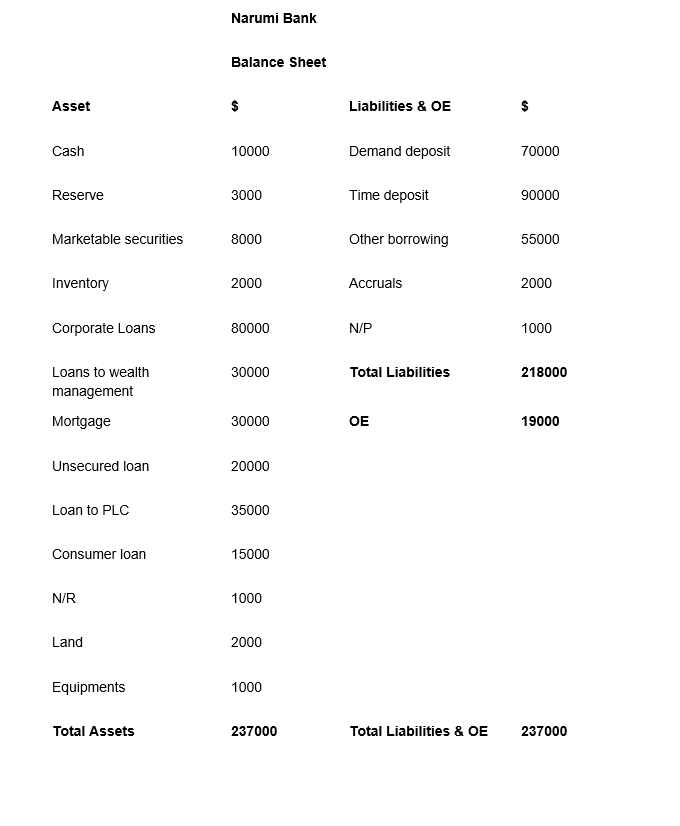

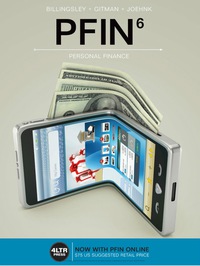

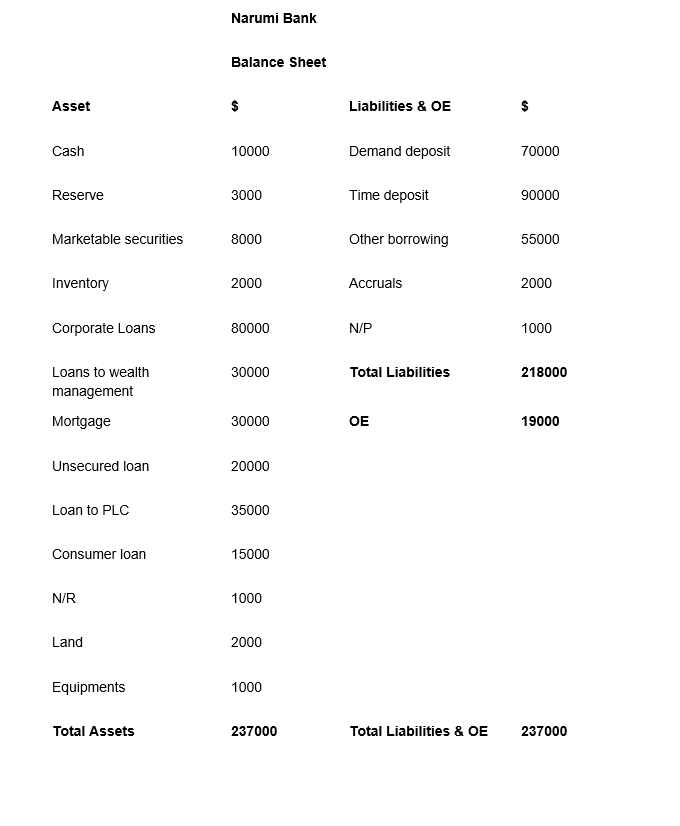

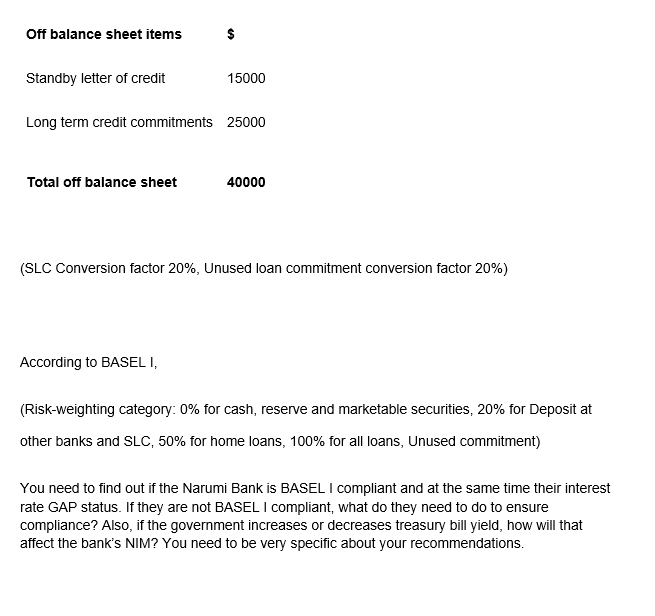

Narumi Bank Balance Sheet Asset $ Liabilities & OE Cash 10000 Demand deposit 70000 Reserve 3000 Time deposit 90000 Marketable securities 8000 Other borrowing 55000 Inventory 2000 Accruals 2000 Corporate Loans 80000 N/P 1000 30000 Total Liabilities 218000 Loans to wealth management Mortgage 30000 OE 19000 Unsecured loan 20000 Loan to PLC 35000 Consumer loan 15000 N/R 1000 Land 2000 Equipments 1000 Total Assets 237000 Total Liabilities & OE 237000 Off balance sheet items $ Standby letter of credit 15000 Long term credit commitments 25000 Total off balance sheet 40000 (SLC Conversion factor 20%, Unused loan commitment conversion factor 20%) According to BASELI, (Risk-weighting category: 0% for cash, reserve and marketable securities, 20% for Deposit at other banks and SLC, 50% for home loans, 100% for all loans, Unused commitment) You need to find out if the Narumi Bank is BASEL I compliant and at the same time their interest rate GAP status. If they are not BASEL I compliant, what do they need to do to ensure compliance? Also, if the government increases or decreases treasury bill yield, how will