Question

Natalie was approached by one of her friends, Warren Gerard. Gerard runs a coffee shop where he sells specialty coffees, and prepares and sells muffins

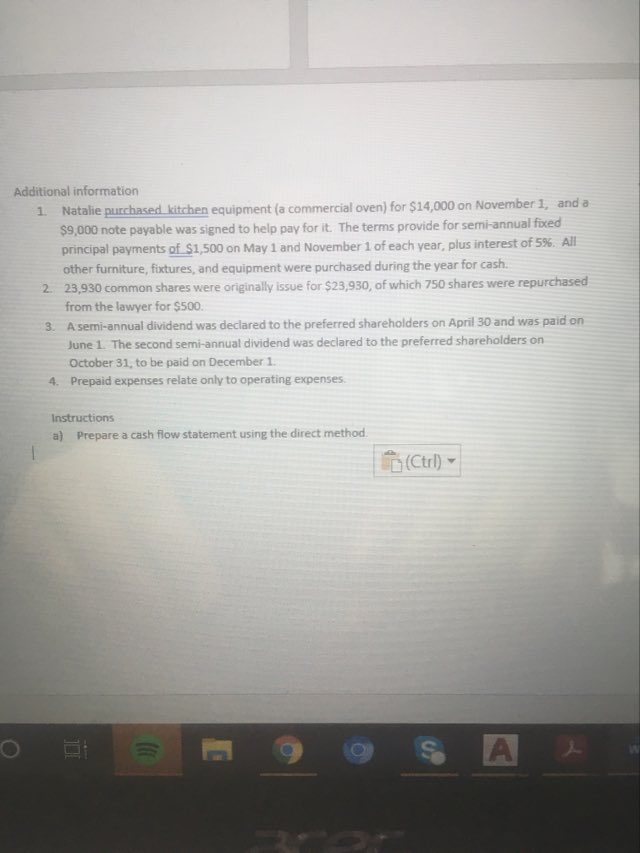

Natalie was approached by one of her friends, Warren Gerard. Gerard runs a coffee shop where he sells specialty coffees, and prepares and sells muffins and cookies. Because they have both been so successful in his/her own right they conclude that they could benefit from each others business expertise. Their new venture, a corporation, is the COOKIE & COFFEE CREATIONS LTD. COOKIE & COFFEE CREATIONS LTD. Income Statement October 31,2013 Sales $462,500 Cost of goods sold 231,250 Gross profit 231,250 Operating expenses Amortization expense $ 9,850 Salaries and wages expense 92,500 Other operating expenses 35,987 138,337 Income from operations 92,913 Other expenses Interest expense 413 Income before income tax 92,500 Income tax expense 18,500 Net Income $ 74,000 COOKIE & COFFEE CREATIONS LTD. Balance Sheet October 31,2013 Assets Current assets Cash $ 9,294 Accounts receivable 27,950 Less Allowance for doubtful accounts 4,700 23,250 Inventory 17,897 Prepaid expenses 6,300 $ 56,741 Property, plant, and equipment Furniture and fixtures $12,500 Accumulated amortization-furniture & fixtures (1,250) 11,250 Computer equipment $ 4,200 Accumulated amortization-computer equipment (600) 3,600 Kitchen equipment $80,000 Accumulated amortization-kitchen equipment (8,000) 72,000 86,850 Total assets $143,591 Liabilities and Shareholders Equity Current liabilities Accounts payable $ 5,848 Income tax payable 18,500 Dividends payable 625 Salaries payable 2,250 Interest payable 188 Note payable-current portion 3,000 $ 30,411 Long-term liabilities Note payable-long-term portion 4,500 Total liabilities $ 34,911 Shareholders equity Contributed capital Preferred shares, 2,500 shares issued $ 12,500 Common shares, 23,180 shares issued 23,180 Contributed capital-reacquisition of shares 250 $ 35,930 Retained earnings 72,750 $108,680 Total liabilities and shareholders equity $143,591 Additional information 1. Natalie purchased kitchen equipment (a commercial oven) for $14,000 on November 1, and a $9,000 note payable was signed to help pay for it. The terms provide for semi-annual fixed principal payments of $1,500 on May 1 and November 1 of each year, plus interest of 5%. All other furniture, fixtures, and equipment were purchased during the year for cash. 2. 23,930 common shares were originally issue for $23,930, of which 750 shares were repurchased from the lawyer for $500. 3. A semi-annual dividend was declared to the preferred shareholders on April 30 and was paid on June 1. The second semi-annual dividend was declared to the preferred shareholders on October 31, to be paid on December 1. 4. Prepaid expenses relate only to operating expenses. Instructions a) Prepare a cash flow statement using the direct method.

Natalie was approached by one of her friends, Warren Gerard. Gerard runs a coffee shop where he sells specialty coffees, and prepares and sells muffins and cookies. Because they have both been so successful in his/her own right they conclude that they could benefit from each others business expertise. Their new venture, a corporation, is the COOKIE & COFFEE CREATIONS LTD. COOKIE & COFFEE CREATIONS LTD. Income Statement October 31,2013 Sales $462,500 Cost of goods sold 231,250 Gross profit 231,250 Operating expenses Amortization expense $ 9,850 Salaries and wages expense 92,500 Other operating expenses 35,987 138,337 Income from operations 92,913 Other expenses Interest expense 413 Income before income tax 92,500 Income tax expense 18,500 Net Income $ 74,000 COOKIE & COFFEE CREATIONS LTD. Balance Sheet October 31,2013 Assets Current assets Cash $ 9,294 Accounts receivable 27,950 Less Allowance for doubtful accounts 4,700 23,250 Inventory 17,897 Prepaid expenses 6,300 $ 56,741 Property, plant, and equipment Furniture and fixtures $12,500 Accumulated amortization-furniture & fixtures (1,250) 11,250 Computer equipment $ 4,200 Accumulated amortization-computer equipment (600) 3,600 Kitchen equipment $80,000 Accumulated amortization-kitchen equipment (8,000) 72,000 86,850 Total assets $143,591 Liabilities and Shareholders Equity Current liabilities Accounts payable $ 5,848 Income tax payable 18,500 Dividends payable 625 Salaries payable 2,250 Interest payable 188 Note payable-current portion 3,000 $ 30,411 Long-term liabilities Note payable-long-term portion 4,500 Total liabilities $ 34,911 Shareholders equity Contributed capital Preferred shares, 2,500 shares issued $ 12,500 Common shares, 23,180 shares issued 23,180 Contributed capital-reacquisition of shares 250 $ 35,930 Retained earnings 72,750 $108,680 Total liabilities and shareholders equity $143,591 Additional information 1. Natalie purchased kitchen equipment (a commercial oven) for $14,000 on November 1, and a $9,000 note payable was signed to help pay for it. The terms provide for semi-annual fixed principal payments of $1,500 on May 1 and November 1 of each year, plus interest of 5%. All other furniture, fixtures, and equipment were purchased during the year for cash. 2. 23,930 common shares were originally issue for $23,930, of which 750 shares were repurchased from the lawyer for $500. 3. A semi-annual dividend was declared to the preferred shareholders on April 30 and was paid on June 1. The second semi-annual dividend was declared to the preferred shareholders on October 31, to be paid on December 1. 4. Prepaid expenses relate only to operating expenses. Instructions a) Prepare a cash flow statement using the direct method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started