Answered step by step

Verified Expert Solution

Question

1 Approved Answer

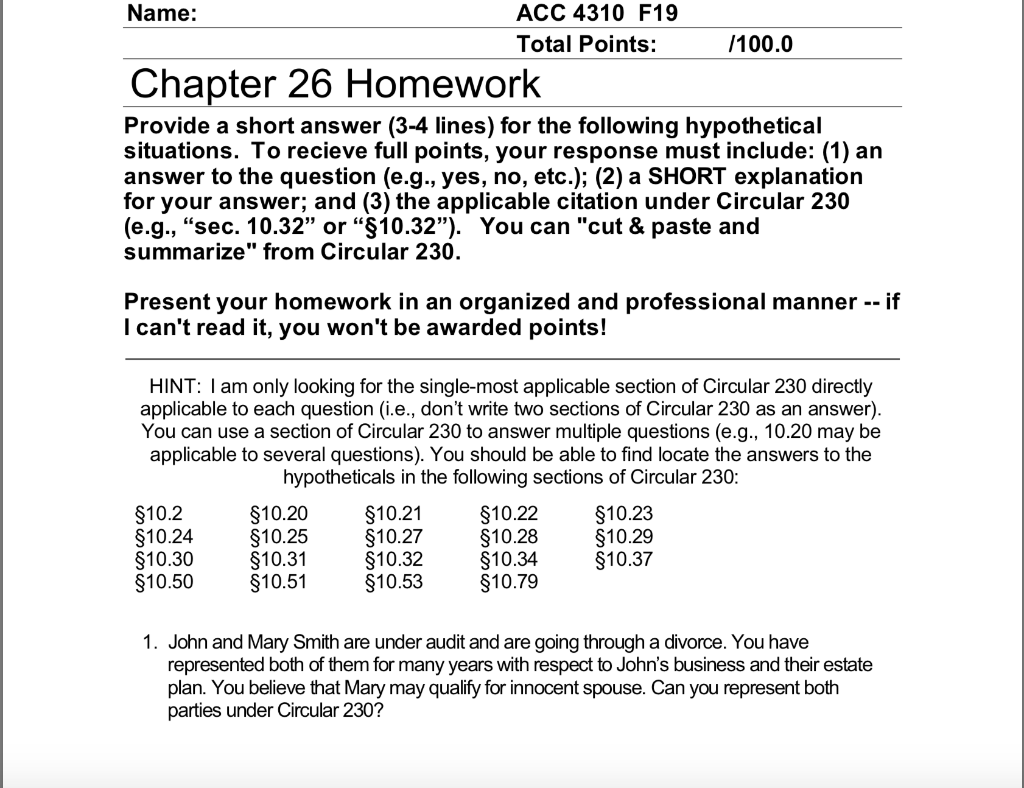

Name: ACC 4310 F19 Total Points: /100.0 Chapter 26 Homework Provide a short answer (3-4 lines) for the following hypothetical situations. To recieve full

