Name of company NIKE INC.

-THE STATEMENT OF CASH FLOWS-

1.What was the ending balance of cash and cash equivalents?

$__________________________________

Does this agree with the ending balance of cash and cash equivalents reported on the balance sheet?

Yes __________ No __________

2. Did the company use the direct or indirect method in reporting net cash flows?

How can you tell?

3. What was the net cash flow from operating activities?

$ ___________________________________________

Was it an inflow or an outflow of cash? ______________________

4. What was the net cash flow from investing activities?

$ ____________________________________________

Was it an inflow or an outflow of cash? _____________________

What activity accounted for the largest cash flow from investing activities?

_______________________________________________

Was this activity an inflow or an outflow of cash?

5.. What was the net cash flow from financing activities?

$ __________________________________________________

Was it an inflow or an outflow of cash? _____________________

What activity accounted for the largest cash flow from financing activities?

___________________________________________________

Was it an inflow or an outflow of cash? ________________________

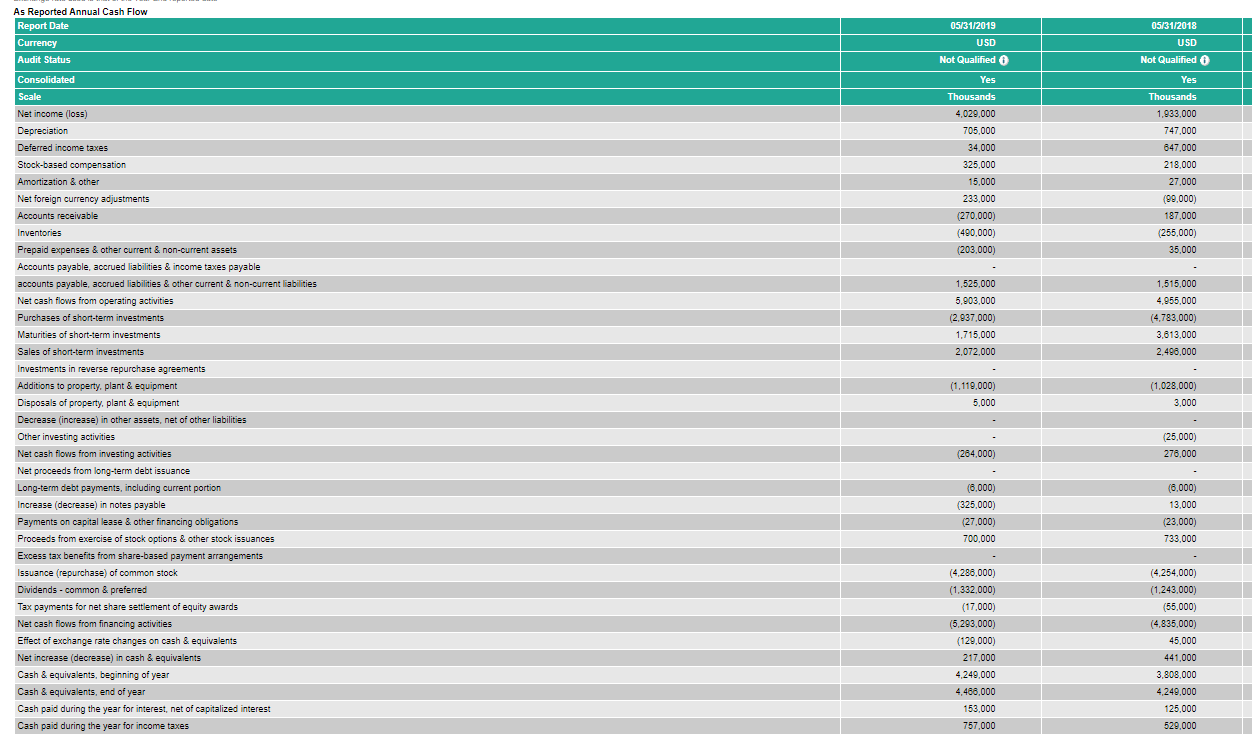

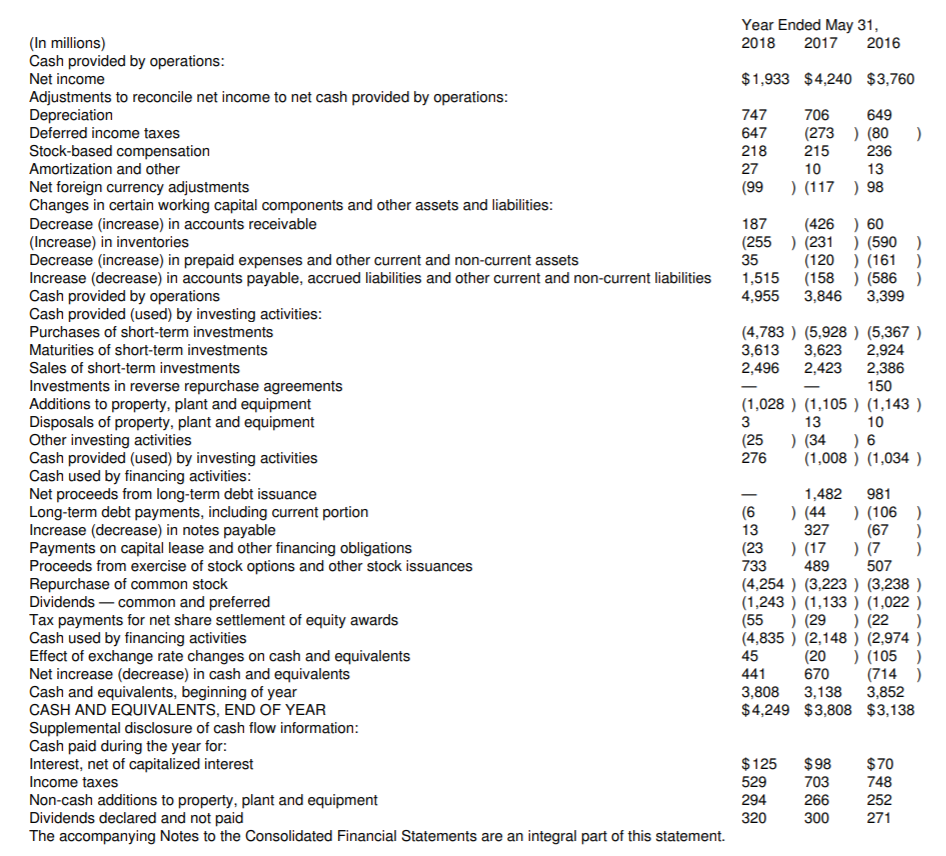

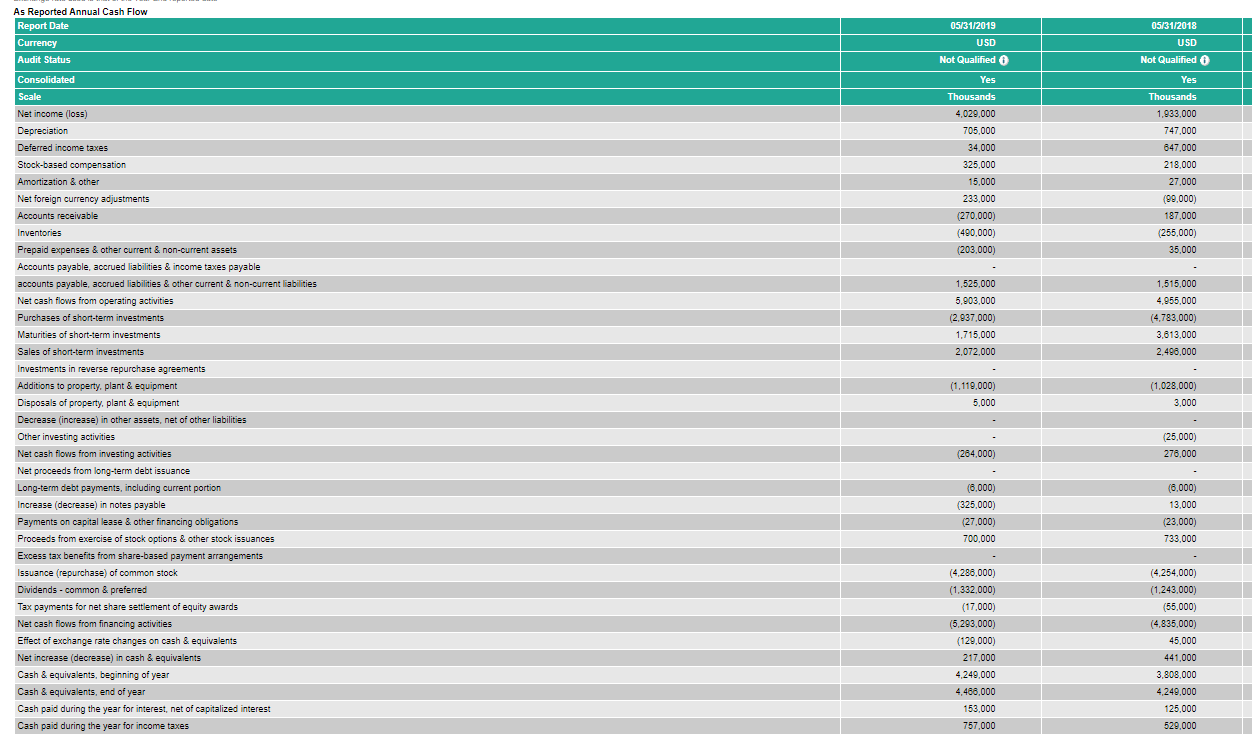

