Question

Natalie and Curtis have been experiencing great demand for their cookies and muffins. As a result, they are now thinking about buying a commercial oven.

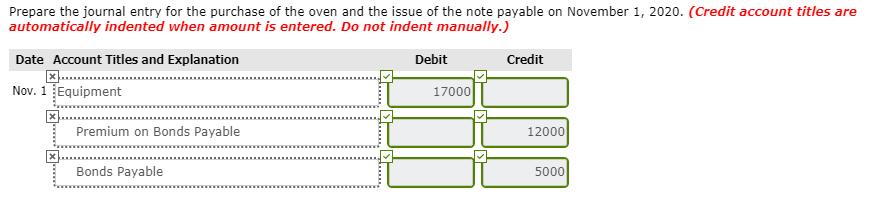

Natalie and Curtis have been experiencing great demand for their cookies and muffins. As a result, they are now thinking about buying a commercial oven. They know which oven they want and that it will cost $17,000. The company already has $5,000 set aside for the purchase and will need to borrow the rest.

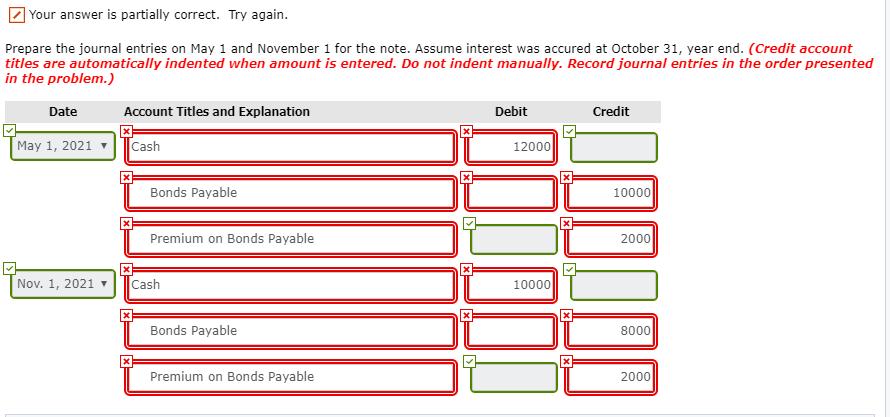

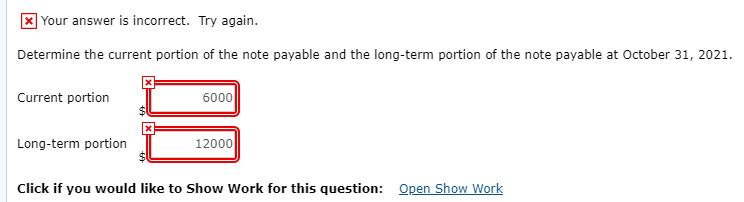

Natalie and Curtis met with a bank manager to discuss their options. She is willing to lend Cookie & Coffee Creations Inc. $12,000 on November 1, 2020, for a period of 3 years at a 5% interest rate. The terms provide for fixed principal payments of $2,000, on May 1 and November 1 of each year plus 6 months of interest.

'

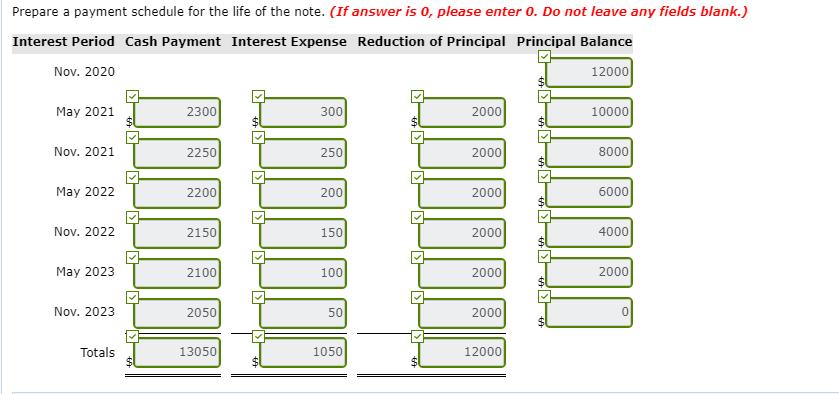

Prepare a payment schedule for the life of the note. (If answer is 0, please enter 0. Do not leave any fields blank.) Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Nov. 2020 12000 May 2021 300 2300 2000 10000 Nov. 2021 2000 8000 2250 250 May 2022 2200 200 2000 6000 Nov. 2022 2150 150 2000 4000 May 2023 2100 100 2000 2000 Nov. 2023 2050 50 2000 Totals 13050 1050 12000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started