Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Narnia Enterprises is considering an acquisition of Aslan Inc, motivated by the possibility of synergy. You are given the following estimates for key numbers

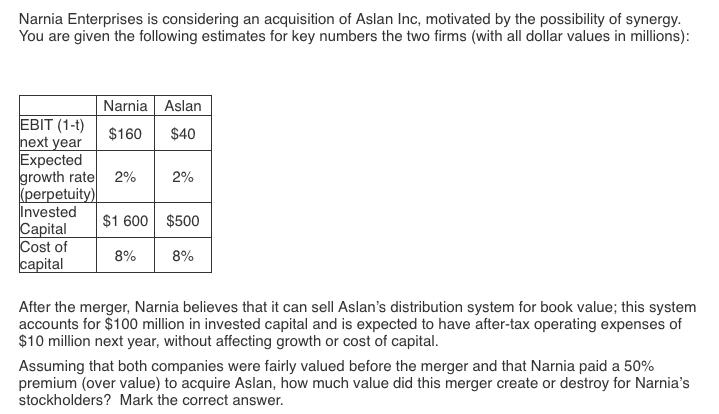

Narnia Enterprises is considering an acquisition of Aslan Inc, motivated by the possibility of synergy. You are given the following estimates for key numbers the two firms (with all dollar values in millions): EBIT (1-1) next year Narnia Aslan $160 $40 Expected growth rate 2% (perpetuity) Invested Capital Cost of capital $1 600 8% 2% $500 8% After the merger, Narnia believes that it can sell Aslan's distribution system for book value; this system accounts for $100 million in invested capital and is expected to have after-tax operating expenses of $10 million next year, without affecting growth or cost of capital. Assuming that both companies were fairly valued before the merger and that Narnia paid a 50% premium (over value) to acquire Aslan, how much value did this merger create or destroy for Narnia's stockholders? Mark the correct answer.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started