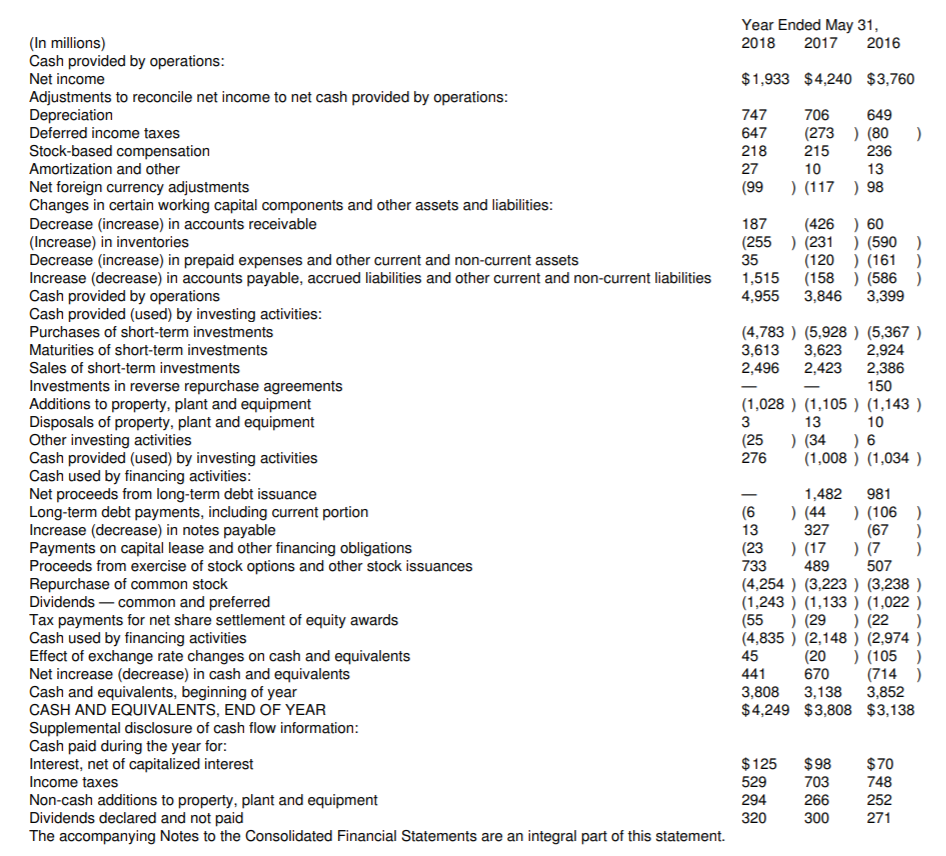

As Reported Annual Cash Flow Report Date Currency Audit Status 05/31/2018 USD | Consolidated Scale Net income (loss) Depreciation Deferred income taxes Stock-based compensation Amortization & other Net foreign currency adjustments Accounts receivable Inventories 05/31/2019 USD Not Qualified Yes Thousands 4,029,000 705,000 34,000 325,000 15.000 233,000 (270.000) (490,000) (203,000) Yes Thousands 1,933.000 747.000 847,000 218,000 27,000 (99.000) 187,000 (255.000) 35,000 1,525,000 5,903.000 (2.937.000) 1,715,000 2.072.000 1,515,000 4,955,000 (4,783,000) 3,613,000 2.498,000 (1,119,000) 5,000 (1,028,000) 3,000 (25.000) 278,000 (284.000) Prepaid expenses & other current & non-current assets Accounts payable, accrued liabilities & income taxes payable accounts payable, accrued liabilities & other current & non-current liabilities Net cash flows from operating activities Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Investments in reverse repurchase agreements Additions to property, plant & equipment Disposals of property, plant & equipment Decrease (increase) in other assets, net of other liabilities Other investing activities Net cash flows from investing activities Net proceeds from long-term debt issuance Long-term debt payments, including current portion Increase (decrease) in notes payable Payments on capital lease & other financing