Answered step by step

Verified Expert Solution

Question

1 Approved Answer

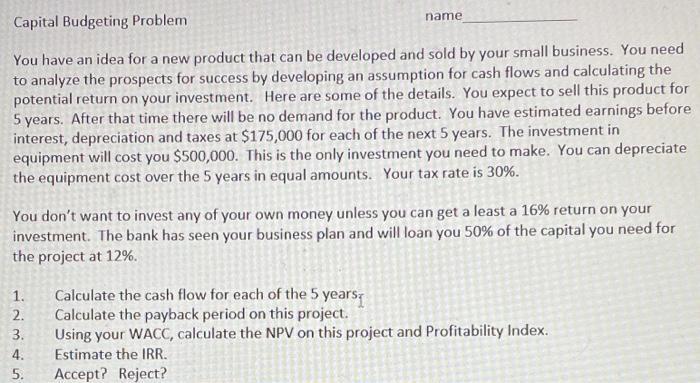

name Capital Budgeting Problem You have an idea for a new product that can be developed and sold by your small business. You need

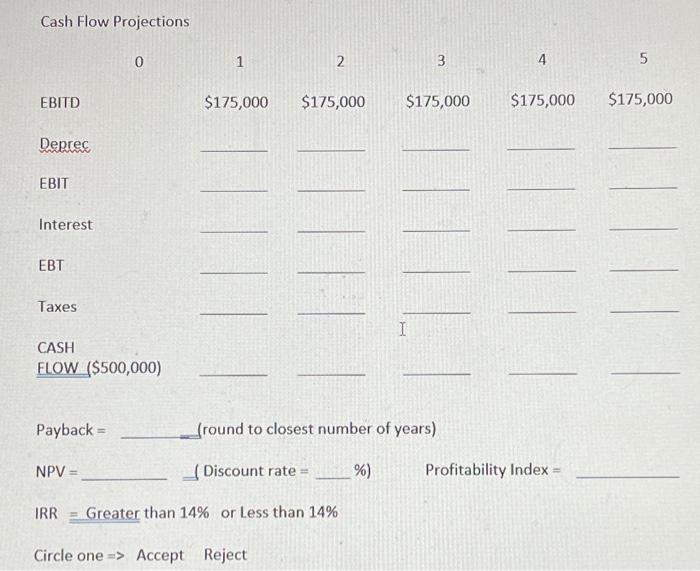

name Capital Budgeting Problem You have an idea for a new product that can be developed and sold by your small business. You need to analyze the prospects for success by developing an assumption for cash flows and calculating the potential return on your investment. Here are some of the details. You expect to sell this product for 5 years. After that time there will be no demand for the product. You have estimated earnings before interest, depreciation and taxes at $175,000 for each of the next 5 years. The investment in equipment will cost you $500,000. This is the only investment you need to make. You can depreciate the equipment cost over the 5 years in equal amounts. Your tax rate is 30%. You don't want to invest any of your own money unless you can get a least a 16% return on your investment. The bank has seen your business plan and will loan you 50% of the capital you need for the project at 12%. 1. 2. 3. 4. 5. Calculate the cash flow for each of the 5 years Calculate the payback period on this project. Using your WACC, calculate the NPV on this project and Profitability Index. Estimate the IRR. Accept? Reject? Cash Flow Projections EBITD Deprec EBIT Interest EBT Taxes CASH FLOW ($500,000) Payback = 0 NPV = 1 2 $175,000 $175,000 IRR Greater than 14% or Less than 14% Circle one-> Accept Reject $175,000 I (round to closest number of years) (Discount rate= %) 3 4 $175,000 Profitability Index = 5 $175,000

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started