Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Natalya has recently bought a new house where she will live with her new husband, Jonah. She is taking out a personal property insurance

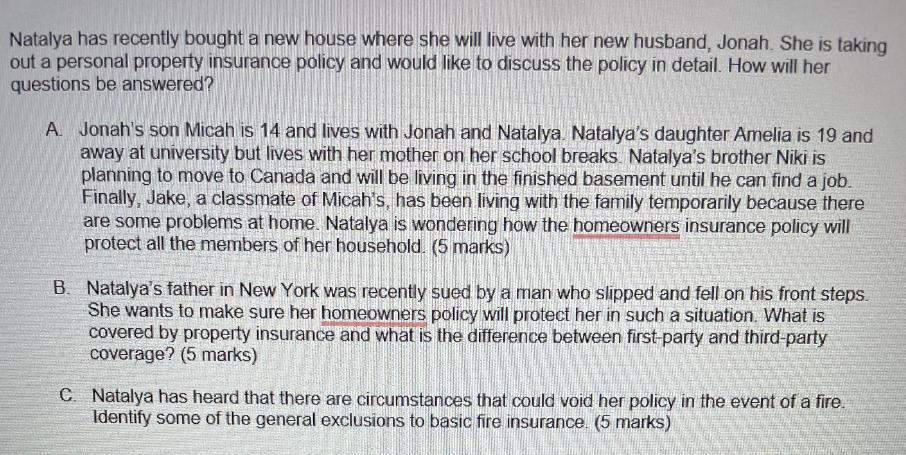

Natalya has recently bought a new house where she will live with her new husband, Jonah. She is taking out a personal property insurance policy and would like to discuss the policy in detail. How will her questions be answered? A Jonah's son Micah is 14 and lives with Jonah and Natalya. Natalya's daughter Amelia is 19 and away at university but lives with her mother on her school breaks. Natalya's brother Niki is planning to move to Canada and will be living in the finished basement until he can find a job. Finally, Jake, a classmate of Micah's, has been living with the family temporarily because there are some problems at home. Natalya is wondering how the homeowners insurance policy will protect all the members of her household. (5 marks) B. Natalya's father in New York was recently sued by a man who slipped and fell on his front steps. She wants to make sure her homeowners policy will protect her in such a situation. What is covered by property insurance and what is the difference between first-party and third-party coverage? (5 marks) C. Natalya has heard that there are circumstances that could void her policy in the event of a fire. Identify some of the general exclusions to basic fire insurance. (5 marks) S

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

A Natalyas question regarding how the homeowners insurance policy will protect all the members of her household will be answered by explaining the typ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started