Answered step by step

Verified Expert Solution

Question

1 Approved Answer

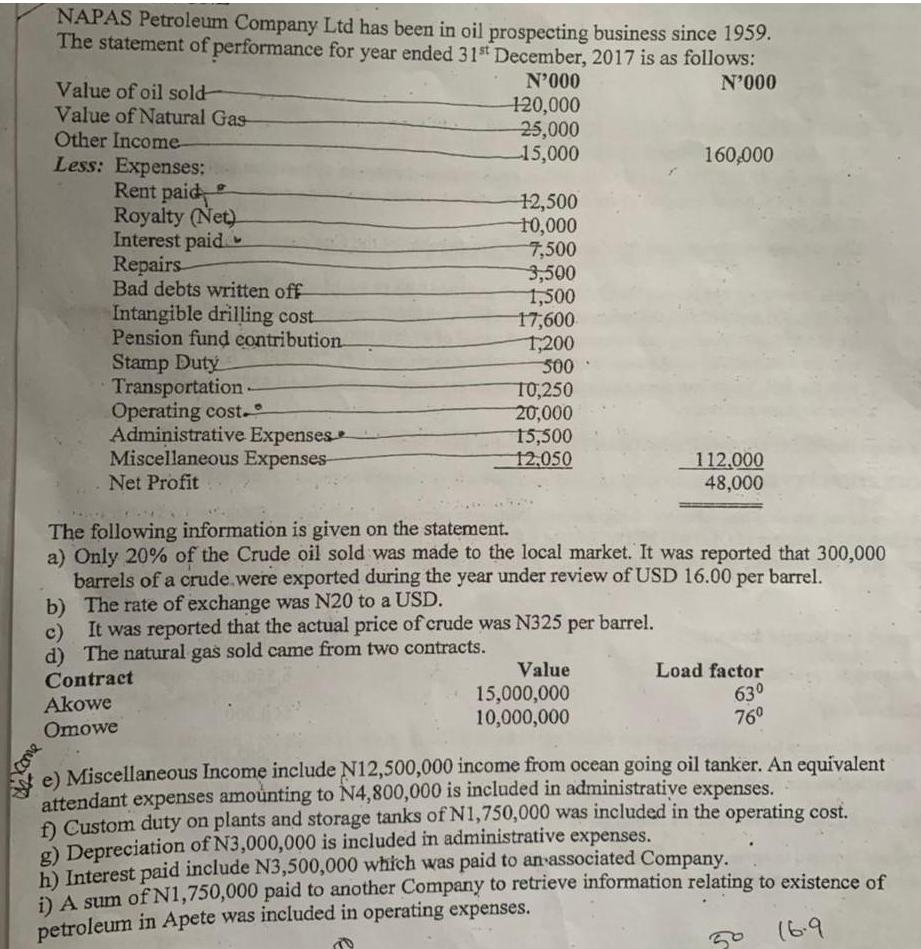

NAPAS Petroleum Company Ltd has been in oil prospecting business since 1959. The statement of performance for year ended 31st December, 2017 is as

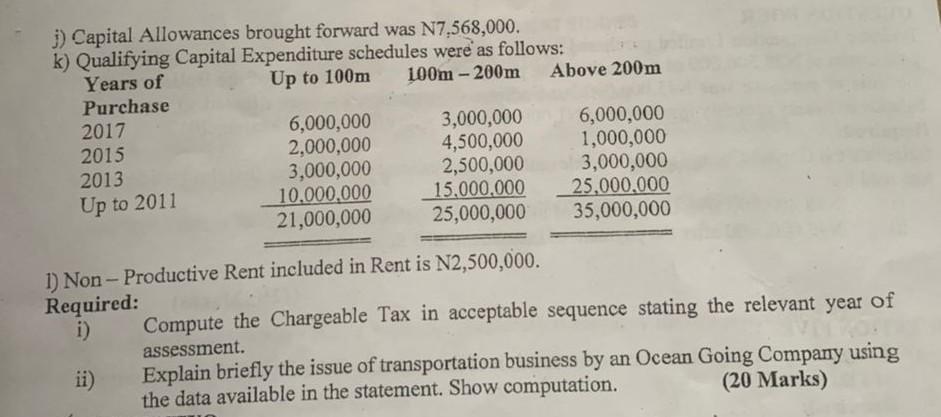

NAPAS Petroleum Company Ltd has been in oil prospecting business since 1959. The statement of performance for year ended 31st December, 2017 is as follows: N'000 N'000 Value of oil sold- Value of Natural Gas Other Income- Less: Expenses: come Rent paid Royalty (Net) Interest paid Repairs Bad debts written off Intangible drilling cost Pension fund contribution Stamp Duty Transportation. Operating cost. Administrative Expenses Miscellaneous Expenses- Net Profit 120,000 25,000 15,000 Akowe Omowe 12,500 10,000 7,500 3,500 1,500 17,600 1,200 500 10,250 20,000 15,500 12,050 b) The rate of exchange was N20 to a USD. c) It was reported that the actual price of crude was N325 per barrel. d) The natural gas sold came from two contracts. Contract The following information is given on the statement. a) Only 20% of the Crude oil sold was made to the local market. It was reported that 300,000 barrels of a crude were exported during the year under review of USD 16.00 per barrel. 160,000 Value 15,000,000 10,000,000 112,000 48,000 Load factor 63 76 e) Miscellaneous Income include N12,500,000 income from ocean going oil tanker. An equivalent attendant expenses amounting to N4,800,000 is included in administrative expenses. f) Custom duty on plants and storage tanks of N1,750,000 was included in the operating cost. g) Depreciation of N3,000,000 is included in administrative expenses. h) Interest paid include N3,500,000 which was paid to an associated Company. i) A sum of N1,750,000 paid to another Company to retrieve information relating to existence of petroleum in Apete was included in operating expenses. 16.9 j) Capital Allowances brought forward was N7,568,000. k) Qualifying Capital Expenditure schedules were as follows: Years of Up to 100m 100m - 200m Purchase 2017 2015 2013 Up to 2011 6,000,000 2,000,000 3,000,000 10,000,000 21,000,000 3,000,000 4,500,000 2,500,000 15,000,000 25,000,000 1) Non-Productive Rent included in Rent is N2,500,000. Required: i) ii) Above 200m 6,000,000 1,000,000 3,000,000 25,000,000 35,000,000 Compute the Chargeable Tax in acceptable sequence stating the relevant year of Tron assessment. Explain briefly the issue of transportation business by an Ocean Going Company using (20 Marks) the data available in the statement. Show computation.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer and Explanation i To compute the chargeable tax for NAPAS Petroleum Company Ltd we need to fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started