Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ne with one of two newer more effective models. The existing crane is 3 years old, cost $32.000 and is being depreciated under MACRS using

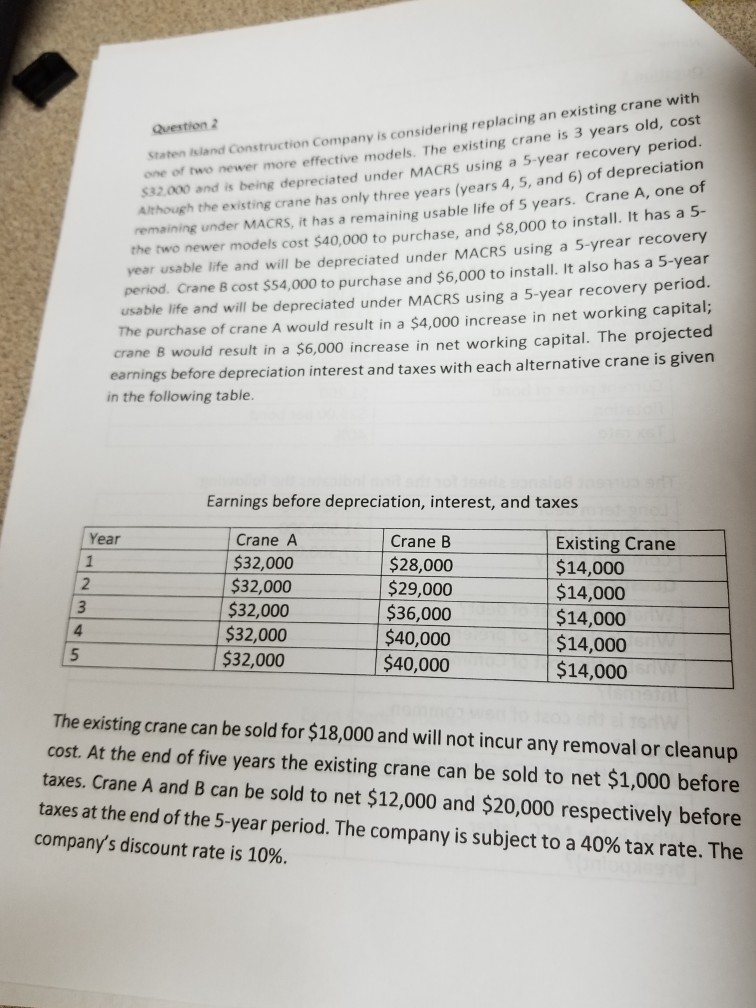

ne with one of two newer more effective models. The existing crane is 3 years old, cost $32.000 and is being depreciated under MACRS using a 5-year recovery period. Although the existing crane has only three years (years 4, 5, and 6) of depreciation remaining under MACRS, it has a remaining usable life of 5 years. Crane A, one of two newer models cost $40,000 to purchase, and $8,000 to install. It has a 5- and will be depreciated under MACRS using a 5-yrear recovery period. Crane B cost $54,000 to purchase and $6,000 to install. It also has a 5-year usable life and will be depreciated under MACRS using a 5-year recovery period. The purchase of crane A would result in a $4,000 increase in net working capital; crane B would result in a $6,000 increase in net working capital. The projected Question 2 Staten island Construction Company is considering replacing an existing cra the year usable life earnings before depreciation interest and taxes with each alternative crane is given in the following table. Earnings before depreciation, interest, and taxes Year Crane A 32,000 $32,000 $32,000 $32,000 Crane B $28,000 $29,000 $36,000 $40,000 $40,000 Existing Crane $14,000 2 14,000 $14,000 $14,000 $14,000 5 $32,000 The existing crane can be sold for $18,000 and will not incur any removal or cleanup cost. At the end of five years the existing crane can be sold to net $1,000 before taxes. Crane A and B can be sold to net $12,000 and $20,000 respectively before taxes at the end of the 5-year period. The company is subject to a 40% tax rate. The company's discount rate is 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started