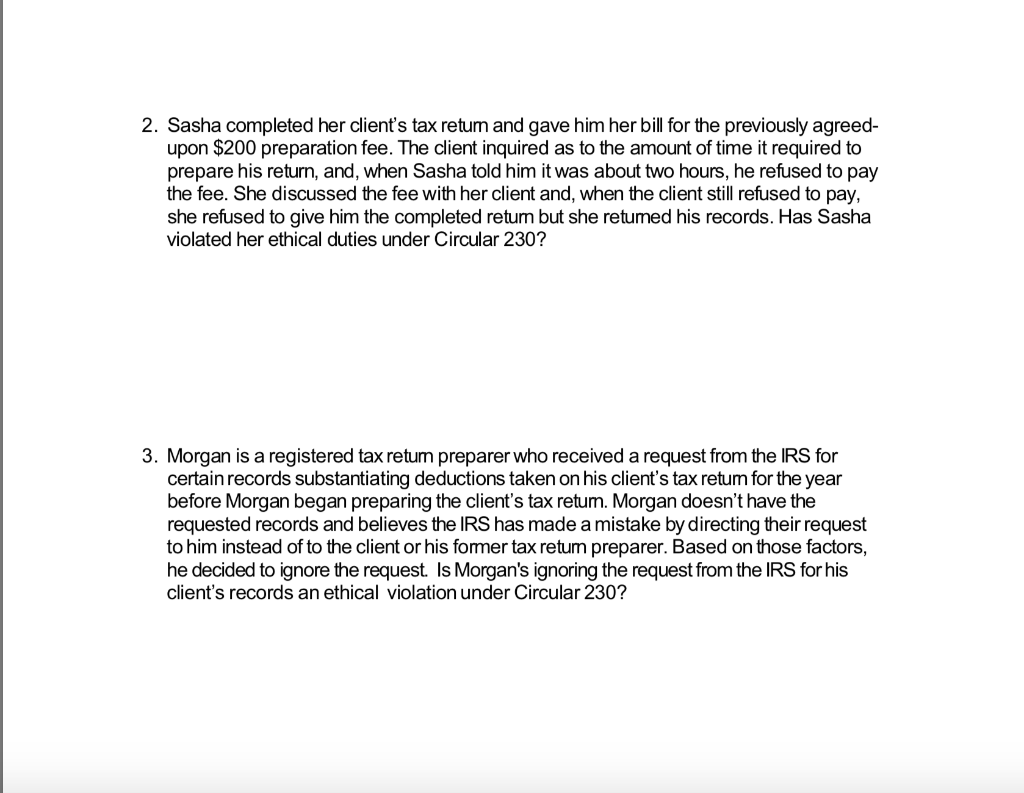

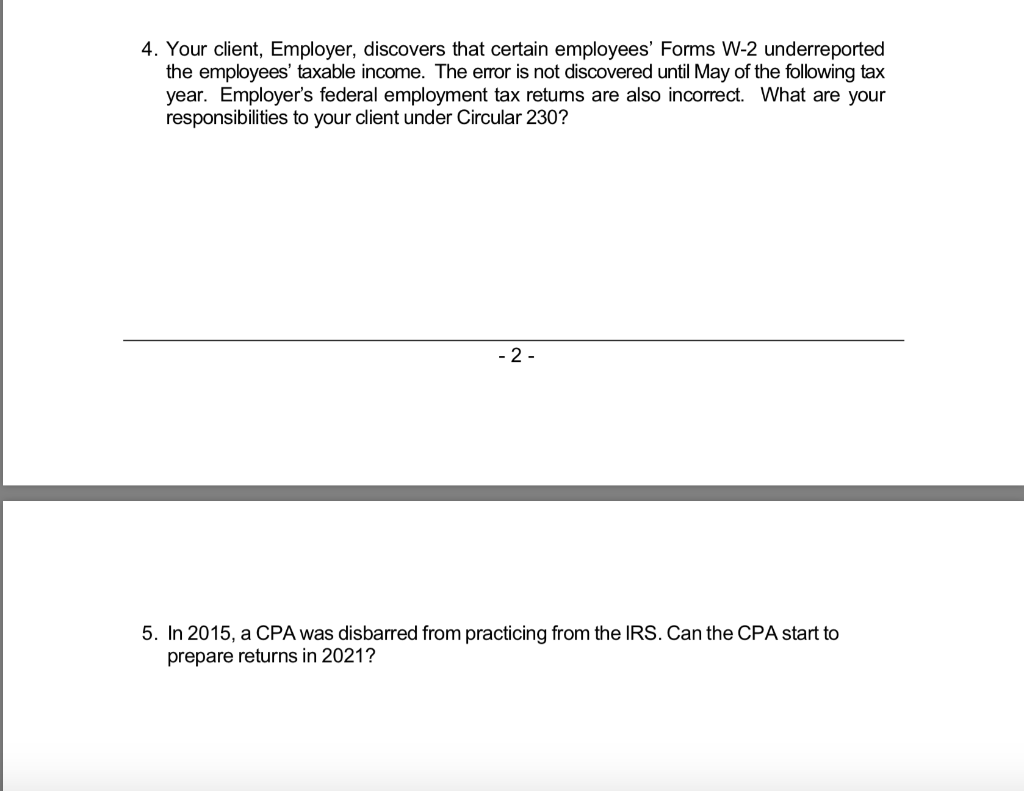

Name: ACC 4310 F19 Total Points: /100.0 Chapter 26 Homework Provide a short answer (3-4 lines) for the following hypothetical situations. To recieve full points, your response must include: (1) an answer to the question (e.g., yes, no, etc.); (2) a SHORT explanation for your answer; and (3) the applicable citation under Circular 230 (e.g., "sec. 10.32" or "10.32"). You can "cut & paste and summarize" from Circular 230. Present your homework in an organized and professional manner -- if I can't read it, you won't be awarded points! HINT: I am only looking for the single-most applicable section of Circular 230 directly applicable to each question (i.e., don't write two sections of Circular 230 as an answer). You can use a section of Circular 230 to answer multiple questions (e.g., 10.20 may be applicable to several questions). You should be able to find locate the answers to the hypotheticals in the following sections of Circular 230: 10.2 10.20 10.21 10.22 $10.23 10.24 10.25 10.27 $10.28 $10.29 10.30 10.31 $10.32 10.34 10.37 $10.50 10.51 $10.53 $10.79 1. John and Mary Smith are under audit and are going through a divorce. You have represented both of them for many years with respect to John's business and their estate plan. You believe that Mary may qualify for innocent spouse. Can you represent both parties under Circular 230? 2. Sasha completed her client's tax retum and gave him her bill for the previously agreed- upon $200 preparation fee. The client inquired as to the amount of time it required to prepare his return, and, when Sasha told him it was about two hours, he refused to pay the fee. She discussed the fee with her client and, when the client still refused to pay, she refused to give him the completed return but she retumed his records. Has Sasha violated her ethical duties under Circular 230? 3. Morgan is a registered tax retum preparer who received a request from the IRS for certain records substantiating deductions taken on his client's tax retum for the year before Morgan began preparing the client's tax retum. Morgan doesn't have the requested records and believes the IRS has made a mistake by directing their request to him instead of to the client or his former tax retum preparer. Based on those factors, he decided to ignore the request. Is Morgan's ignoring the request from the IRS for his client's records an ethical violation under Circular 230? 4. Your client, Employer, discovers that certain employees' Forms W-2 underreported the employees' taxable income. The error is not discovered until May of the following tax year. Employer's federal employment tax retums are also incorrect. What are your responsibilities to your client under Circular 230? -2- 5. In 2015, a CPA was disbarred from practicing from the IRS. Can the CPA start to prepare returns in 2021? 