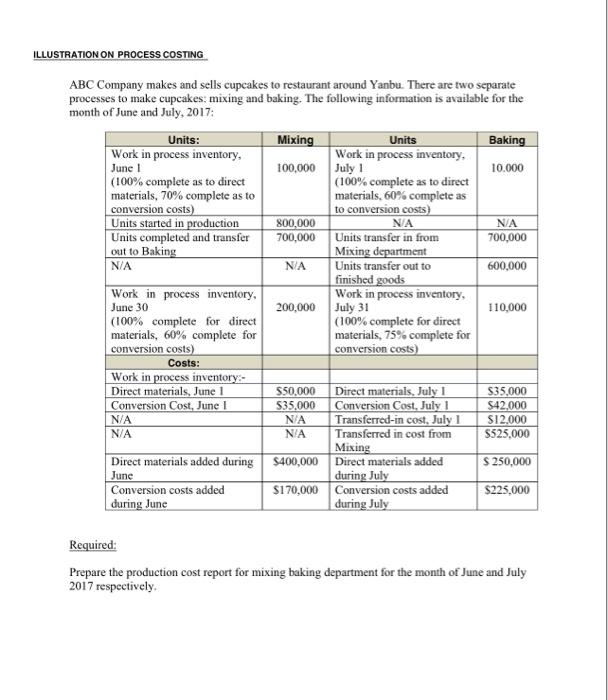

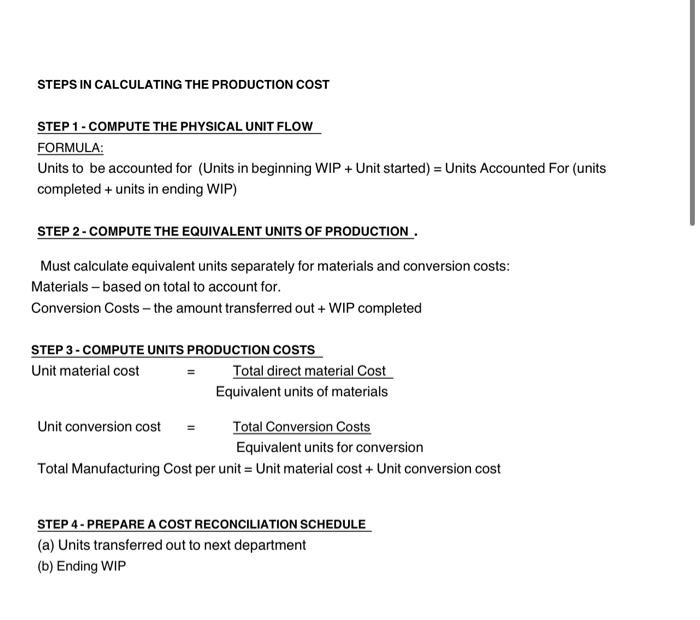

NA ILLUSTRATION ON PROCESS COSTING ABC Company makes and sells cupcakes to restaurant around Yanbu. There are two separate processes to make cupcakes, mixing and baking. The following information is available for the month of June and July, 2017: Units: Mixing Units Baking Work in process inventory, Work in process inventory, June 1 100,000 July 10.000 (100% complete as to direct (100% complete as to direct materials, 70% complete as to materials, 60% complete as conversion costs) to conversion costs) Units started in production 800,000 NA Units completed and transfer 700,000 Units transfer in from 700,000 out to Baking Mixing department NA NA Units transfer out to 600,000 finished goods Work in process inventory, Work in process inventory, June 30 200,000 July 31 110,000 (100% complete for direct (100% complete for direct materials, 60% complete for materials, 75% complete for conversion costs) conversion costs) Costs: Work in process inventory: Direct materials, June 1 S50.000 Direct materials, July 1 S35.000 Conversion Cost, June 1 S35.000 Conversion Cost, July 1 S42,000 N/A NA Transferred-in cost, July 1 SI 2.000 N/A NA Transferred in cost from $525,000 Mixing Direct materials added during $400,000 Direct materials added $ 250,000 June during July Conversion costs added $170,000 Conversion costs added $225,000 during June during July Required: Prepare the production cost report for mixing baking department for the month of June and July 2017 respectively. STEPS IN CALCULATING THE PRODUCTION COST STEP 1 - COMPUTE THE PHYSICAL UNIT FLOW FORMULA: Units to be accounted for (Units in beginning WIP + Unit started) = Units Accounted For (units completed + units in ending WIP) STEP 2 - COMPUTE THE EQUIVALENT UNITS OF PRODUCTION. Must calculate equivalent units separately for materials and conversion costs: Materials - based on total to account for. Conversion Costs - the amount transferred out + WIP completed STEP 3 - COMPUTE UNITS PRODUCTION COSTS Unit material cost Total direct material Cost Equivalent units of materials Unit conversion cost Total Conversion Costs Equivalent units for conversion Total Manufacturing Cost per unit = Unit material cost + Unit conversion cost STEP 4 - PREPARE A COST RECONCILIATION SCHEDULE (a) Units transferred out to next department (b) Ending WIP