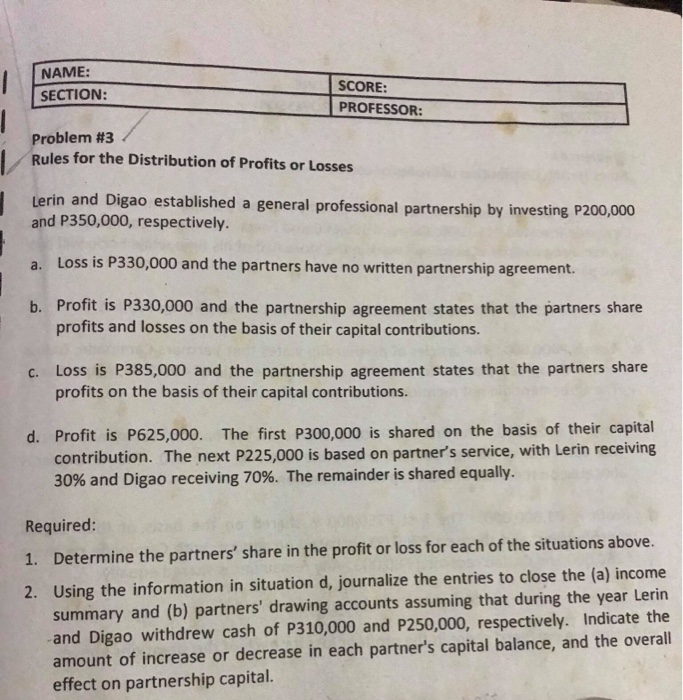

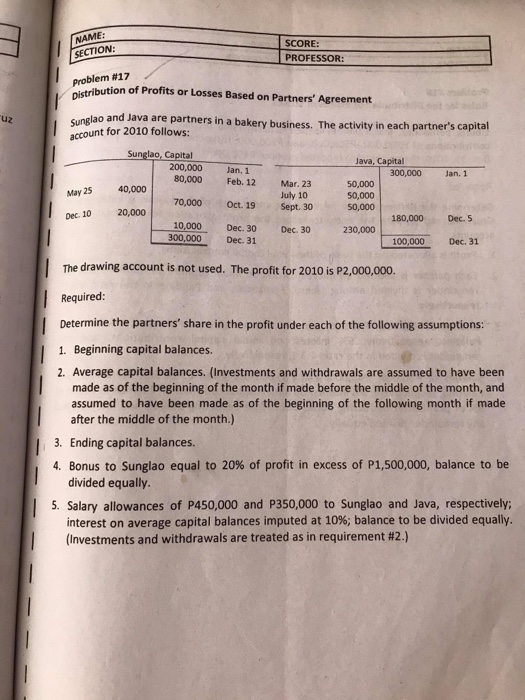

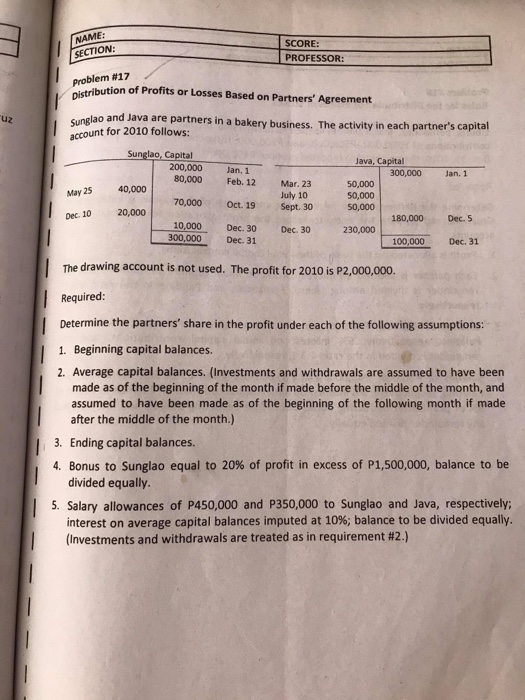

NAME: SECTION: SCORE: PROFESSOR: Problem #3 Rules for the Distribution of Profits or Losses Lerin and Digao established a general professional partnership by investing P200,000 and P350,000, respectively. a. Loss is P330,000 and the partners have no written partnership agreement. b. Profit is P330,000 and the partnership agreement states that the partners share profits and losses on the basis of their capital contributions. C. Loss is P385,000 and the partnership agreement states that the partners share profits on the basis of their capital contributions. d. Profit is P625,000. The first P300,000 is shared on the basis of their capital contribution. The next P225,000 is based on partner's service, with Lerin receiving 30% and Digao receiving 70%. The remainder is shared equally. Required: 1. Determine the partners' share in the profit or loss for each of the situations above. 2. Using the information in situation d, journalize the entries to close the (a) income summary and (b) partners' drawing accounts assuming that during the year Lerin and Digao withdrew cash of P310,000 and P250,000, respectively. Indicate the amount of increase or decrease in each partner's capital balance, and the overall effect on partnership capital. NAME: SECTION: SCORE: PROFESSOR: Problem #17 ribution of Profits or Losses Based on Partners' Agreement uz cunglao and Java are partners in a bakery business. The activity in each partner's capital account for 2010 follows: Jan. Feb. 12 Jan. 1 May 25 Dec. 10 Sunglao, Capital 200,000 80,000 40,000 70,000 20,000 10,000 300,000 Mar. 23 July 10 Sept. 30 Oct. 19 Java, Capital 300,000 50,000 50,000 50,000 180,000 230,000 100,000 Dec. 5 Dec. 30 Dec. 31 Dec. 30 Dec. 31 The drawing account is not used. The profit for 2010 is P2,000,000. Required: Determine the partners' share in the profit under each of the following assumptions: 1. Beginning capital balances. 2. Average capital balances. (Investments and withdrawals are assumed to have been made as of the beginning of the month if made before the middle of the month, and assumed to have been made as of the beginning of the following month if made after the middle of the month.) 3. Ending capital balances. 4. Bonus to Sunglao equal to 20% of profit in excess of P1,500,000, balance to be divided equally. 5. Salary allowances of P450,000 and P350,000 to Sunglao and Java, respectively; interest on average capital balances imputed at 10%; balance to be divided equally. (Investments and withdrawals are treated as in requirement #2.)