6. Eugene Porter, a CPA, began preparing tax returns regularly publishes a list of his fees and blankets the local area with flyers advertising that, for uncomplicated tax returns, his fees is $100. A footnote at the bottom of the flyer states that additional fees may apply in certain situations. Eugene prepares a tax retum for a client. Since the taxpayer qualified for the eamed income tax credit (EITC), without telling the client, Eugene charged an additional $500 for completing the EITC form. Has Eugene violated any ethical duties under Circular 230? 7. In preparing a client's tax retum for the current year, you discover the prior accountant made an error regarding a net operating loss (NOL). The error results in the NOL carryforward being overstated by $100,000. You inform your client of the error. The client still wants you to prepare the current year's tax return using the incorrect $100,000 NOL carryforward amount. Explain whether you can you do as the client requested? 8. Your client is under audit by the IRS and the Revenue Agent has issued an Information Document Request (IDR). Your client gives a number of documents, some of which you know are false, to respond to the IDR. What are your duties in responding to the IDR? 9. Suppose one of your fellow tax colleagues is suspended from practice before the IRS for violations of Circular 230. May you hire that individual to assist you in a tax audit? 10. Deanna receives an Information Document Request (IDR) from the IRS for her books and records. Deanna picked up her books and records from her accountant and gave them to her uncle for safekeeping. You have filed a Form 2848, Power of Attomey, with the IRS and the Revenue Agent has sent you a copy of the IDR. What are your duties regarding the response to the IDR? 11. A tax return preparer used one of his clients' social security numbers to obtain Medicare benefits for her elderly father. The preparer was convicted of theft by deception (i.e., a type of theft crime where an individual uses false pretenses to gain control of someone's property), but because hardship was only sentenced to 2-years probation. The Secretary of the Treasury, after notice and an opportunity for a proceeding, disbars the preparer from practicing before the IRS for disreputable conduct. Was the preparer's actions disreputable?. 12. Andrea was referred to you by her Family Law Attomey to prepare her current year's retum. Andrea is an enrolled agent and is currently getting a divorce. She has unreported income of at least $75,000 for each of the past 3 years. What are your ethical responsibilities to Andrea? 13. Mary receives a notice of audit for her 20XX retum and has come to you for help. An enrolled agent (EA) prepared Mary's 20XX tax return and you need the workpapers to assist you in defending the audit. The EA refuses to tum over the records because Mary still owes him money on an outstanding bill. Is the EA in violation of Circular 230? 14. Your client, Employer, ask you to submit to the IRS a Form W-4, Employee's Withholding Allowance Certificate, claiming numerous exemptions that it received from one of its employees. Although the employee hasn't made any oral or written statement to Employer indicating the Form W-4 is false, Employer tells you it has reason to believe the Form W-4 is false. Can you submit the Form W-4 to the IRS? 15. In a collection case, you have advised your client that you will try and delay giving the IRS information as long as possible so that the client does not have to start making payments on a federal tax liability. Have you violated your duties under Circular 230? 