Answered step by step

Verified Expert Solution

Question

1 Approved Answer

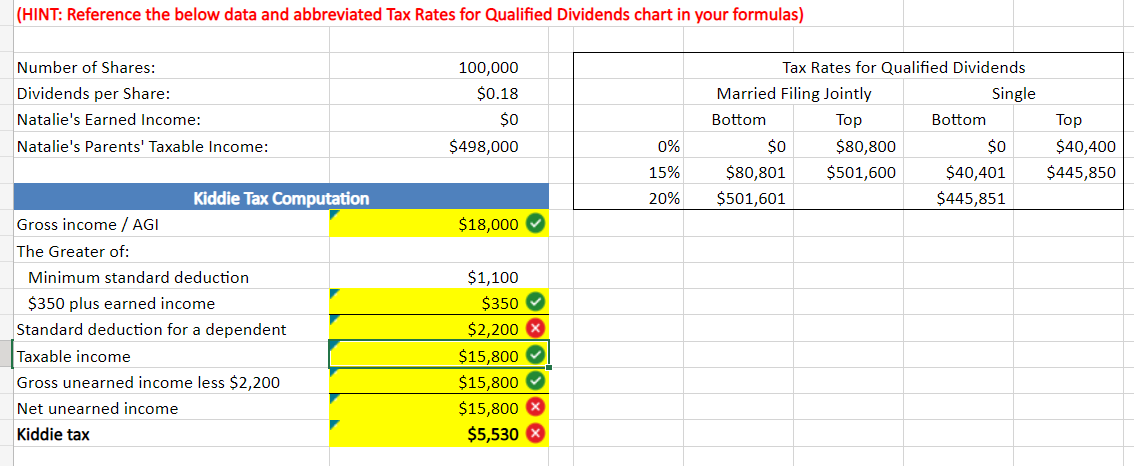

Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no

Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no other sources of income and her parents file Married Filing Jointly with their taxable income presented below.

Required

Complete the Kiddie Tax computation

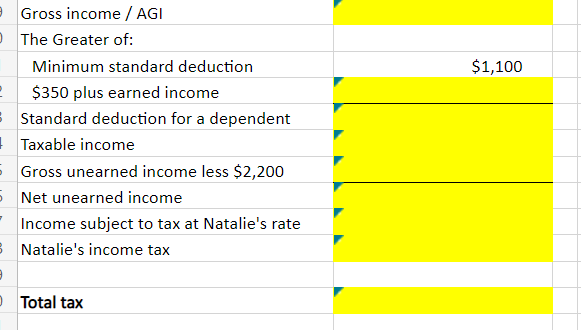

Complete the Income Tax computation for Natalie.

Determine the total tax on the dividends

(HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) Gross income / AGI The Greater of: \begin{tabular}{l} Minimum standard deduction \\ $350 plus earned income \\ Standard deduction for a dependent \\ Taxable income \\ Gross unearned income less $2,200 \\ Net unearned income \\ \hline Income subject to tax at Natalie's rate \\ \hline Natalie's income tax \end{tabular} Total tax (HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) Gross income / AGI The Greater of: \begin{tabular}{l} Minimum standard deduction \\ $350 plus earned income \\ Standard deduction for a dependent \\ Taxable income \\ Gross unearned income less $2,200 \\ Net unearned income \\ \hline Income subject to tax at Natalie's rate \\ \hline Natalie's income tax \end{tabular} Total tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started