Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no

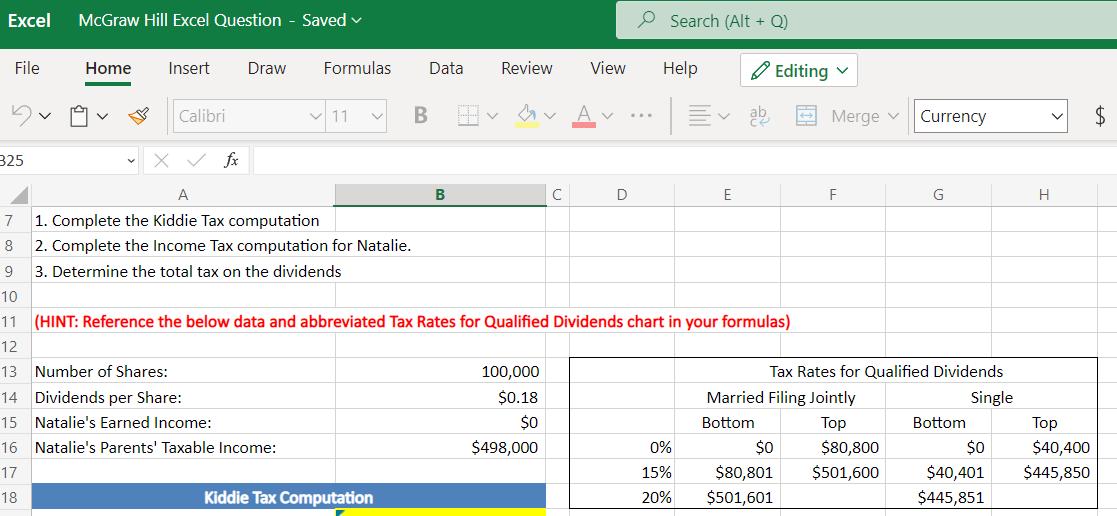

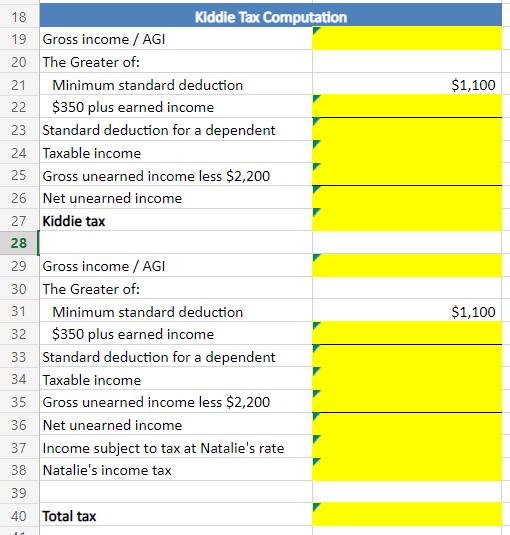

Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no other sources of income and her parents file Married Filing Jointly with their taxable income presented below.

Excel McGraw Hill Excel Question - Saved File 325 V Home 4 V Insert Calibri fx Draw Formulas 11 Data Review Kiddie Tax Computation B B v 100,000 $0.18 $0 $498,000 View Help A v A 7 1. Complete the Kiddie Tax computation 8 2. Complete the Income Tax computation for Natalie. 9 3. Determine the total tax on the dividends 10 11 (HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) 12 13 Number of Shares: 14 Dividends per Share: 15 Natalie's Earned Income: 16 Natalie's Parents' Taxable Income: 17 18 O Search (Alt + Q) D ... E 0% 15% 20% Editing Merge v $0 $80,801 $501,601 F Married Filing Jointly Bottom Tax Rates for Qualified Dividends Single Currency Top $80,800 $501,600 G Bottom $0 $40,401 $445,851 H Top $40,400 $445,850 $

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer a First we must calculate the overall AG for the pyruvate kinase re...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started