Answered step by step

Verified Expert Solution

Question

1 Approved Answer

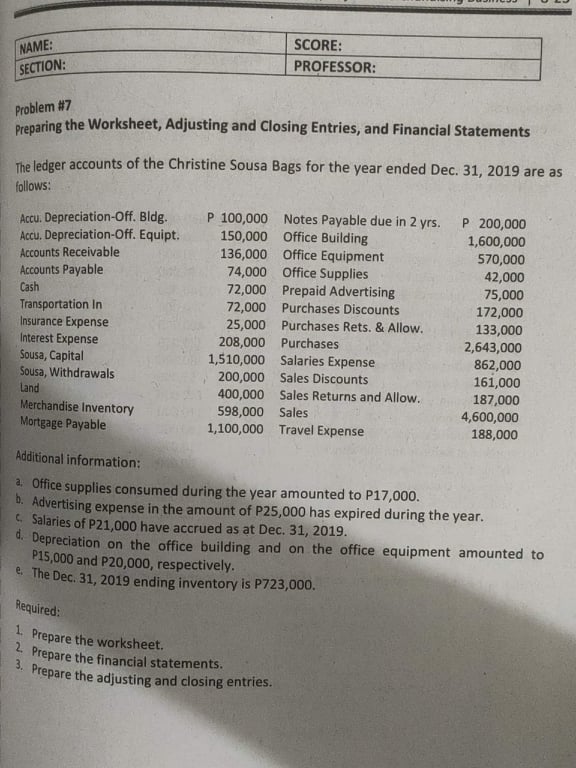

NAME: SECTION: Problem #7 SCORE: PROFESSOR: Preparing the Worksheet, Adjusting and Closing Entries, and Financial Statements The ledger accounts of the Christine Sousa Bags

NAME: SECTION: Problem #7 SCORE: PROFESSOR: Preparing the Worksheet, Adjusting and Closing Entries, and Financial Statements The ledger accounts of the Christine Sousa Bags for the year ended Dec. 31, 2019 are as follows: Accu. Depreciation-Off. Bldg. P 100,000 Accu. Depreciation-Off. Equipt. 150,000 Notes Payable due in 2 yrs. Office Building P 200,000 1,600,000 Accounts Receivable 136,000 Office Equipment 570,000 Cash Accounts Payable Transportation In 74,000 Office Supplies 42,000 72,000 Prepaid Advertising 75,000 72,000 Purchases Discounts 172,000 Insurance Expense 25,000 Purchases Rets. & Allow. 133,000 Interest Expense 208,000 Purchases 2,643,000 Sousa, Capital 1,510,000 Salaries Expense 862,000 Sousa, Withdrawals 200,000 Sales Discounts 161,000 Land 400,000 Sales Returns and Allow. 187,000 Merchandise Inventory 598,000 Sales 4,600,000 Mortgage Payable 1,100,000 Travel Expense 188,000 Additional information: a. Office supplies consumed during the year amounted to P17,000. b. Advertising expense in the amount of P25,000 has expired during the year. Salaries of P21,000 have accrued as at Dec. 31, 2019. d. Depreciation on the office building and on the office equipment amounted to P15,000 and P20,000, respectively. e. The Dec. 31, 2019 ending inventory is P723,000. Required: 1. Prepare the worksheet. 2. Prepare the financial statements. 3. Prepare the adjusting and closing entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started