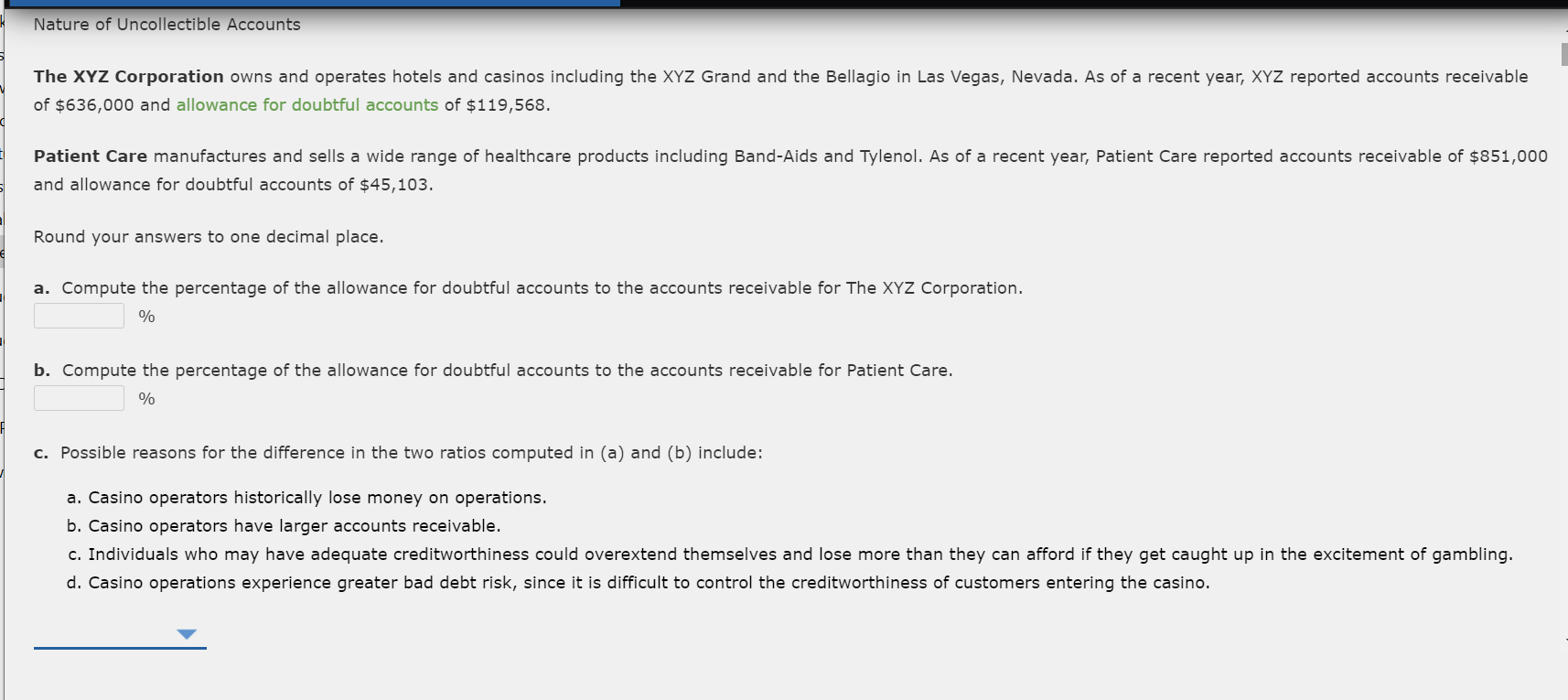

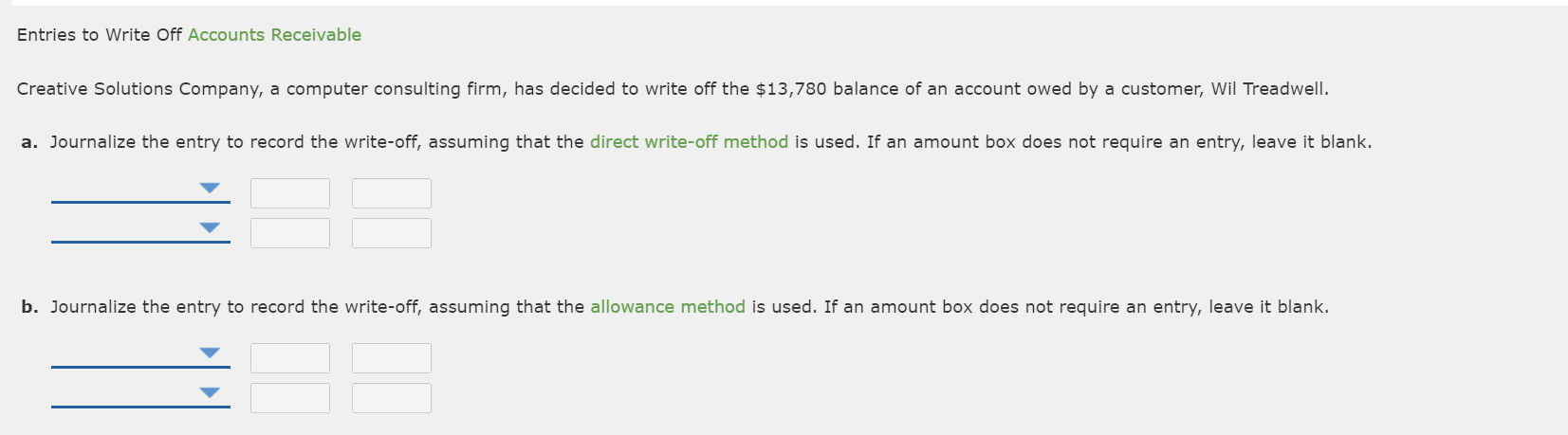

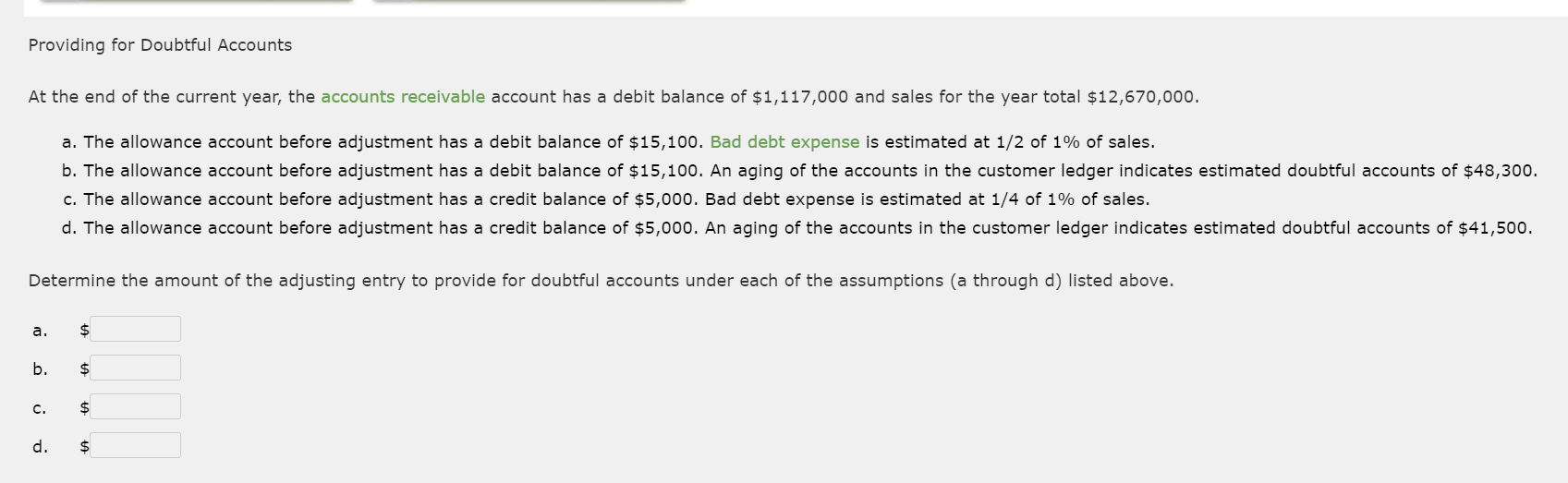

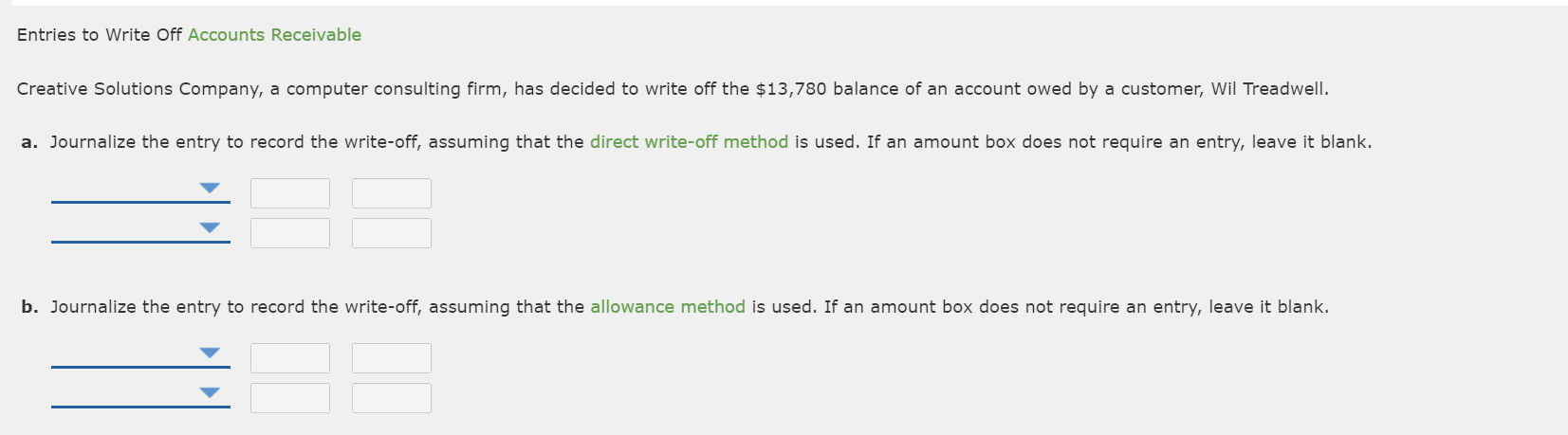

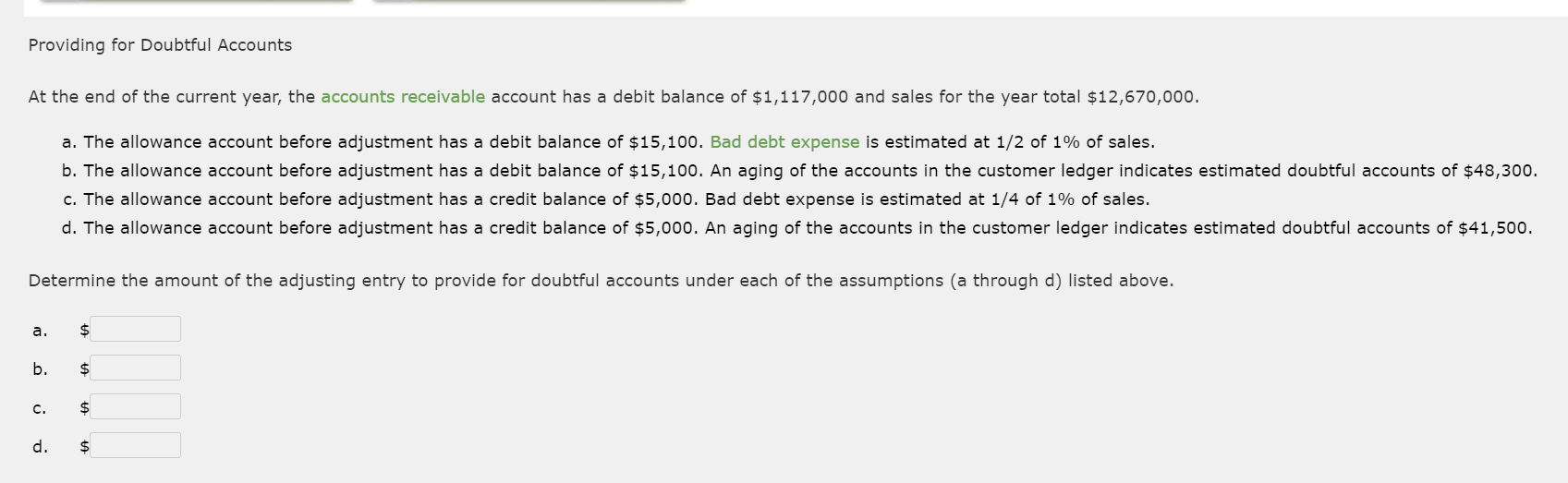

Nature of Uncollectible Accounts The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, XYZ reported accounts receivable of $636,000 and allowance for doubtful accounts of $119,568. Patient Care manufactures and sells a wide range of healthcare products including Band-Aids and Tylenol. As of a recent year, Patient Care reported accounts receivable of $851,000 and allowance for doubtful accounts of $45,103. Round your answers to one decimal place. a. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for The XYZ Corporation. % b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient Care. % c. Possible reasons for the difference in the two ratios computed in (a) and (b) include: a. Casino operators historically lose money on operations. b. Casino operators have larger accounts receivable. c. Individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of gambling. d. Casino operations experience greater bad debt risk, since it is difficult to control the creditworthiness of customers entering the casino. Entries to Write Off Accounts Receivable Creative Solutions Company, a computer consulting firm, has decided to write off the $13,780 balance of an account owed by a customer, Wil Treadwell. a. Journalize the entry to record the write-off, assuming that the direct write-off method is used. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the write-off, assuming that the allowance method is used. If an amount box does not require an entry, leave it blank. Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,117,000 and sales for the year total $12,670,000. a. The allowance account before adjustment has a debit balance of $15,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $15,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $48,300. c. The allowance account before adjustment has a credit balance of $5,000. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a credit balance of $5,000. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $41,500. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. $ b. $ c. $ d. $