Answered step by step

Verified Expert Solution

Question

1 Approved Answer

name of the company is Nec Requirement #4: Ch 8: Stock Valuation. Find your company's stock value at year end. See your statement of financial

name of the company is Nec

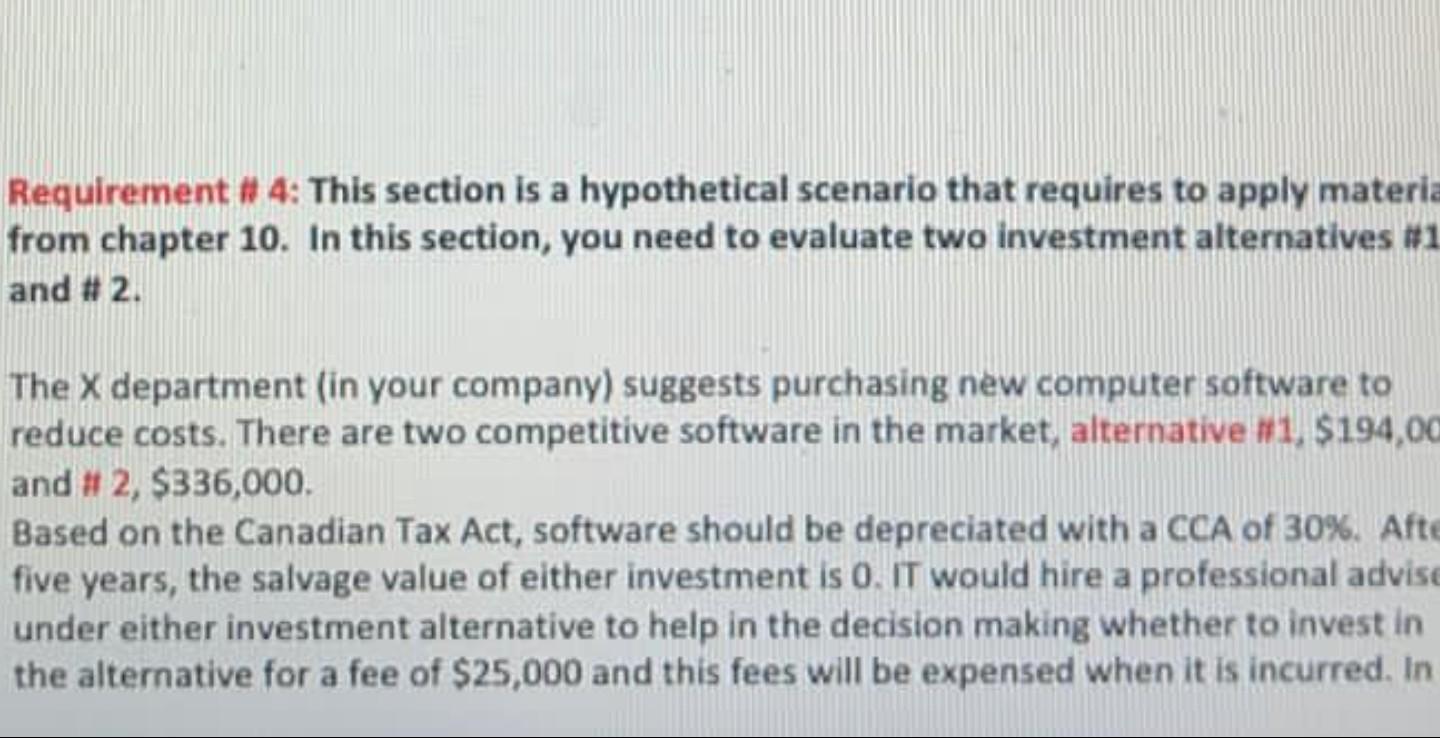

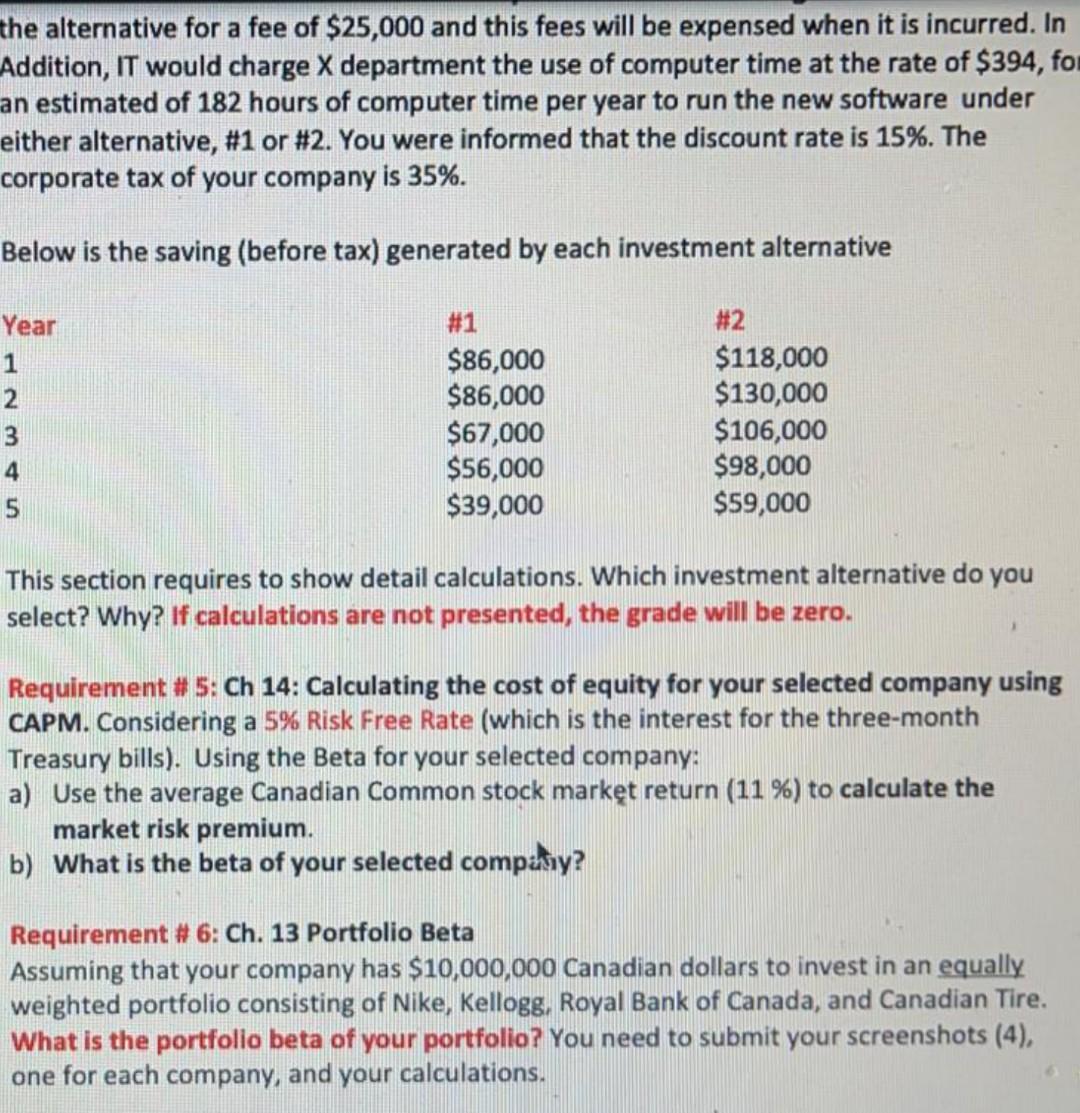

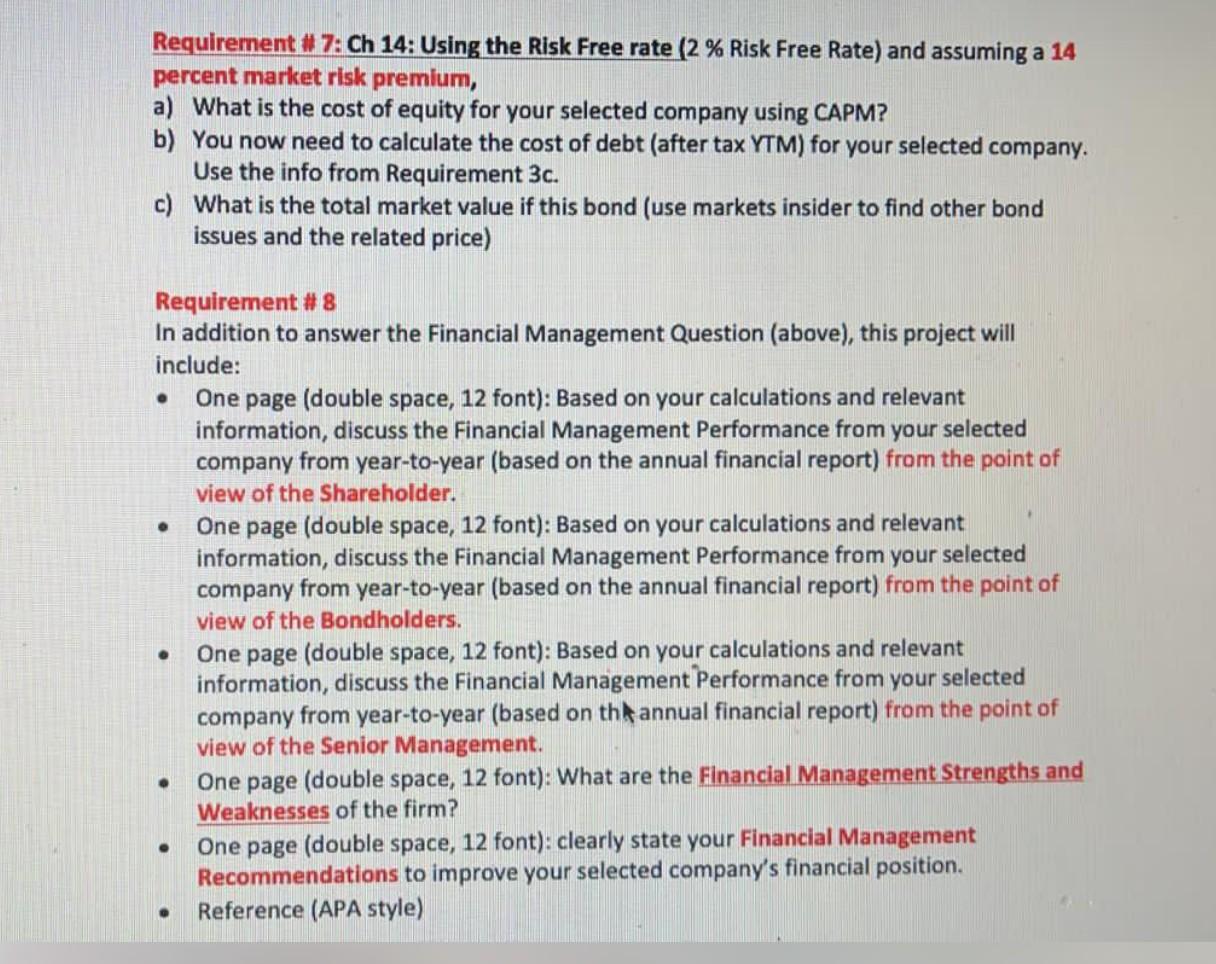

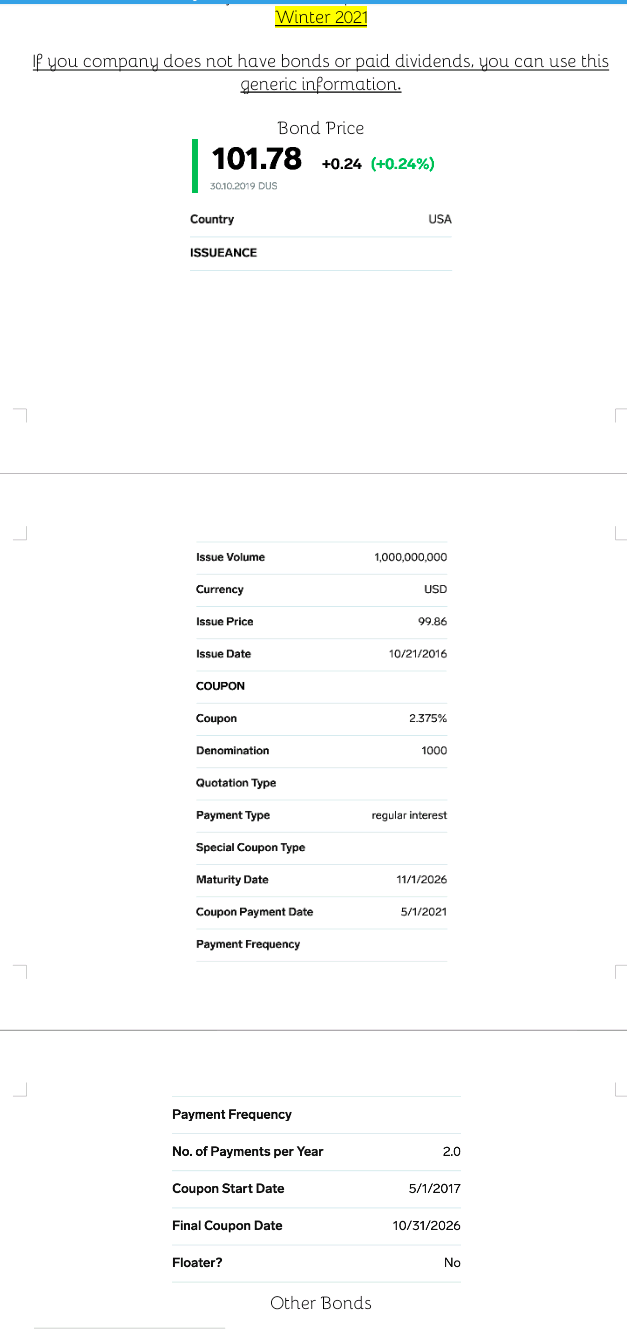

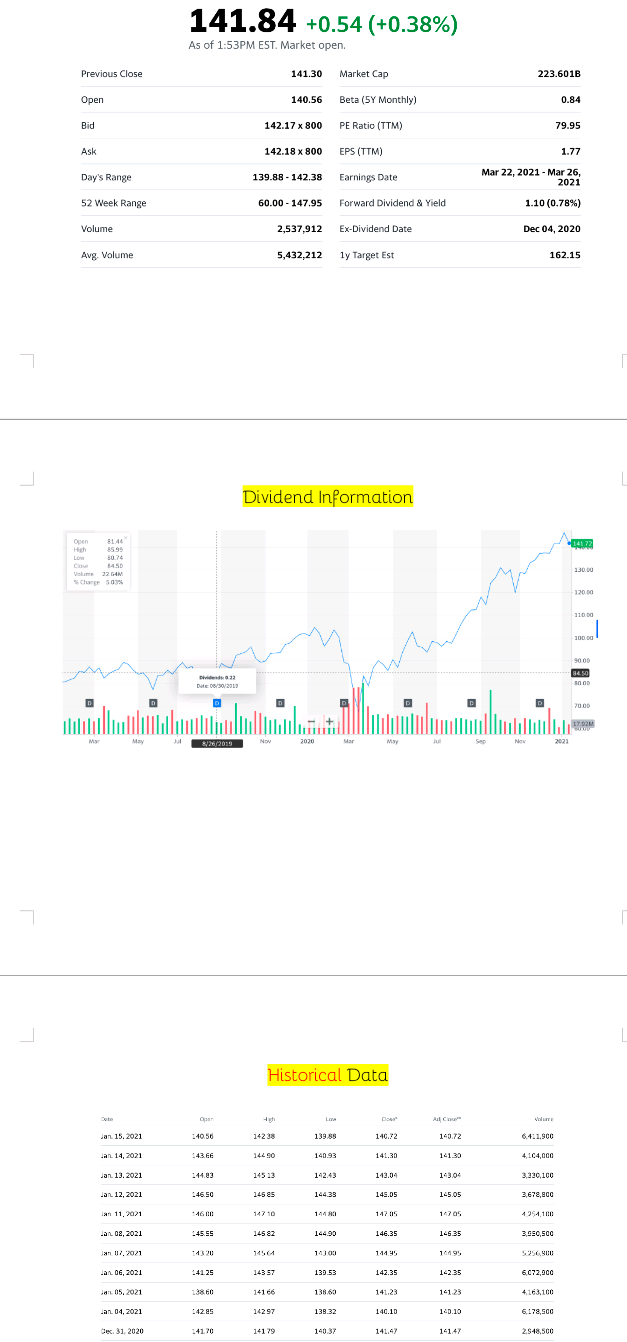

Requirement #4: Ch 8: Stock Valuation. Find your company's stock value at year end. See your statement of financial position date. Locate your company's annual dividend per share and calculate the dividend yield. Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? What do you conclude from the above Information? the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year 1 2 3 4 5 #1 $86,000 $86,000 $67,000 $56,000 $39,000 #2 $118,000 $130,000 $106,000 $98,000 $59,000 This section requires to show detail calculations. Which investment alternative do you select? Why? If calculations are not presented, the grade will be zero. Requirement #5: Ch 14: Calculating the cost of equity for your selected company using CAPM. Considering a 5% Risk Free Rate (which is the interest for the three-month Treasury bills). Using the Beta for your selected company: