Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nailufar Sdn . ?Bhd . ?is a manufacturer of antique - style souvenir box using an assembly line process. A unit of product passes through

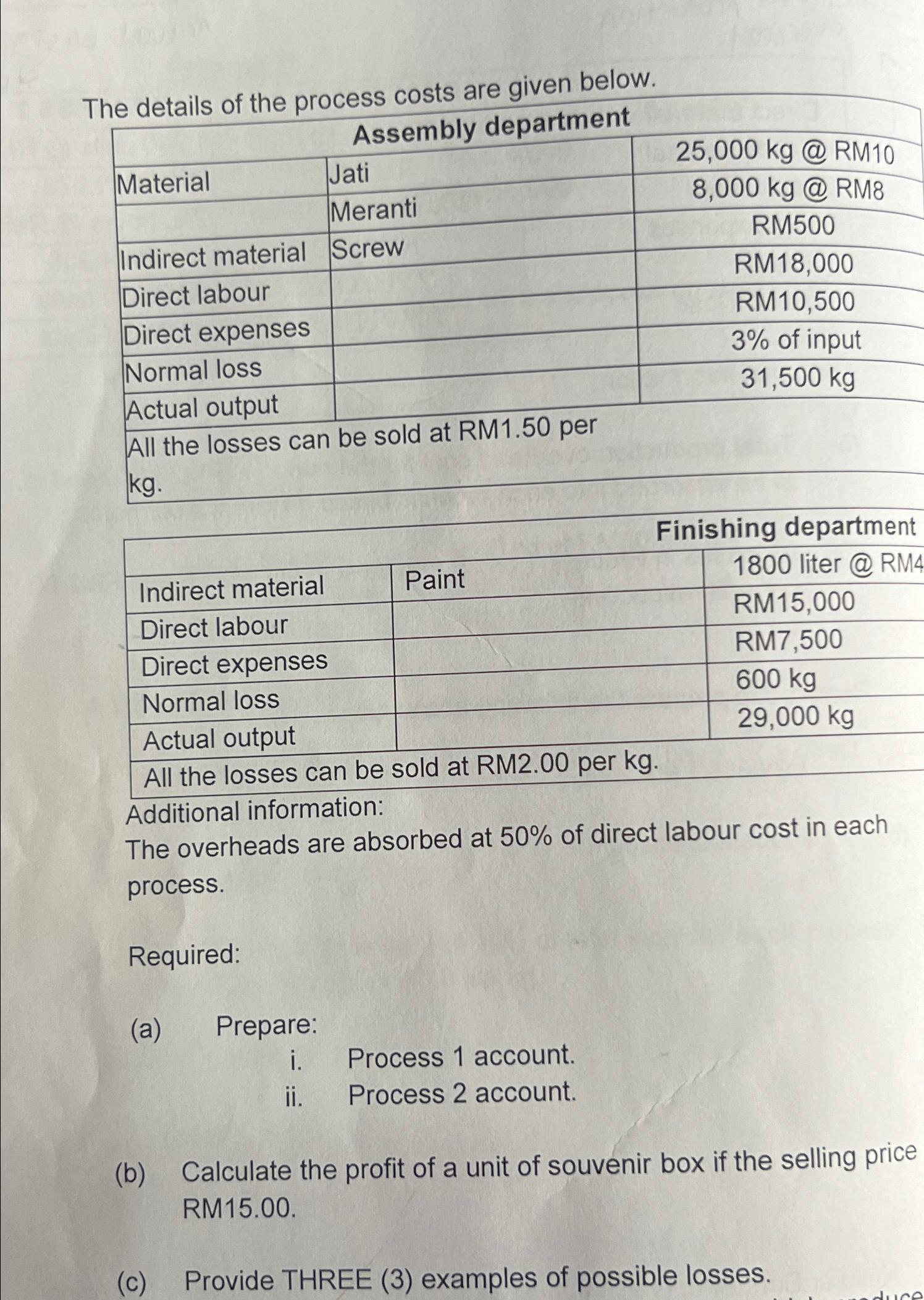

Nailufar Sdn ?Bhd ?is a manufacturer of antiquestyle souvenir box using an assembly line process. A unit of product passes through two department; Assembly and Finishing department, before it is completed. The output from Assembly department will be transferred to Finishing department where additional material is then added in that process.

The details of the process costs are given below. Assembly department Material Indirect material Direct labour Direct expenses Normal loss Actual output All the losses can be sold at RM1.50 per kg. Indirect material Direct labour Direct expenses Normal loss Required: Jati Meranti Screw (a) Prepare: i. ii. (b) Paint Actual output All the losses can be sold at RM2.00 per kg. Additional information: The overheads are absorbed at 50% of direct labour cost in each process. 25,000 kg @RM10 8,000 kg @RM8 RM500 RM18,000 RM10,500 3% of input 31,500 kg Process 1 account. Process 2 account. Finishing department 1800 liter @ RM4 RM15.000 RM7,500 600 kg 29,000 kg Calculate the profit of a unit of souvenir box if the selling price RM15.00. (c) Provide THREE (3) examples of possible losses. aduce

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the image youve provided we need to prepare the accounts for two processes Assembly Process 1 and Finishing Process 2 for Nailufar Sdn Bhd wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started