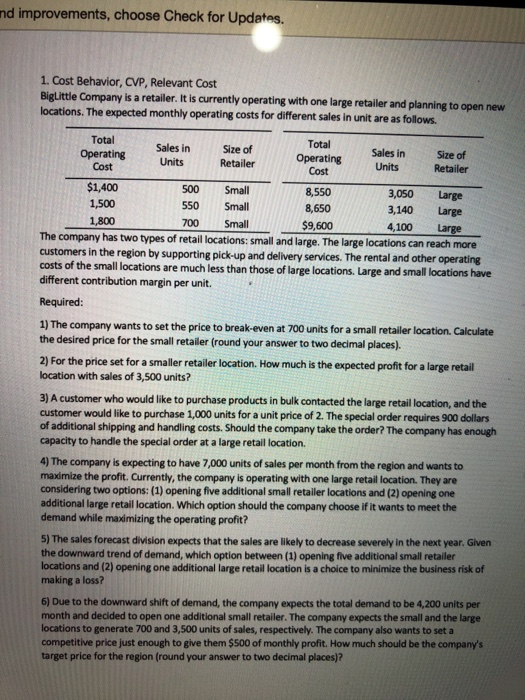

nd improvements, choose Check for Updates. 1. Cost Behavior, CVP, Relevant Cost Big Little Company is a retailer. It is currently operating with one large retailer and planning to open new locations. The expected monthly operating costs for different sales in unit are as follows. 500 Total Sales in Operating Total Size of Sales in Size of Operating Units Cost Retailer Cost Units Retailer $1,400 Small 8,550 3,050 Large 1,500 550 Small 8,650 3,140 Large 1,800 700 Small $9,600 4,100 Large The company has two types of retail locations: small and large. The large locations can reach more customers in the region by supporting pick-up and delivery services. The rental and other operating costs of the small locations are much less than those of large locations. Large and small locations have different contribution margin per unit. Required: 1) The company wants to set the price to break-even at 700 units for a small retailer location. Calculate the desired price for the small retailer (round your answer to two decimal places). 2) For the price set for a smaller retailer location. How much is the expected profit for a large retail location with sales of 3,500 units? 3) A customer who would like to purchase products in bulk contacted the large retail location, and the customer would like to purchase 1,000 units for a unit price of 2. The special order requires 900 dollars of additional shipping and handling costs. Should the company take the order? The company has enough capacity to handle the special order at a large retail location. 4) The company is expecting to have 7,000 units of sales per month from the region and wants to maximize the profit. Currently, the company is operating with one large retail location. They are considering two options: (1) opening five additional small retailer locations and (2) opening one additional large retail location. Which option should the company choose if it wants to meet the demand while maximizing the operating profit? 5) The sales forecast division expects that the sales are likely to decrease severely in the next year. Given the downward trend of demand, which option between (1) opening five additional small retailer locations and (2) opening one additional large retail location is a choice to minimize the business risk of making a loss? 6) Due to the downward shift of demand, the company expects the total demand to be 4,200 units per month and decided to open one additional small retailer. The company expects the small and the large locations to generate 700 and 3,500 units of sales, respectively. The company also wants to set a competitive price just enough to give them $500 of monthly profit. How much should be the company's target price for the region (round your answer to two decimal places)? nd improvements, choose Check for Updates. 1. Cost Behavior, CVP, Relevant Cost Big Little Company is a retailer. It is currently operating with one large retailer and planning to open new locations. The expected monthly operating costs for different sales in unit are as follows. 500 Total Sales in Operating Total Size of Sales in Size of Operating Units Cost Retailer Cost Units Retailer $1,400 Small 8,550 3,050 Large 1,500 550 Small 8,650 3,140 Large 1,800 700 Small $9,600 4,100 Large The company has two types of retail locations: small and large. The large locations can reach more customers in the region by supporting pick-up and delivery services. The rental and other operating costs of the small locations are much less than those of large locations. Large and small locations have different contribution margin per unit. Required: 1) The company wants to set the price to break-even at 700 units for a small retailer location. Calculate the desired price for the small retailer (round your answer to two decimal places). 2) For the price set for a smaller retailer location. How much is the expected profit for a large retail location with sales of 3,500 units? 3) A customer who would like to purchase products in bulk contacted the large retail location, and the customer would like to purchase 1,000 units for a unit price of 2. The special order requires 900 dollars of additional shipping and handling costs. Should the company take the order? The company has enough capacity to handle the special order at a large retail location. 4) The company is expecting to have 7,000 units of sales per month from the region and wants to maximize the profit. Currently, the company is operating with one large retail location. They are considering two options: (1) opening five additional small retailer locations and (2) opening one additional large retail location. Which option should the company choose if it wants to meet the demand while maximizing the operating profit? 5) The sales forecast division expects that the sales are likely to decrease severely in the next year. Given the downward trend of demand, which option between (1) opening five additional small retailer locations and (2) opening one additional large retail location is a choice to minimize the business risk of making a loss? 6) Due to the downward shift of demand, the company expects the total demand to be 4,200 units per month and decided to open one additional small retailer. The company expects the small and the large locations to generate 700 and 3,500 units of sales, respectively. The company also wants to set a competitive price just enough to give them $500 of monthly profit. How much should be the company's target price for the region (round your answer to two decimal places)