a) Use the average Canadian Common stock market return (11 %) to calculate the market risk premium. b) What is the beta of your selected compaly? Requirement #6: Ch. 13 Portfolio Beta Assuming that your company has $10,000,000 Canadian dollars to invest in an equally weighted portfolio consisting of Nike, Kellogg, Royal Bank of Canada, and Canadian Tire. What is the portfolio beta of your portfolio? You need to submit your screenshots (4), one for each company, and your calculations. Requirement #7: Ch 14: Using the Risk Free rate (2 % Risk Free Rate) and assuming a 14 percent market risk premium, a) What is the cost of equity for your selected company using CAPM? b) You now need to calculate the cost of debt (after tax YTM) for your selected company. Use the info from Requirement 3c. c) What is the total market value if this bond (use markets insider to find other bond issues and the related price) . Requirement #8 In addition to answer the Financial Management Question (above), this project will include: One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Shareholder. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Bondholders. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Senior Management. One page (double space, 12 font): What are the Financial Management Strengths and Weaknesses of the firm? One page (double space, 12 font): clearly state your Financial Management Recommendations to improve your selected company's financial position. Reference (APA style) . . . 141.84 +0.54 (+0.38%) As of 1:53PM EST. Market open. Previous Close 141.30 Market Cap 223.601B Open 140.56 Beta (5Y Monthly) ) 0.84 Bid 142.17 x 800 PE Ratio (TTM) 79.95 142.18 x 800 EPS (TTM) 1.77 Day's Range 139.88 - 142.38 Earnings Date Mar 22, 2021 - Mar 26, 2021 52 Week Range 60.00 - 147.95 Forward Dividend & Yield 1.10 (0.78%) Volume 2,537,912 Ex-Dividend Date Dec 04, 2020 Avg Volume 5,432,212 1y Target Est 162.15 Dividend Information 14172 Open 5144 8599 LO 30.74 845D Volume 22 AM Change 59 130.00 120 00 110.00 100.00 90.00 84,50 OD Divide Date: 08/30/2013 20.00 17.02 M May Now 2020 8/26/2015 ut May Now 2023 Historical Data On H Jan 15, 2021 240.50 14238 139.85 140.72 140.72 6.4.1,900 Jan 14, 2021 14490 140.93 141.30 141.30 4,104,000 Jan 13.2021 214.83 145 13 142.43 143.04 143.04 3.320,100 Jan 12, 2021 146.50 145 85 144.39 145.05 145.05 3,678,000 lan 11.2021 4600 14710 1443 14705 14705 1954,100 an 08, 2021 145 5S 14582 144,90 146.35 145.35 3,550,5CC Jan 07,2021 14320 14300 144.95 10195 5.250,900 an 06, 2021 141 25 14357 139.53 142.35 142.35 6.072,000 Jan 05, 2021 13860 141 66 138 63 141.23 14123 4,103,100 Jan 