Question

Nader International is considering investing in two assetsA and B. The initial outlay and annual cash flows for each asset are shown in the following

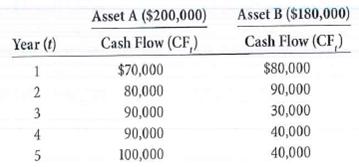

Nader International is considering investing in two assets—A and B. The initial outlay and annual cash flows for each asset are shown in the following table for the assets’ assumed 5-year lives. The firm requires a 12% return on each of these equally risky assets. Nader’s maximum payback period is 2.5 years, and its maximum discounted payback period is 3.25 years.

a. Calculate the payback period for each asset, assess its acceptability, and indicate which asset is best in terms of this criterion.

b. Calculate the discounted payback for each asset, assess its acceptability, and indicate which asset is best in terms of this criterion.

c. Compare and contrast your findings in parts (a) and (b). Assuming that they are mutually exclusive, which asset would you recommend to Nader? Why?

Year (t) 1 2 3 4 50 Asset A ($200,000) Cash Flow (CF) $70,000 80,000 90,000 90,000 100,000 Asset B ($180,000) Cash Flow (CF) $80,000 90,000 30,000 40,000 40,000

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Year Cash flow of A 1 2 3 Cash flow of B Cumulati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started