16. Assume that you worked for the U.S. attomey's office (federal prosecutor's office) and just retired as the head of the tax division for your district. You now work for a large law firm. Just before you left the U.S. attomey's office, you were involved in reviewing some criminal tax matters involving Phillip Blake (aka "The Governor"). One year later Mr. Blake comes to your firm seeking representation. Can your firm represent Mr. Blake? 17. As a practitioner, you knowingly submit false documents to a Revenue Agent during an audit. The Revenue Agent discovers the false information and refers the matter to the Office of Professional Responsibility (OPR). The Secretary of the Treasury has delegated authority to OPR to determine alleged misconduct in violation of Circular 230. OPR ultimately determines you violated your duties under Circular 230 through your disreputable conduct. OPR sanctions you. Can OPR do this? 18. Your client loans $100,000 to his brother to invest in a travel agency business that will be owned by the client and the brother. You know the client has never worked in the business and is a full-time physician by trade. The travel agency goes under. The client wants to take the position loan is a business bad debt. You think this position is unreasonable. Can you prepare and sign the return with this position? 19. Jack and Jill are divorcing after Jack accused Jill of pushing him down a hill. The IRS is currently auditing the couple's 20XX joint return and their accountant is representing both of them in the audit. Jack may qualify for the innocent spouse defense to any assessed tax liabilities resulting from the audit. The Revenue Agent as asked the accountant if Jack intends to seek innocent spouse relief as the Revenue Agent believes Jack would qualify for such relief. The accountant tells the Revenue Agent that he does not want to inform Jack of his innocent spouse rights because it will just prolong the audit, which Jill wants closed soon. What is the Revenue Agent expected to do? -7- 20. Bob suffered a workplace injury that left him unable to work. He sued his former employer. Bob and his employer agreed to settle the lawsuit and Bob received a large settlement last year. Bob's accountant did not report the settlement as taxable income on Bob's tax year for that year. The IRS disagreed and adjusted Bob's return to include the settlement as taxable income. Bob has come to you to file a petition to the US Tax Court challenging the IRS' position regarding the taxability of the settlement. Bob would like to know whether you would take a contingency fee?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 John and Mary Smith Representation Under Circular 230 Question Can you represent both John and Mary Smith under Circular 230 given that they are undergoing an audit and divorce and you have represen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started