04,2021 :42.as 14297 13932 140.10 120.10 6,178,500 Dec 31, 2020 241.70 14179 140.37 141,47 141.47 2.548,500 Requirement #4: Ch 8: Stock Valuation. Find your company's stock value at year end. See your statement of financial position date. Locate your company's annual dividend per share and calculate the dividend yield. Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? What do you conclude from the above Information? the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year 1 2 3 4 5 #1 $86,000 $86,000 $67,000 $56,000 $39,000 #2 $118,000 $130,000 $106,000 $98,000 $59,000 This section requires to show detail calculations. Which investment alternative do you select? Why? If calculations are not presented, the grade will be zero. Requirement #5: Ch 14: Calculating the cost of equity for your selected company using CAPM. Considering a 5% Risk Free Rate (which is the interest for the three-month Treasury bills). Using the Beta for your selected company: a) Use the average Canadian Common stock market return (11 %) to calculate the market risk premium. b) What is the beta of your selected compaly? Requirement #6: Ch. 13 Portfolio Beta Assuming that your company has $10,000,000 Canadian dollars to invest in an equally weighted portfolio consisting of Nike, Kellogg, Royal Bank of Canada, and Canadian Tire. What is the portfolio beta of your portfolio? You need to submit your screenshots (4), one for each company, and your calculations. Requirement #7: Ch 14: Using the Risk Free rate (2 % Risk Free Rate) and assuming a 14 percent market risk premium, a) What is the cost of equity for your selected company using CAPM? b) You now need to calculate the cost of debt (after tax YTM) for your selected company. Use the info from Requirement 3c. c) What is the total market value if this bond (use markets insider to find other bond issues and the related price) . Requirement #8 In addition to answer the Financial Management Question (above), this project will include: One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Shareholder. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Bondholders. One page (double space, 12 font): Based on your calculations and relevant information, discuss the Financial Management Performance from your selected company from year-to-year (based on the annual financial report) from the point of view of the Senior Management. One page (double space, 12 font): What are the Financial Management Strengths and Weaknesses of the firm? One page (double space, 12 font): clearly state your Financial Management Recommendations to improve your selected company's financial position. Reference (APA style) . . . 