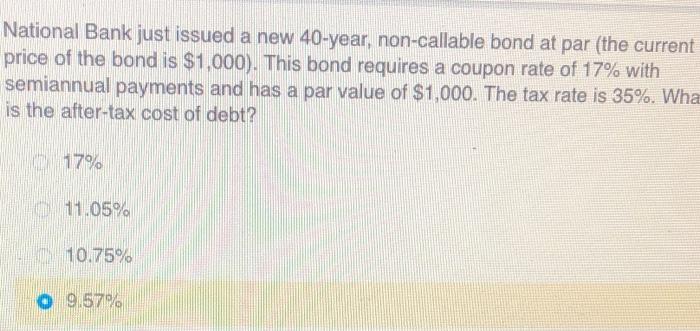

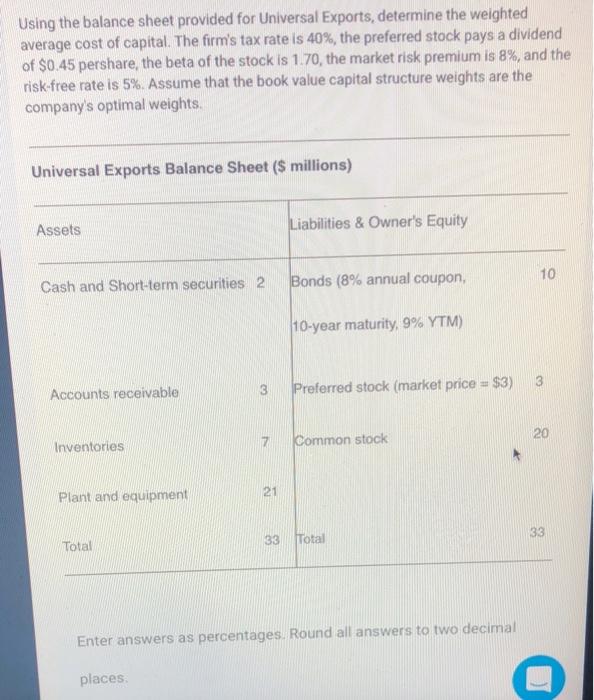

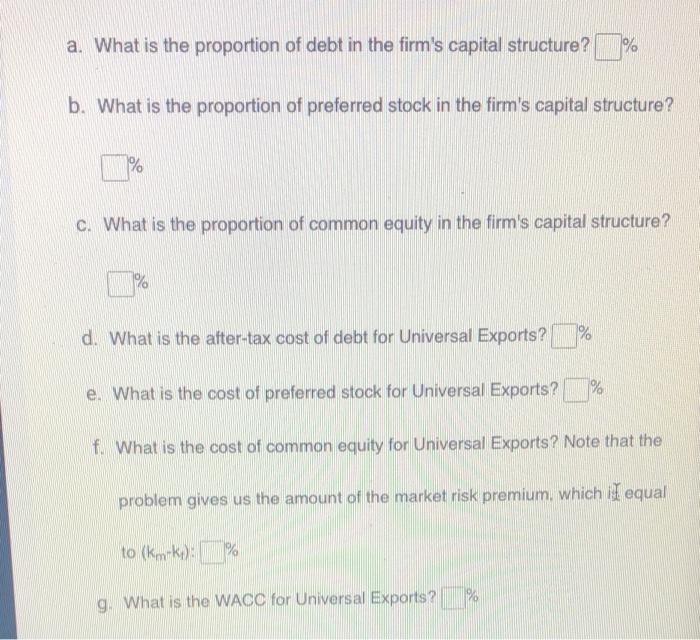

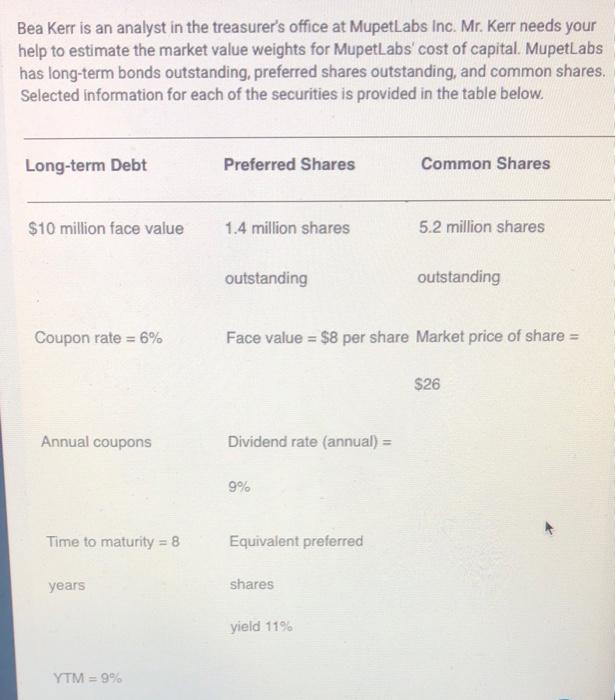

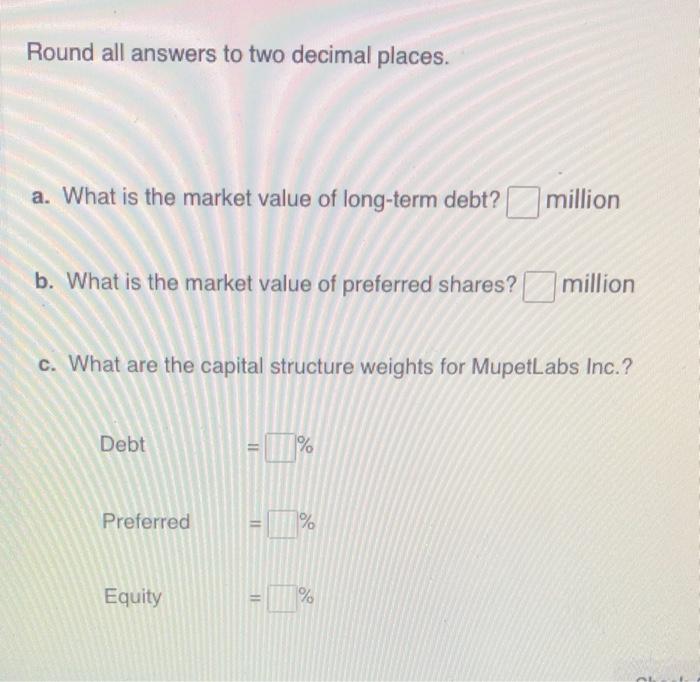

National Bank just issued a new 40-year, non-callable bond at par (the current price of the bond is $1,000). This bond requires a coupon rate of 17% with semiannual payments and has a par value of $1,000. The tax rate is 35%. Wha is the after-tax cost of debt? 17% 11.05% 10.75% o 9,57% Using the balance sheet provided for Universal Exports, determine the weighted average cost of capital. The firm's tax rate is 40%, the preferred stock pays a dividend of $0.45 pershare the beta of the stock is 1.70, the market risk premium is 8%, and the risk-free rate is 5%. Assume that the book value capital structure weights are the company's optimal weights. Universal Exports Balance Sheet ($ millions) Assets Liabilities & Owner's Equity 10 Cash and Short-term securities 21 Bonds (8% annual coupon, 10-year maturity, 9% YTM) 3 Accounts receivable 3 Preferred stock (market price = $3) 20 7 Inventories Common stock 21 Plant and equipment 33 33 Total Total Enter answers as percentages Round all answers to two decimal places a. What is the proportion of debt in the firm's capital structure? % b. What is the proportion of preferred stock in the firm's capital structure? % C. What is the proportion of common equity in the firm's capital structure? % d. What is the after-tax cost of debt for Universal Exports? % % e. What is the cost of preferred stock for Universal Exports? f. What is the cost of common equity for Universal Exports? Note that the problem gives us the amount of the market risk premium, which I equal to km-kp): % % g. What is the WACC for Universal Exports? Bea Kerr is an analyst in the treasurer's office at MupetLabs Inc. Mr. Kerr needs your help to estimate the market value weights for MupetLabs' cost of capital. MupetLabs has long-term bonds outstanding, preferred shares outstanding, and common shares, Selected information for each of the securities is provided in the table below. Long-term Debt Preferred Shares Common Shares $10 million face value 1.4 million shares 5.2 million shares outstanding outstanding Coupon rate = 6% Face value = $8 per share Market price of share = $26 Annual coupons Dividend rate (annual) = 9% Time to maturity = 8 Equivalent preferred years shares yield 119 YTM = 9% Round all answers to two decimal places. a. What is the market value of long-term debt? million b. What is the market value of preferred shares? million c. What are the capital structure weights for MupetLabs Inc.? Debt = % Preferred = % Equity % 11