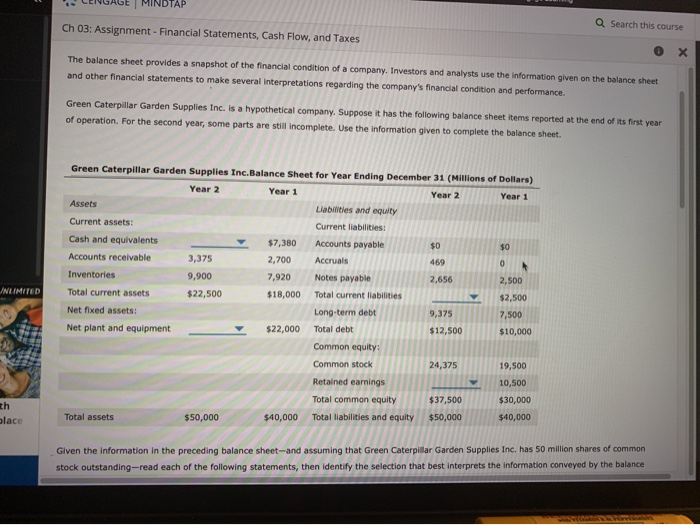

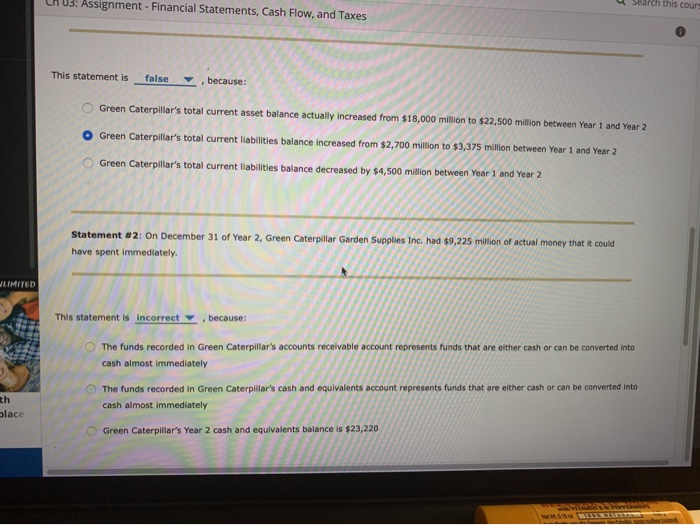

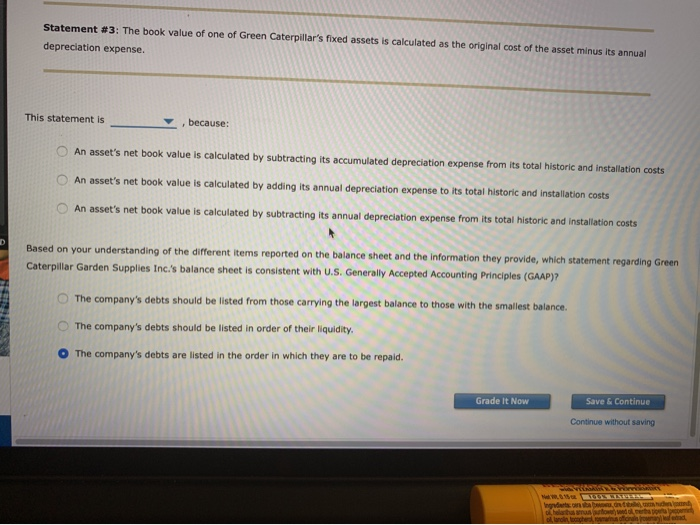

NDTAP Q Search this course Ch 03: Assignment - Financial Statements, Cash Flow, and Taxes The balance sheet provides a snapshot of the financial condition ofa company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance. Green Caterpillar Garden Supplies Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Green Caterpillar Garden Supplies Inc.Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Assets Liabilities and equity Current assets: Current liabilities: Cash and equivalents $7,380 Accounts payable $0 $0 Accounts receivable 3,375 2,700 Accruals 469 Inventories 9,900 7,920 Notes payable 2,656 2,500 NLIMITED Total current assets $22,500 $18,000 Total current liabilities $2,500 Net fixed assets: Long-term debt 9,375 7,500 Net plant and equipment $22,000 Total debt $12,500 $10,000 Common equity: Common stock 24,375 19,500 Retained earnings 10,500 Total common equity $37,500 $30,000 th olace Total liabilities and equity Total assets $50,000 $40,000 $50,000 $40,000 Given the information in the preceding balance sheet-and assuming that Green Caterpillar Garden Supplies Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance Assignment- Financial Statements, Cash Flow, and Taxes Earch this cours This statement is false because: Green Caterpillar's total current asset balance actually increased from $18,000 million to $22,500 million between Year 1 and Year 2 O Green Caterpillar's total current liabilities balance increased from $2,700 million to $3,375 million between Year 1 and Year 2 Green Caterpillar's total current liabilities balance decreased by $4,500 million between Year 1 and Year 2 Statement #2: On December 31 of Year 2, Green Caterpillar Garden Supplies Inc. had $9,225 million of actual money that it could have spent immediately. LIMITED This statement is incorrect , because: The funds recorded in Green Caterpillar's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately The funds recorded in Green Caterpillar's cash and equivalents account represents funds that are either cash or can be converted into th cash almost immediately olace Green Caterpillar's Year 2 cash and equlvalents balance is $23,220 Statement # 3 : The book value of one of Green Caterpillar's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense. This statement is because: An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs D Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Green Caterpillar Garden Supplies Inc.'s balance sheet is consistent with U.S. Generally Accepted Accounting Principles (GAAP)? The company's debts should be listed from those carrying the largest balance to those with the smallest balance. The company's debts should be listed in order of their liquidity. O The company's debts are listed in the order in which they are to be repaid. Save & Continue Grade It Now Continue without saving Ingndants cars ab t ds ohelantha amaarto d oerba po eed ol lanolin, tooapher offnoay)