Answered step by step

Verified Expert Solution

Question

1 Approved Answer

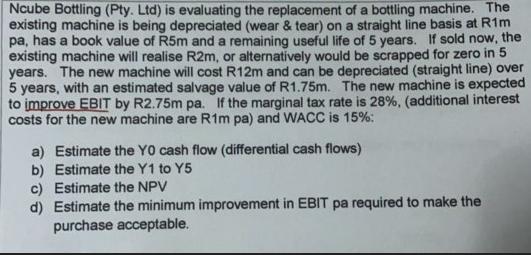

Ncube Bottling (Pty. Ltd) is evaluating the replacement of a bottling machine. The existing machine is being depreciated (wear & tear) on a straight

Ncube Bottling (Pty. Ltd) is evaluating the replacement of a bottling machine. The existing machine is being depreciated (wear & tear) on a straight line basis at R1m pa, has a book value of R5m and a remaining useful life of 5 years. If sold now, the existing machine will realise R2m, or alternatively would be scrapped for zero in 5 years. The new machine will cost R12m and can be depreciated (straight line) over 5 years, with an estimated salvage value of R1.75m. The new machine is expected to improve EBIT by R2.75m pa. If the marginal tax rate is 28%, (additional interest costs for the new machine are R1m pa) and WACC is 15%: a) Estimate the YO cash flow (differential cash flows) b) Estimate the Y1 to Y5 c) Estimate the NPV d) Estimate the minimum improvement in EBIT pa required to make the purchase acceptable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started