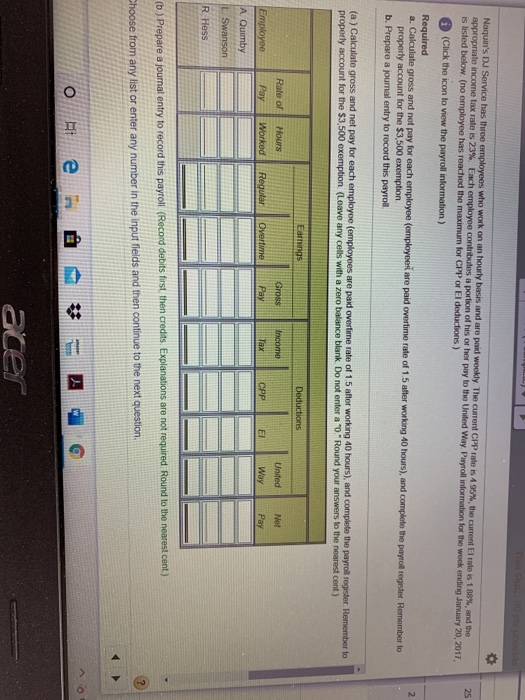

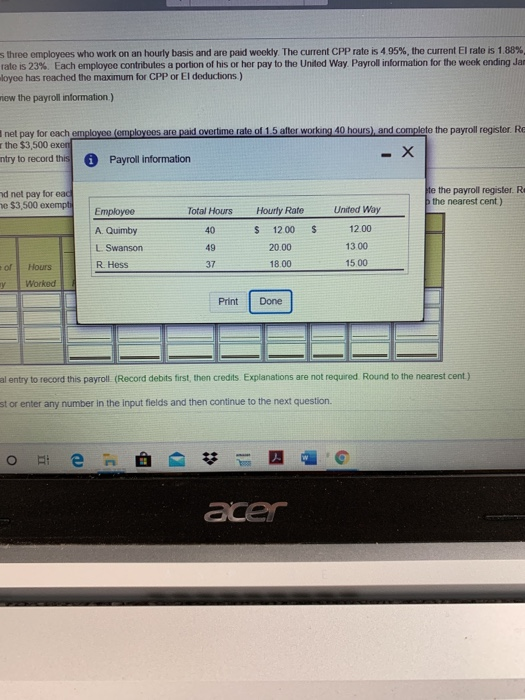

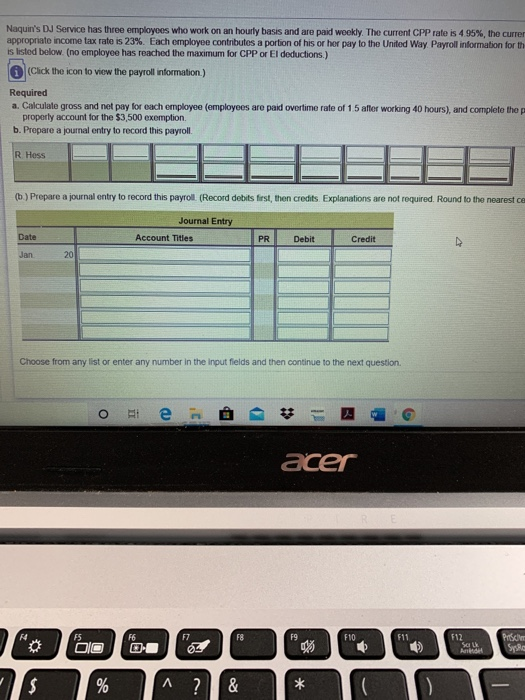

Naquin's DJ Service has three employees who work on an hourly basis and are paid weekly The Current CPP rate is 1957%, the current mais 160% and the appropriate income tax rate is 23%. Each employee contributes a portion of his or her pay to the United Way Payroll information for the week ending January 20, 2017 is listed below. (no employee has reached the maximum for CPP or El deductions) (Click the icon to view the payroll information) Required a. Calculate gross and not pay for each employee (omployees are paid overtime rate of 1.5 after working 40 hours), and complete the payroll register. Remember to properly account for the $3,500 exemption b. Prepare a journal entry to record this payroll (a) Calculate gross and net pay for each employee (employees are paid overtime rate of 1.5 after working 40 hours), and complete the payroll register. Remember to properly account for the $3,500 exemption (Leave any cells with a zero balance blank. Do not enter a 'o." Round your answers to the nearest cent) Deductions Rate or Pay Hours Worked United Way Employee Regular Overtime CPP Pay A Quimby L Swanson R. Hess (b.) Prepare a journal entry to record this payroll (Record debits first then credits Explanations are not required Round to the nearest cent) Choose from any list or enter any number in the input fields and then continue to the next question. ater three employees who work on an hourly basis and are paid weekly. The current CPP rate is 4.95%, the current El rate is 1.88% ale is 23%. Each employee contributes a portion of his or her pay to the United Way Payrol information for the week ending Ja loyee has reached the maximum for CPP or El deductions) lew the payroll information) net pay for each employee employees are paid overtime rate of 1.5 after working 40 hours), and complete the payroll register. R the $3,500 exen nitry to record this * Payroll information id net pay for ead e $3.500 exemple te the payroll register. R the nearest cent) Employee Total Hours A Quimby $ Hourly Rate $ 12.00 20.00 18.00 United Way 12.00 1300 1500 Swanson of Hours R Hess Winked Print Done al entry to record this payroll (Record debits first, then credits. Explanations are not required Round to the nearest cent) stor enter any number in the input fields and then continue to the next question O e * = acer Naquin's DJ Service has three employees who work on an hourly basis and are paid wookly. The current CPP rate is 4 95%, the curre appropriate income tax rate is 23%. Each employee contributos a portion of his or her pay to the United Way Payroll information for th is listed below. (no employee has reached the maximum for CPP or El deductions.) (Click the icon to view the payroll information.) Required a. Calculate gross and not pay for each employee (employees are paid overtime rate of 1.5 after working 40 hours), and complete the properly account for the $3,500 exemption b. Prepare a journal entry to record this payroll R Hess (b) Prepare a journal entry to record this payroll (Record debits first, then credits Explanations are not required. Round to the nearest ce Date Journal Entry Account Titles PR Debit Credit an 20 Choose from any list or enter any number in the input fields and then continue to the next question o e * = 6 acer 10% ?&*ODE