Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Name **** BANKS **** ASIATRUST ASIA UNITED BDO UNIBANK BANK PH ISLANDS CHINABANK CITYSTATE BANK EXPORT BANK A EXPORT BANK B EAST WEST BANK

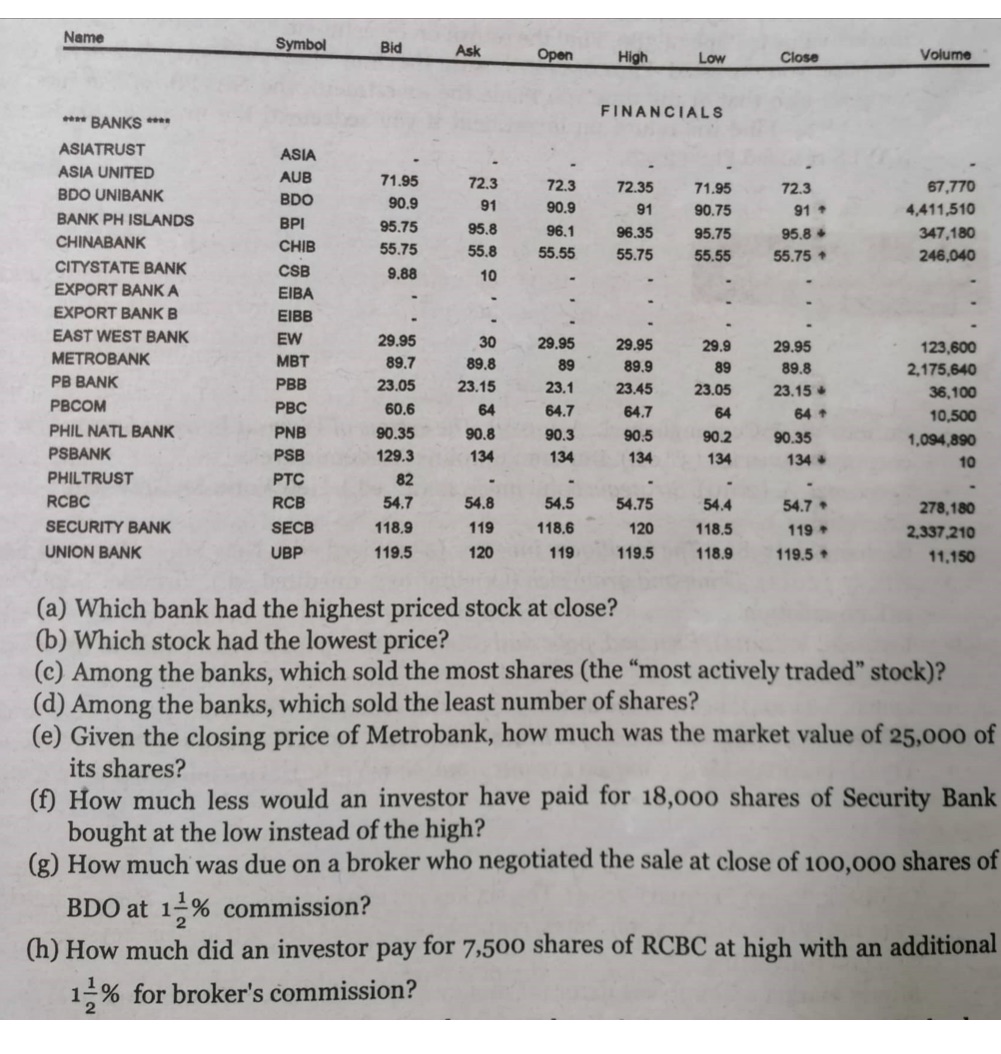

Name **** BANKS **** ASIATRUST ASIA UNITED BDO UNIBANK BANK PH ISLANDS CHINABANK CITYSTATE BANK EXPORT BANK A EXPORT BANK B EAST WEST BANK METROBANK PB BANK PBCOM PHIL NATL BANK PSBANK PHILTRUST RCBC SECURITY BANK UNION BANK Symbol ASIA AUB BDO BPI CHIB CSB EIBB EW MBT PBB PBC PNB PSB PTC RCB SECB UBP Bid 71.95 90.9 95.75 55.75 9.88 29.95 89.7 23.05 60.6 90.35 129.3 82 54.7 118.9 119.5 Ask 72.3 91 95.8 55.8 10 30 89.8 23.15 64 90.8 134 54.8 119 120 Open 72.3 90.9 96.1 55.55 29.95 89 23.1 64.7 90.3 134 54.5 118.6 119 High FINANCIALS 72.35 91 96.35 55.75 29.95 89.9 23.45 64.7 90.5 134 Low 54.75 120 119.5 71.95 90.75 95.75 55.55 29.9 89 23.05 64 90.2 134 54.4 118.5 118.9 Close 72.3 91 + 95.8 55.75 + 29.95 89.8 23.15 64 + 90.35 134- 54.7. 119 119.5 Volume 67,770 4,411,510 347,180 246,040 123,600 2,175,640 36,100 10,500 1,094,890 - 278,180 2,337,210 11,150 (a) Which bank had the highest priced stock at close? (b) Which stock had the lowest price? (c) Among the banks, which sold the most shares (the "most actively traded" stock)? (d) Among the banks, which sold the least number of shares? (e) Given the closing price of Metrobank, how much was the market value of 25,000 of its shares? (f) How much less would an investor have paid for 18,000 shares of Security Bank bought at the low instead of the high? (g) How much was due on a broker who negotiated the sale at close of 100,000 shares of BDO at 1% commission? (h) How much did an investor pay for 7,500 shares of RCBC at high with an additional 1% for broker's commission?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to your questions a Which bank had the highest priced stock at close Union Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started