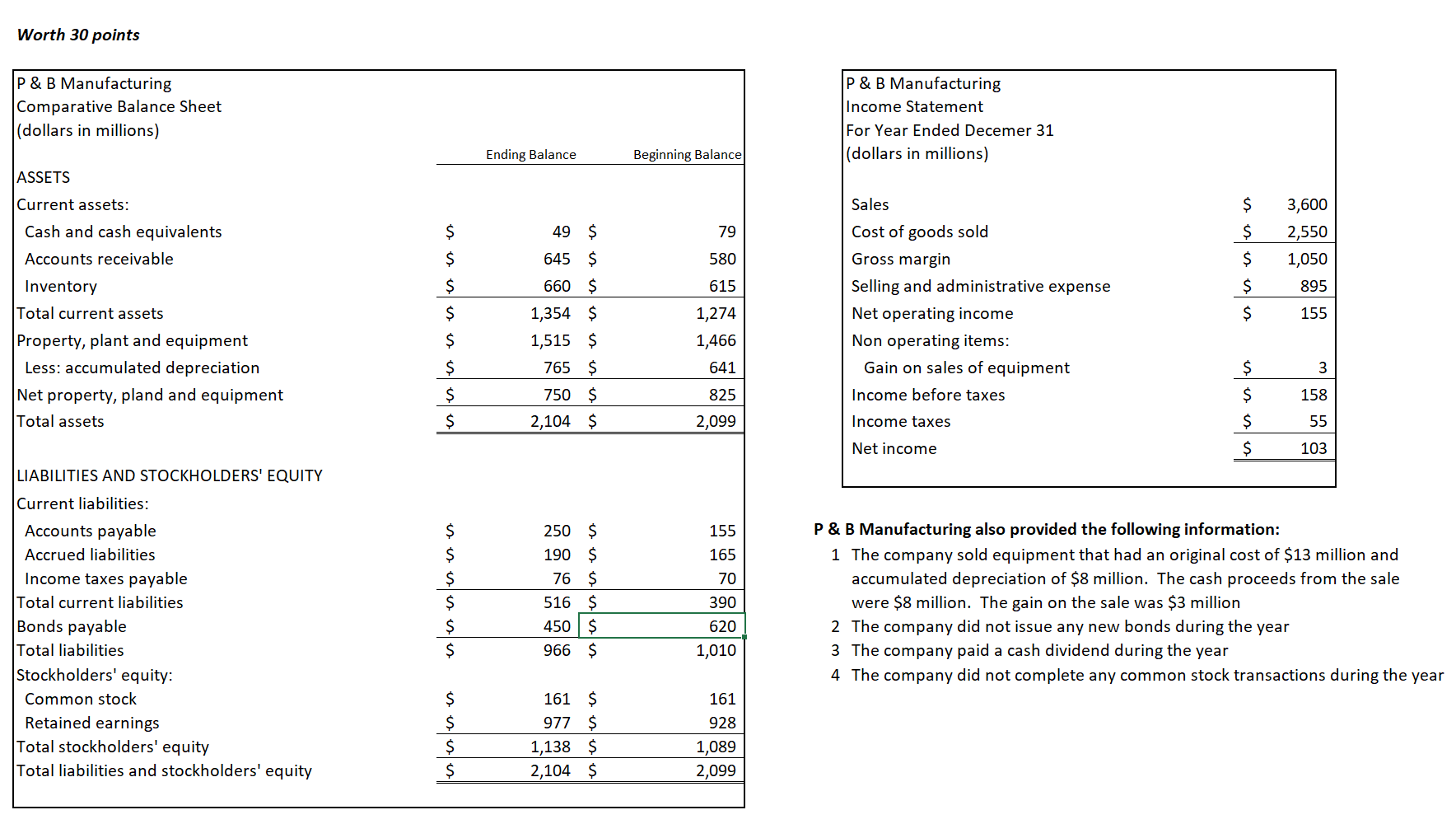

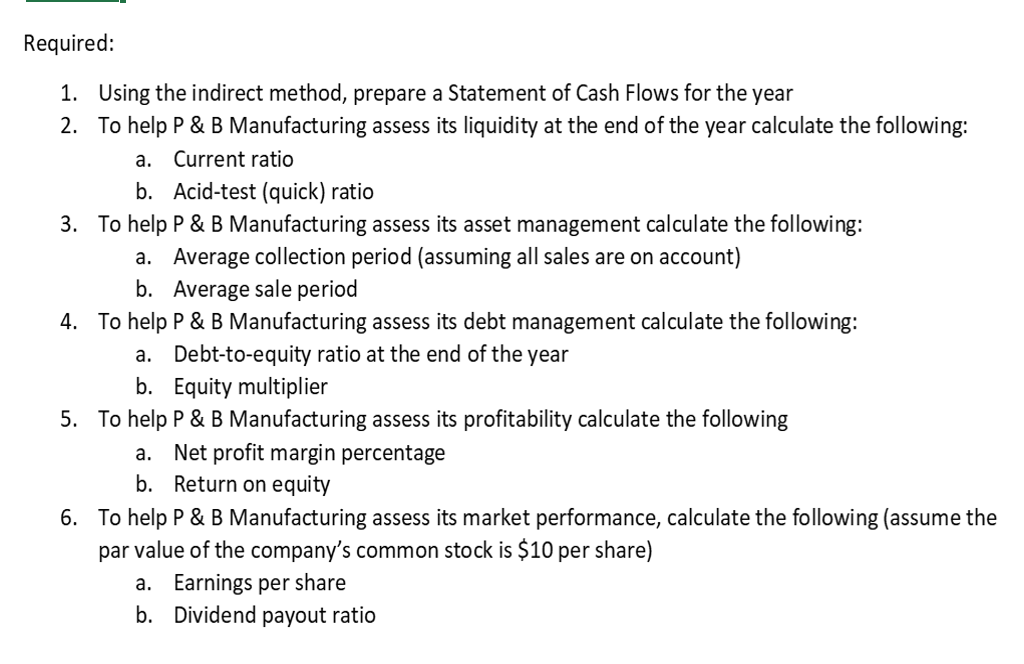

P & B Manufacturing Comparative Balance Sheet (dollars in millions) Parts 1 thru 6b Any answer box highlighted in yellow will turn green with a correct answer 1 Blue boxes have drop down menu's to choose from P&B Manufacturing Statement of Cash Flows (indirect method) For the Year Ended December 31 Ending Balance Beginning Balance ASSETS Current assets: Cash and cash equivalents $ 49 $ 79 Accounts receivable $ 645 $ 580 Inventory $ 660 $ 615 Total current assets $ 1,354 $ 1,274 Property, plant and equipment $ 1,515 $ 1,466 Less: accumulated depreciation $ 765 $ 641 Operating Activities: Net property, pland and equipment $ 750 $ 825 Net Income (starting point) 103 Total assets $ 2,104 S 2,099 Adjustments to convert net income to cash basis: LIABILITIES AND STOCKHOLDERS' EQUITY Depreciation 124 Current liabilities: Gain on sales of equipment 3 Accounts payable $ 250 $ 155 Change in accounts receivable Accrued liabilities $ 190 $ 165 65 Income taxes payable $ 76 $ 70 Increase in inventory 45 Total current liabilities $ 516 $ 390 Change in accrued liabilities Bonds payable $ 450 $ 620 25 Total liabilities $ 966 $ 1,010 Change in income taxes payable 6 Stockholders' equity: Common stock $ 161 $ 161 Retained earnings $ 977 $ 928 Subtotal of Adjustments 268 Total stockholders' equity $ 1,138 $ 1,089 Total liabilities and stockholders' equity $ 2,104 $ 2,099 Net cash provided by operating activities 371 Investing Activities: P&B Manufacturing Proceeds from sale of equipment 3 Income Statement For Year Ended Decemer 31 Additions to property, plant & equipment 75 (dollars in millions) Net cash used in investing activities 78 Sales $ 3,600 Financing Activities: Cost of goods sold $ 2,550 Gross margin $ 1,050 Retirement of bonds payable 170 Selling and administrative expense $ 895 Cash dividends 49 Net operating income $ 155 Net cash used in financing activities 219 Non operating items: Gain on sales of equipment $ 3 Decrease in cash Income before taxes $ 158 Beginning cash and cash equivalents Income taxes Net income $ 55 $ 103 Ending cash and cash equivalents Worth 30 points P&B Manufacturing Comparative Balance Sheet (dollars in millions) ASSETS Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant and equipment Less: accumulated depreciation Net