that affect the bank's NIM? You need to be very specific about your recommendations. Narumi Bank Balance Sheet Asset $ Liabilities & OE Cash 10000 Demand deposit 70000 Reserve 3000 Time deposit 90000 Marketable securities 8000 Other borrowing 55000 Inventory 2000 Accruals 2000 Corporate Loans 80000 N/P 1000 30000 Total Liabilities 218000 Loans to wealth management Mortgage 30000 OE 19000 Unsecured loan 20000 Loan to PLC 35000 Consumer loan 15000 N/R 1000 Land 2000 Equipments 1000 Total Assets 237000 Total Liabilities & OE 237000 Off balance sheet items $ Standby letter of credit 15000 Long term credit commitments 25000 Total off balance sheet 40000 (SLC Conversion factor 20%, Unused loan commitment conversion factor 20%) According to BASELI, (Risk-weighting category: 0% for cash, reserve and marketable securities, 20% for Deposit at other banks and SLC, 50% for home loans, 100% for all loans, Unused commitment) You need to find out if the Narumi Bank is BASEL I compliant and at the same time their interest rate GAP status. If they are not BASEL I compliant, what do they need to do to ensure compliance? Also, if the government increases or decreases treasury bill yield, how will that affect the bank's NIM? You need to be very specific about your recommendations