141.84 +0.54 (+0.38%) As of 1:53PM EST. Market open. Previous Close 141.30 Market Cap 223.601B Open 140.56 Beta (5Y Monthly) ) 0.84 Bid 142.17 x 800 PE Ratio (TTM) 79.95 142.18 x 800 EPS (TTM) 1.77 Day's Range 139.88 - 142.38 Earnings Date Mar 22, 2021 - Mar 26, 2021 52 Week Range 60.00 - 147.95 Forward Dividend & Yield 1.10 (0.78%) Volume 2,537,912 Ex-Dividend Date Dec 04, 2020 Avg Volume 5,432,212 1y Target Est 162.15 Dividend Information 14172 Open 5144 8599 LO 30.74 845D Volume 22 AM Change 59 130.00 120 00 110.00 100.00 90.00 84,50 OD Divide Date: 08/30/2013 20.00 17.02 M May Now 2020 8/26/2015 ut May Now 2023 Historical Data On H Jan 15, 2021 240.50 14238 139.85 140.72 140.72 6.4.1,900 Jan 14, 2021 14490 140.93 141.30 141.30 4,104,000 Jan 13.2021 214.83 145 13 142.43 143.04 143.04 3.320,100 Jan 12, 2021 146.50 145 85 144.39 145.05 145.05 3,678,000 lan 11.2021 4600 14710 1443 14705 14705 1954,100 an 08, 2021 145 5S 14582 144,90 146.35 145.35 3,550,5CC Jan 07,2021 14320 14300 144.95 10195 5.250,900 an 06, 2021 141 25 14357 139.53 142.35 142.35 6.072,000 Jan 05, 2021 13860 141 66 138 63 141.23 14123 4,103,100 Jan 04,2021 :42.as 14297 13932 140.10 120.10 6,178,500 Dec 31, 2020 241.70 14179 140.37 141,47 141.47 2.548,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started