Question

Nagkamali Inc. adds materials at the start of the process in Department B. Units received from Department A costs P11.10 while in Department B, unit

Nagkamali Inc. adds materials at the start of the process in Department B. Units received from Department A costs P11.10 while in Department B, unit costs for materials and conversion costs were P1 and P1.22 respectively. The company's quantity data showed that WIP beg, which had a cost of P80,000, had 8,000 units and were done. During the period, Department A transferred 50,000 units to Department B. At the end of the period, WIP has 10,000 units which are 1/5 done and there were 3,000 normal lost units. Compute for the total cost of units transferred to finished goods using average costing assuming that the lost units were spoiled at the start of processing.

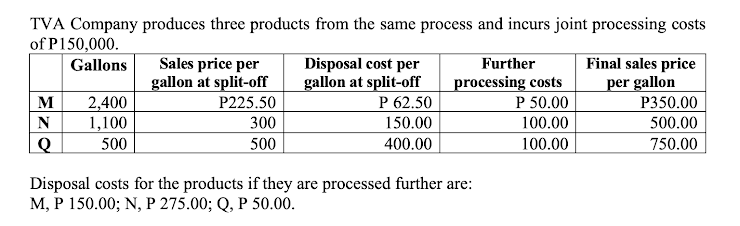

6.)How much is the net income attributable to Product M, assuming that joint costs are allocated using the Approximate Net Realizable Value x, and after being processed further, 1,800 gallons of Product M was sold during the year?

TVA Company produces three products from the same process and incurs joint processing costs of P150,000. Gallons Sales price per gallon at split-off Disposal cost per gallon at split-off Further processing costs Final sales price per gallon M 2,400 P225.50 P 62.50 P 50.00 N 1,100 300 150.00 100.00 Q 500 500 400.00 100.00 P350.00 500.00 750.00 Disposal costs for the products if they are processed further are: M, P 150.00; N, P 275.00; Q, P 50.00.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to follow these steps 1 Calculate the total cost of units transferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started