obligations Proceeds from exercise of stock options & other stock issuances Excess tax benefits from share-based payment arrangements Issuance (repurchase) of common stock Dividends - common & preferred Tax payments for net share settlement of equity awards Net cash flows from financing activities Effect of exchange rate changes on cash & equivalents Net increase (decrease) in cash & equivalents Cash & equivalents, beginning of year Cash & equivalents, end of year Cash paid during the year for interest, net of capitalized interest Cash paid during the year for income taxes (8,000) (325,000) (27,000) 700.000 (6.000) 13,000 (23,000) 733.000 (4,286,000) (1,332,000) (17.000) (5,293,000) (129,000) 217.000 4,249,000 4.468,000 153,000 757.000 (4.254,000) (1,243,000) (55,000) (4.835.000) 45,000 441,000 3.808,000 4,249,000 125.000 529.000 Year Ended May 31, 2018 2017 2016 $1,933 $4,240 $3,760 ) 747 647 218 27 (99 706 (273 215 10 ) (117 649 ) (80 236 13 98 187 (255 35 1,515 4,955 (426 ) 60 ) (231 ) (590 ) (120 ) (161) (158) (586 ) 3,846 3,399 (In millions) Cash provided by operations: Net income Adjustments to reconcile net income to net cash provided by operations: Depreciation Deferred income taxes Stock-based compensation Amortization and other Net foreign currency adjustments Changes in certain working capital components and other assets and liabilities: Decrease increase) in accounts