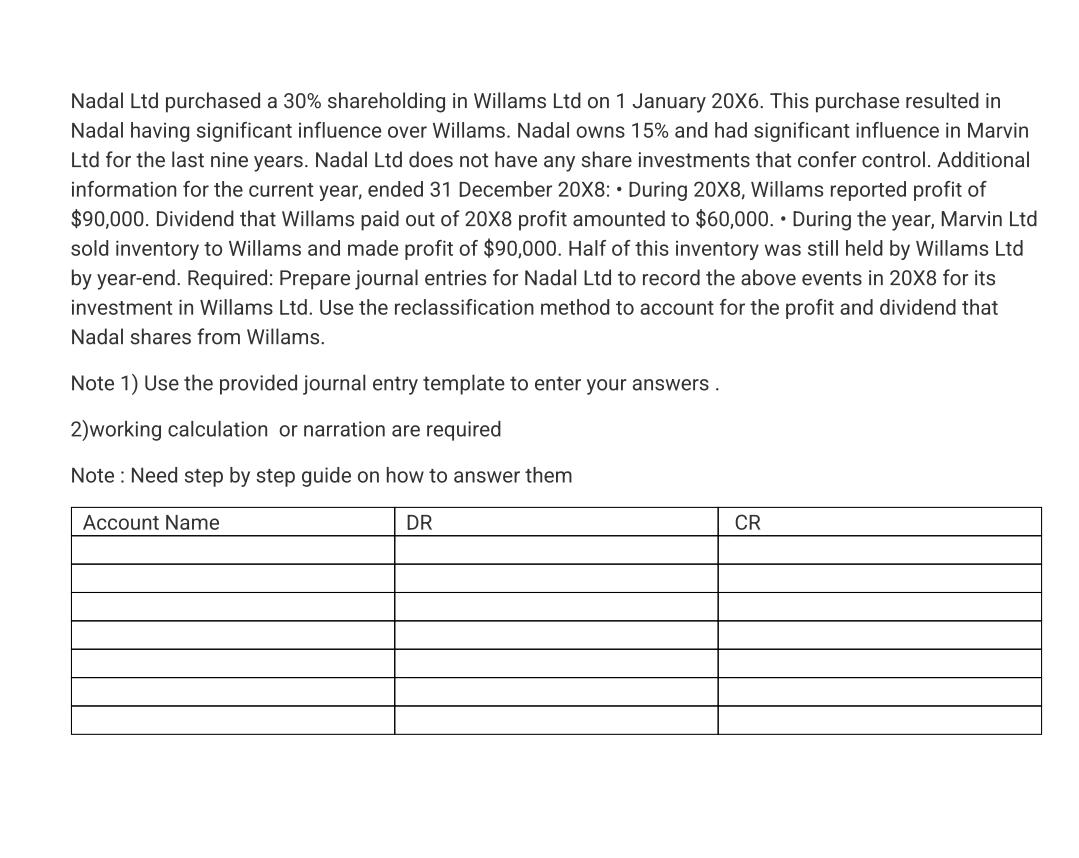

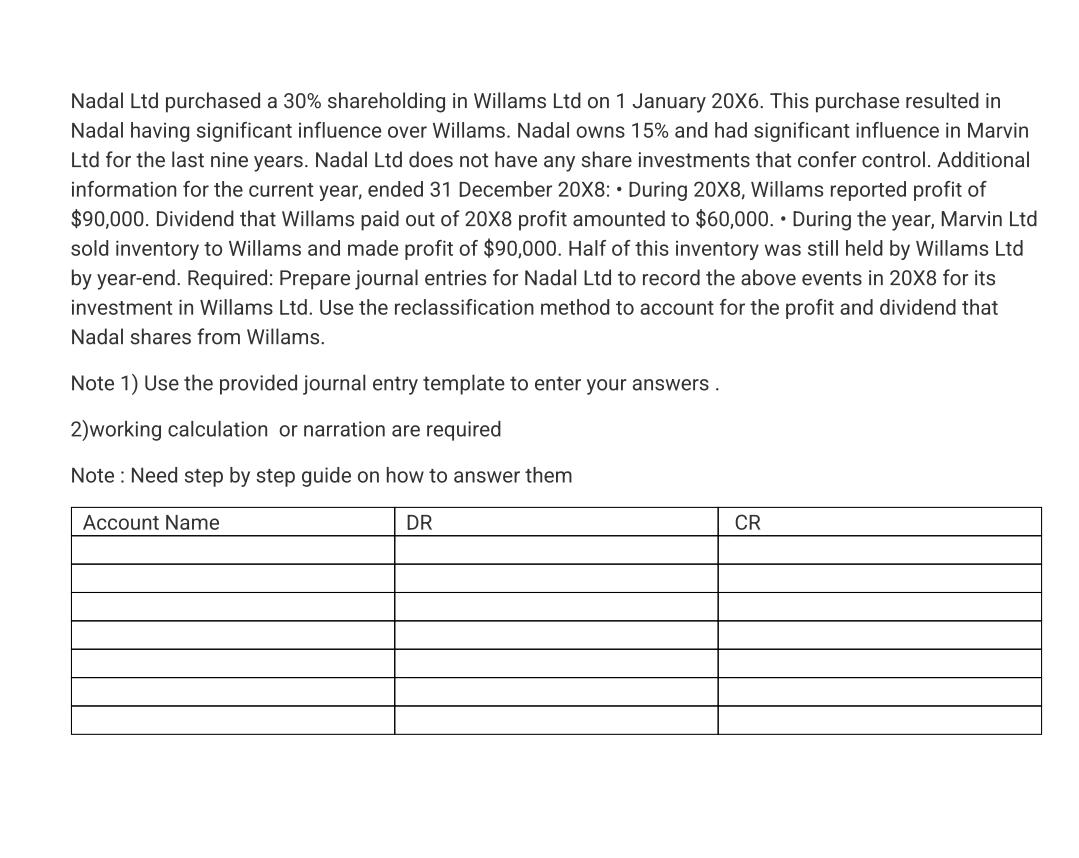

Nadal Ltd purchased a 30% shareholding in Willams Ltd on 1 January 206. This purchase resulted in Nadal having significant influence over Willams. Nadal owns 15% and had significant influence in Marvin Ltd for the last nine years. Nadal Ltd does not have any share investments that confer control. Additional information for the current year, ended 31 December 20X8: During 20X8, Willams reported profit of $90,000. Dividend that Willams paid out of 208 profit amounted to $60,000. - During the year, Marvin Ltd sold inventory to Willams and made profit of $90,000. Half of this inventory was still held by Willams Ltd by year-end. Required: Prepare journal entries for Nadal Ltd to record the above events in 20X8 for its investment in Willams Ltd. Use the reclassification method to account for the profit and dividend that Nadal shares from Willams. Note 1) Use the provided journal entry template to enter your answers . 2)working calculation or narration are required Note : Need step by step guide on how to answer them Nadal Ltd purchased a 30% shareholding in Willams Ltd on 1 January 206. This purchase resulted in Nadal having significant influence over Willams. Nadal owns 15% and had significant influence in Marvin Ltd for the last nine years. Nadal Ltd does not have any share investments that confer control. Additional information for the current year, ended 31 December 20X8: During 20X8, Willams reported profit of $90,000. Dividend that Willams paid out of 208 profit amounted to $60,000. - During the year, Marvin Ltd sold inventory to Willams and made profit of $90,000. Half of this inventory was still held by Willams Ltd by year-end. Required: Prepare journal entries for Nadal Ltd to record the above events in 20X8 for its investment in Willams Ltd. Use the reclassification method to account for the profit and dividend that Nadal shares from Willams. Note 1) Use the provided journal entry template to enter your answers . 2)working calculation or narration are required Note : Need step by step guide on how to answer them