Question

Nam-Bubble Ltd is a bubble gum manufacturing companythat has been in the business for some years. The board of directors is currently evaluating budgets for

Nam-Bubble Ltd is a bubble gum manufacturing companythat has been in the business for some years. The board of directors is currently evaluating budgets for the forthcoming period of operations.

Nam-Bubble Ltd currently only has the resources to manufacture one type of bubble gum product, which is sold in sealed packets of 100 units at NS100 per packet.

The marketing director made the following commentat the recent directors’ meeting: “Wewill price our sealed packets at NS100 per packetfor the coming year. At this level we shall sell 3 000 packets.” “but...| believe we will out-price ourselves if we set the packet price at NS125 per packet.

The effectwill be disastrous, as wewill only sell 1 700 packets.

” The following information is available regarding the cost structures of Nam-Bubble Ltd:

1. Budget for the company

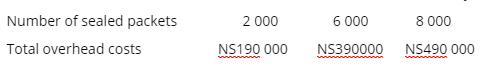

Nam-Bubble Ltd’s total fixed and variable overhead costs, on an activity basis, for various manufacturing levels are estimated below:

2. Manufacturing plant

The manufacturing plant, which has a maximum capacity of 80 000 sealed packets per annum, waspurchased two years ago for N$1 million. The estimated useful life of the plant is five years, and the annual depreciation charge has been included in the overhead costs given above.

3. Overheads

Total production and administrative overheads have been allocated between theactivities above. However, should activity levels exceed 8 000 sealed packets, additional overhead costs amounting to NS45 000 per annum will be incurred. These costs have not been taken into account above.

Requirement:

a) Determine the break-even point of Nam- Bubble Ltd.

b) Comment on whether you agree or disagree with the marketing director’s statement that increasing the selling price to NS125 will be detrimental..

c) Determine the new contribution margin per packet if Nam-Bubble Ltd would like to sell 3 000 packets without making a loss or profit.

d) What is the percentage increase or decreasein the selling price if Nam-Bubble Ltd would like to sell 3 000 packets without making a loss or profit, assuming the variable cost per unit remains constant?

e) Assuming the same contribution/sales (C/S) ratio as on original data; determine the minimum selling price that can be charged on 9 000 packets of bubble gum whereby NamBubble will not make a loss or profit.

f) What assumptions are usually made when using cost volume (CVP) analysis concerning the costs?

Number of sealed packets 2 000 6 000 8 000 Total overhead costs NS190 000 NS390000 NS490 000 ww n

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started