receivable (Increase) in inventories Decrease increase) in prepaid expenses and other current and non-current assets Increase (decrease) in accounts payable, accrued liabilities and other current and non-current liabilities Cash provided by operations Cash provided (used) by investing activities Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Investments in reverse repurchase agreements Additions to property, plant and equipment Disposals of property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash used by financing activities: Net proceeds from long-term debt issuance Long-term debt payments, including current portion Increase (decrease) in notes payable Payments on capital lease and other financing obligations Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends - common and preferred Tax payments for net share settlement of equity awards Cash used by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for: Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. (4,783 ) (5,928 ) (5,367 ) 3,613 3,623 2,924 2,496 2,423 2,386 - 150 (1,028) (1,105 ) (1,143 ) 3 13 10 (25 (34 6 276 (1,008) (1,034 ) 1,482 981 (6 (44 (106 ) 13 327 (67 ) (23 ) (17 (7 ) 733 489 507 (4,254 ) (3,223 ) (3,238 ) (1,243 ) (1,133 ) (1,022 ) (55 (29 (22 ) (4,835 ) (2,148 ) (2,974 ) 45 (20 (105 ) 441 670 (714 ) 3,808 3,138 3,852 $4,249 $3,808 $3,138 $125 529 294 320 $98 703 266 $70 748 252 271 300