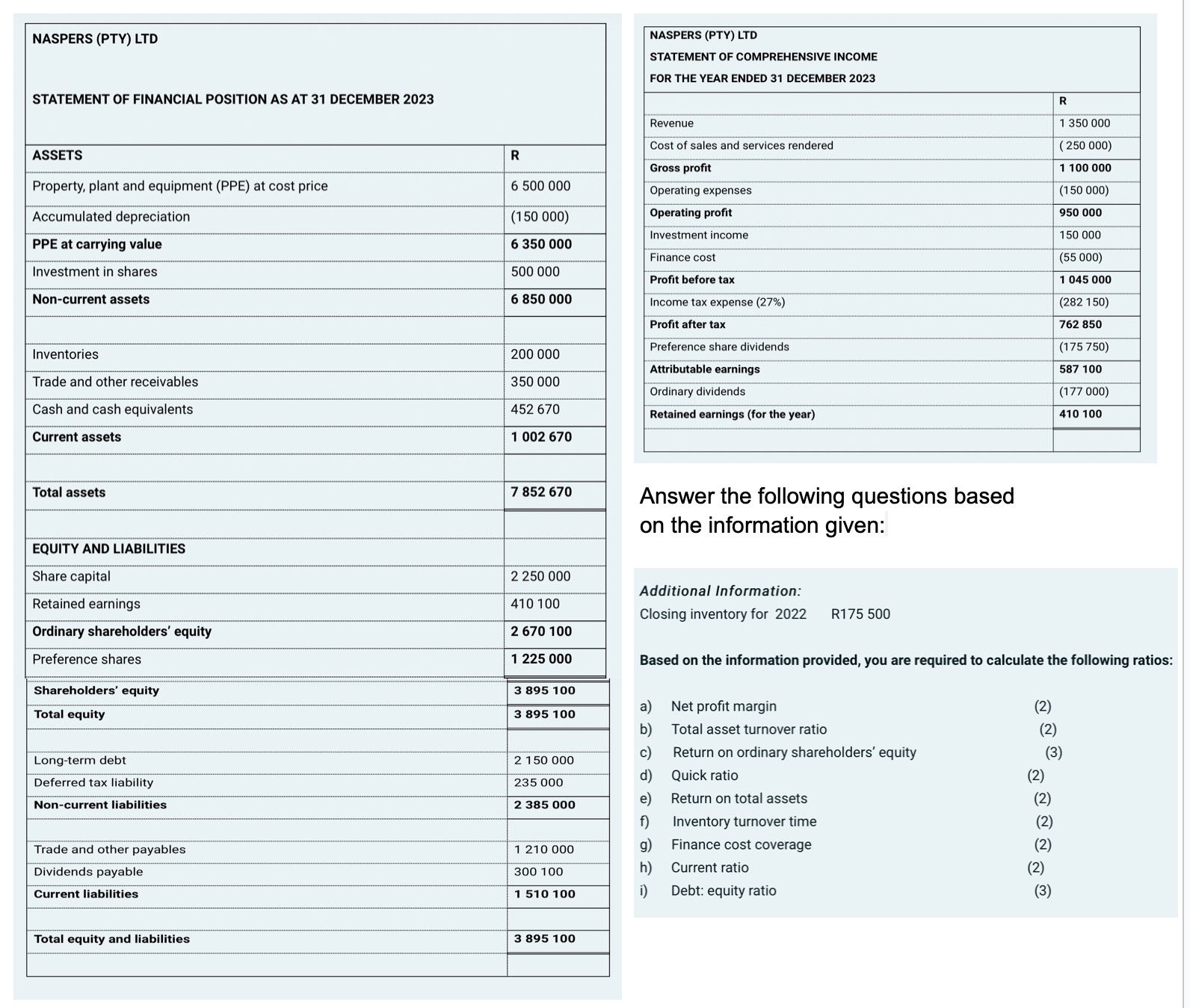

NASPERS (PTY) LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2023 ASSETS Property, plant and equipment (PPE) at cost price Accumulated depreciation PPE

NASPERS (PTY) LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2023 ASSETS Property, plant and equipment (PPE) at cost price Accumulated depreciation PPE at carrying value Investment in shares Non-current assets Inventories Trade and other receivables Cash and cash equivalents Current assets Total assets EQUITY AND LIABILITIES Share capital NASPERS (PTY) LTD STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2023 R Revenue Cost of sales and services rendered Operating profit R Gross profit 6 500 000 Operating expenses (150 000) 6 350 000 500 000 6 850 000 Investment income Finance cost Profit before tax Income tax expense (27%) Profit after tax Preference share dividends Attributable earnings 200 000 350 000 Ordinary dividends 452 670 Retained earnings (for the year) 1 002 670 1 350 000 (250 000) 1 100 000 (150 000) 950 000 150 000 (55 000) 1 045 000 (282 150) 762 850 (175 750) 587 100 (177 000) 410 100 7 852 670 Answer the following questions based on the information given: 2 250 000 Additional Information: Closing inventory for 2022 R175 500 Based on the information provided, you are required to calculate the following ratios: Retained earnings 410 100 Ordinary shareholders' equity 2 670 100 Preference shares 1 225 000 Shareholders' equity Total equity Long-term debt Deferred tax liability Non-current liabilities Trade and other payables Dividends payable Current liabilities Total equity and liabilities 3 895 100 a) Net profit margin (2) 3 895 100 b) Total asset turnover ratio (2) c) Return on ordinary shareholders' equity (3) 2 150 000 d) Quick ratio (2) 235 000 2 385 000 e) Return on total assets (2) f) Inventory turnover time (2) 1 210 000 g) Finance cost coverage (2) 300 100 h) Current ratio (2) 1 510 100 i) Debt: equity ratio (3) 3 895 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started