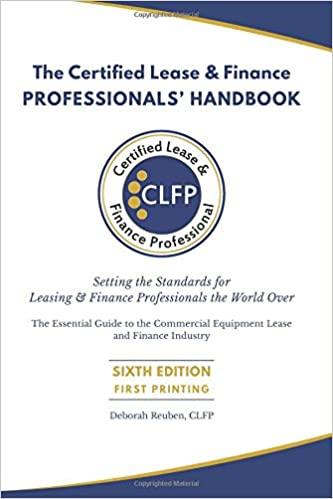

Nabil is considering buying a house while he is at university. The house costs $240,000 today. Renting out part of the house and living in the rest over his five years at school will net, after expenses, $3000 per month. He estimates that he will sell the house after five years for $250,000. If Nabil's MARR is 6 percent compounded monthly, should he buy the house? Use annual worth. Click the icon to view the table of compound interest factors for discrete compounding periods when i = 6% compounded monthly Nabil should buy the house because the annual worth of the house is $ (Round to the nearest cent as needed.) Compound interest factors for discrete compounding, discrete cash flows (i=0.5%) Single Payment Uniform Series N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Compound Present Amount Worth Factor Factor (F/P,1,N) (P/F,1,N) 1.0050 0.99502 1.0100 0.99007 1.0151 0.98515 1.0202 0.98025 1.0253 0.97537 1.0304 0.97052 1.0355 0.96569 1.0407 0.96089 1.0459 0.95610 1.0511 0.95135 1.0564 0.94661 1.0617 0.94191 1.0670 0.93722 1.0723 0.93256 1.0777 0.92792 1.0831 0.92330 1.0885 0.91871 1.0939 0.91414 1 nga nanasa Sinking Fund Factor (A/F,1,N) 1.0000 0.49875 0.33167 0.24813 0.19801 0.16460 0.14073 0.12283 0.10891 0.09777 0.08866 0.08107 0.07464 0.06914 0.06436 0.06019 0.05651 0.05323 n05030 Uniform Capital Series Recovery Factor Factor (FIA,I,N) (A/P,1,N) 1.00000 1.0050 2.0050 0.50375 3.0150 0.33667 4.0301 0.25313 5.0503 0.20301 6.0755 0.16960 7.1059 0.14573 8.1414 0.12783 9.1821 0.11391 10.228 0.10277 11.279 0.09366 12.336 0.08607 13.397 0.07964 14.464 0.07414 15.537 0.06936 16.614 0.06519 17.697 0.06151 18.786 0.05823 10 gan n0553 Series Present Worth Factor (P/A,1,N) 0.99502 1.9851 2.9702 3.9505 4.9259 5.8964 6.8621 7.8230 8.7791 9.7304 10.677 11.619 12.556 13.489 14.417 15.340 16.259 17.173 18 082 Arithmetic Gradient Series Factor (A/G,1,N) 0.00000 0.49875 0.99667 1.4938 1.9900 2.4855 2.9801 3.4738 3.9668 4.4589 4.9501 5.4406 5.9302 6.4190 6.9069 7.3940 7.8803 8.3658 82501 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 60 65 70 75 1.1049 1.1104 1.1160 1.1216 1.1272 1.1328 1.1385 1.1442 1.1499 1.1556 1.1614 1.1672 1.1730 1.1789 1.1848 1.1907 1.2208 1.2516 1.2832 1.3156 1.3489 1.3829 1.4178 1.4536 1.4903 0.90506 0.90056 0.89608 0.89162 0.88719 0.88277 0.87838 0.87401 0.86966 0.86533 0.86103 0.85675 0.85248 0.84824 0.84402 0.83982 0.81914 0.79896 0.77929 0.76009 0.74137 0.72311 0.70530 0.68793 0.67099 0.04767 0.04528 0.04311 0.04113 0.03932 0.03765 0.03611 0.03469 0.03336 0.03213 0.03098 0.02990 0.02889 0.02795 0.02706 0.02622 0.02265 0.01987 0.01765 0.01584 0.01433 0.01306 0.01197 0.01102 0.01020 20.979 22.084 23.194 24.310 25.432 26.559 27.692 28.830 29.975 31.124 32.280 33.441 34.609 35.782 36.961 38.145 44.159 50.324 56.645 63.126 69.770 76.582 83.566 90.727 98.068 0.05267 0.05028 0.04811 0.04613 0.04432 0.04265 0.04111 0.03969 0.03836 0.03713 0.03598 0.03490 0.03389 0.03295 0.03206 0.03122 0.02765 0.02487 0.02265 0.02084 0.01933 0.01806 0.01697 0.01602 0.01520 18.987 19.888 20.784 21.676 22.563 23.446 24.324 25.198 26.068 26.933 27.794 28.651 29.503 30.352 31.196 32.035 36.172 40.207 44.143 47.981 51.726 55.377 58.939 62.414 65.802 9.3342 9.8172 10.299 10.781 11.261 11.741 12.220 12.698 13.175 13.651 14.126 14.601 15.075 15.548 16.020 16.492 18.836 21.159 23.462 25.745 28.006 30.247 32.468 34.668 36.847 80 24 25 26 27 28 29 30 31 32 33 34 35 40 45 50 55 60 65 70 75 80 85 90 95 100 1.1272 1.1328 1.1385 1.1442 1.1499 1.1556 1.1614 1.1672 1.1730 1.1789 1.1848 1.1907 1.2208 1.2516 1.2832 1.3156 1.3489 1.3829 1.4178 1.4536 1.4903 1.5280 1.5666 1.6061 1.6467 0.88719 0.88277 0.87838 0.87401 0.86966 0.86533 0.86103 0.85675 0.85248 0.84824 0.84402 0.83982 0.81914 0.79896 0.77929 0.76009 0.74137 0.72311 0.70530 0.68793 0.67099 0.65446 0.63834 0.62262 0.60729 0.03932 0.03765 0.03611 0.03469 0.03336 0.03213 0.03098 0.02990 0.02889 0.02795 0.02706 0.02622 0.02265 0.01987 0.01765 0.01584 0.01433 0.01306 0.01197 0.01102 0.01020 0.00947 0.00883 0.00825 0.00773 25.432 26.559 27.692 28.830 29.975 31.124 32.280 33.441 34.609 35.782 36.961 38.145 44.159 50.324 56.645 63.126 69.770 76.582 83.566 90.727 98.068 105.59 113.31 121.22 129.33 0.04432 0.04265 0.04111 0.03969 0.03836 0.03713 0.03598 0.03490 0.03389 0.03295 0.03206 0.03122 0.02765 0.02487 0.02265 0.02084 0.01933 0.01806 0.01697 0.01602 0.01520 0.01447 0.01383 0.01325 0.01273 22.563 23.446 24.324 25.198 26.068 26.933 27.794 28.651 29.503 30.352 31.196 32.035 36.172 40.207 44.143 47.981 51.726 55.377 58.939 62.414 65.802 69.108 72.331 75.476 78.543 11.261 11.741 12.220 12.698 13.175 13.651 14.126 14.601 15.075 15.548 16.020 16.492 18.836 21.159 23.462 25.745 28.006 30.247 32.468 34.668 36.847 39.006 41.145 43.263 45.361