Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NBA decided to allocate all joint costs to red cells, on the basis, in part, that plasma was routinely discarded to minimize the risk

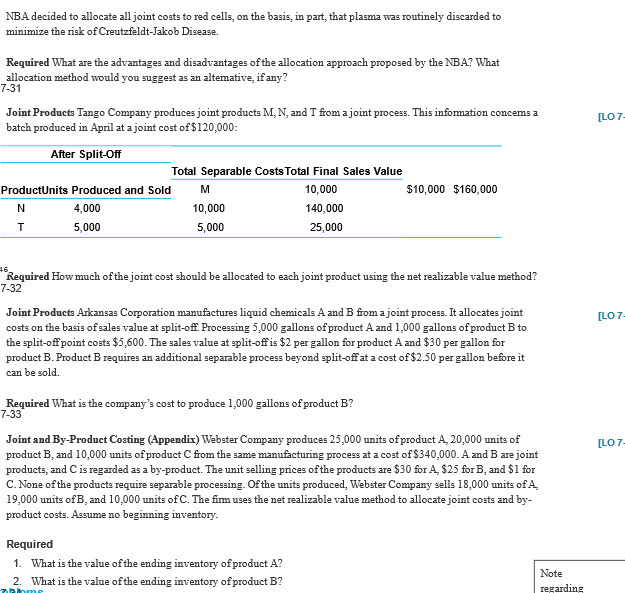

NBA decided to allocate all joint costs to red cells, on the basis, in part, that plasma was routinely discarded to minimize the risk of Creutzfeldt-Jakob Disease. Required What are the advantages and disadvantages of the allocation approach proposed by the NBA? What allocation method would you suggest as an alterative, if any? 7-31 Joint Products Tango Company produces joint products M, N, and T from a joint process. This information concems a batch produced in April at a joint cost of $120,000: After Split-Off Total Separable Costs Total Final Sales Value ProductUnits Produced and Sold M 10,000 $10,000 $160,000 N T 4,000 5,000 10,000 140,000 5,000 25,000 46. Required How much of the joint cost should be allocated to each joint product using the net realizable value method? 7-32 Joint Products Arkansas Corporation manufactures liquid chemicals A and B from a joint process. It allocates joint costs on the basis of sales value at split-off. Processing 5,000 gallons of product A and 1,000 gallons of product B to the split-off point costs $5,600. The sales value at split-off is $2 per gallon for product A and $30 per gallon for product B. Product B requires an additional separable process beyond split-off at a cost of $2.50 per gallon before it can be sold. Required What is the company's cost to produce 1,000 gallons of product B? 7-33 Joint and By-Product Costing (Appendix) Webster Company produces 25,000 units of product A, 20,000 units of product B, and 10,000 units of product C from the same manufacturing process at a cost of $340,000. A and B are joint products, and C is regarded as a by-product. The unit selling prices of the products are $30 for A, $25 for B, and $1 for C. None of the products require separable processing. Of the units produced, Webster Company sells 18,000 units of A, 19,000 units of B, and 10,000 units of C. The firm uses the net realizable value method to allocate joint costs and by- product costs. Assume no beginning inventory. Required 1. What is the value of the ending inventory of product A? 2. What is the value of the ending inventory of product B? Note regarding [LO 7- [LO 7- [LO 7-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started