property, pland and equipment Total assets P&B Manufacturing Income Statement For Year Ended Decemer 31 Ending Balance Beginning Balance (dollars in millions) Sales $ 3,600 es es $ 49 $ 79 Cost of goods sold $ 2,550 $ 645 $ 580 Gross margin $ 1,050 $ 660 $ 615 Selling and administrative expense $ 895 $ 1,354 $ 1,274 Net operating income $ 155 $ 1,515 $ 1,466 Non operating items: $ 765 $ 641 Gain on sales of equipment $ 750 $ 825 Income before taxes $ 2,104 $ 2,099 Income taxes Net income $ 3 $ 158 $ 55 $ 103 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities 5555 it is 250 $ 155 $ 190 $ 165 $ 76 $ 70 516 $ 390 $ 450 $ 620 $ 966 $ 1,010 Stockholders' equity: Common stock Retained earnings Total stockholders' equity sss 161 $ 161 977 $ 928 1,138 $ 1,089 Total liabilities and stockholders' equity $ 2,104 $ 2,099 P & B Manufacturing also provided the following information: 1 The company sold equipment that had an original cost of $13 million and accumulated depreciation of $8 million. The cash proceeds from the sale were $8 million. The gain on the sale was $3 million 2 The company did not issue any new bonds during the year 3 The company paid a cash dividend during the year 4 The company did not complete any common stock transactions during the year Required: 1. Using the indirect method, prepare a Statement of Cash Flows for the year 2. To help P & B Manufacturing assess its liquidity at the end of the year calculate the following: a. Current ratio b. Acid-test (quick) ratio 3. To help P & B Manufacturing assess its asset management calculate the following: a. Average collection period (assuming all sales are on account) b. Average sale period 4. To help P & B Manufacturing assess its debt management calculate the following: a. Debt-to-equity ratio at the end of the b. Equity multiplier year 5. To help P & B Manufacturing assess its profitability calculate the following a. Net profit margin percentage b. Return on equity 6. To help P & B Manufacturing assess its market performance, calculate the following (assume the par value of the company's common stock is $10 per share) a. Earnings per share b. Dividend payout ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres the Statement of Cash Flows prepared using the indirect method PB Manufacturing Statement of C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started