Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Napoleon has been studying the Netflix company stock and has come to the conclusion that Netflix is currently overpriced. Napoleon would like to capitalize

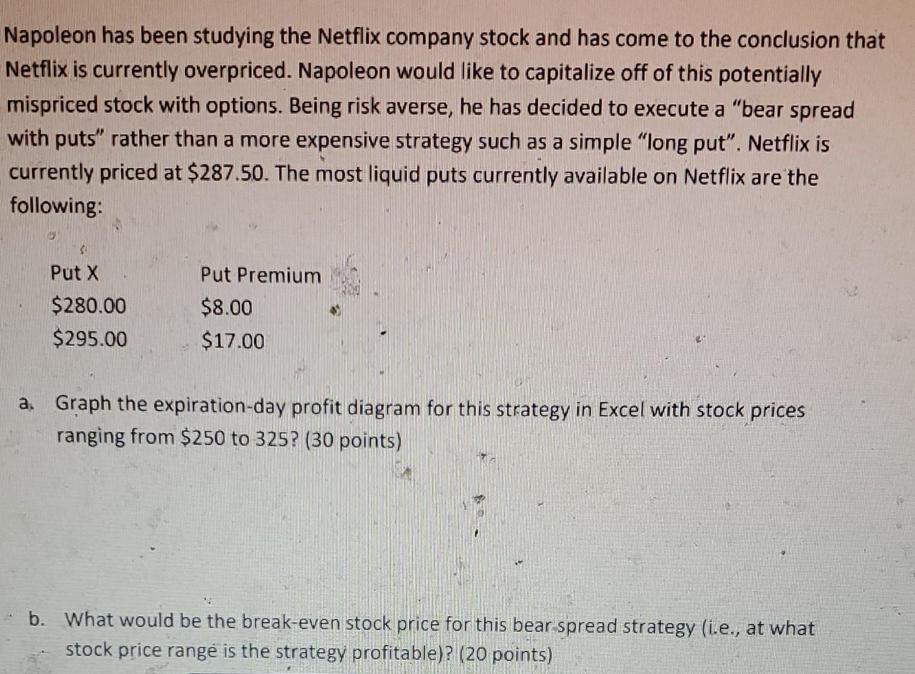

Napoleon has been studying the Netflix company stock and has come to the conclusion that Netflix is currently overpriced. Napoleon would like to capitalize off of this potentially mispriced stock with options. Being risk averse, he has decided to execute a "bear spread with puts" rather than a more expensive strategy such as a simple "long put". Netflix is currently priced at $287.50. The most liquid puts currently available on Netflix are the following: 9 C Put X $280.00 $295.00 Put Premium $8.00 $17.00 a. Graph the expiration-day profit diagram for this strategy in Excel with stock prices ranging from $250 to 325? (30 points) b. What would be the break-even stock price for this bear spread strategy (i.e., at what stock price range is the strategy profitable)? (20 points)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started