Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Natalie Stefou moved from Halifax, NS to Brampton, ON on New Year's Day 2021 to begin a new job as a researcher at Leclerc

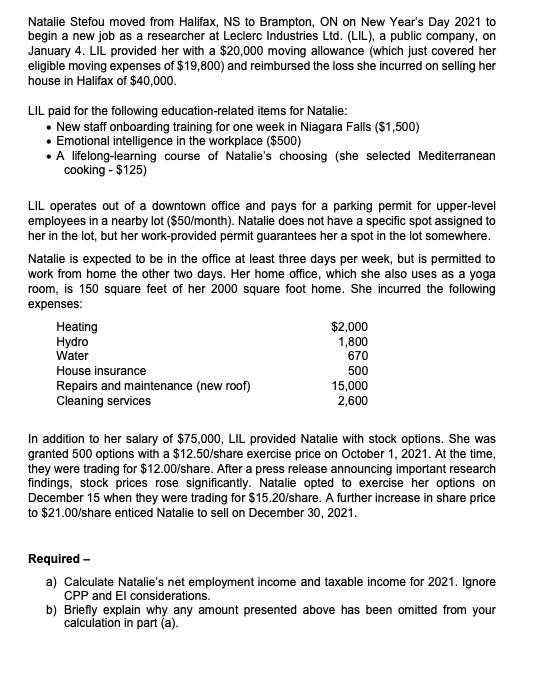

Natalie Stefou moved from Halifax, NS to Brampton, ON on New Year's Day 2021 to begin a new job as a researcher at Leclerc Industries Ltd. (LIL), a public company, on January 4. LIL provided her with a $20,000 moving allowance (which just covered her eligible moving expenses of $19,800) and reimbursed the loss she incurred on selling her house in Halifax of $40,000. LIL paid for the following education-related items for Natalie: New staff onboarding training for one week in Niagara Falls ($1,500) Emotional intelligence in the workplace ($500) A lifelong-learning course of Natalie's choosing (she selected Mediterranean cooking - $125) LIL operates out of a downtown office and pays for a parking permit for upper-level employees in a nearby lot ($50/month). Natalie does not have a specific spot assigned to her in the lot, but her work-provided permit guarantees her a spot in the lot somewhere. Natalie is expected to be in the office at least three days per week, but is permitted to work from home the other two days. Her home office, which she also uses as a yoga room, is 150 square feet of her 2000 square foot home. She incurred the following expenses: Heating Hydro Water House insurance Repairs and maintenance (new roof) Cleaning services $2,000 1,800 670 500 15,000 2,600 In addition to her salary of $75,000, LIL provided Natalie with stock options. She was granted 500 options with a $12.50/share exercise price on October 1, 2021. At the time, they were trading for $12.00/share. After a press release announcing important research findings, stock prices rose significantly. Natalie opted to exercise her options on December 15 when they were trading for $15.20/share. A further increase in share price to $21.00/share enticed Natalie to sell on December 30, 2021. Required - a) Calculate Natalie's net employment income and taxable income for 2021. Ignore CPP and El considerations. b) Briefly explain why any amount presented above has been omitted from your calculation in part (a).

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Net employment income Natalies salary 75000 Moving allowance 20000 Reimbursement for loss on sale ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started