Question

Neamu NOC isto! Fred Murray has been working as a manager in a major music club earning 35,000 per year. He is provided with

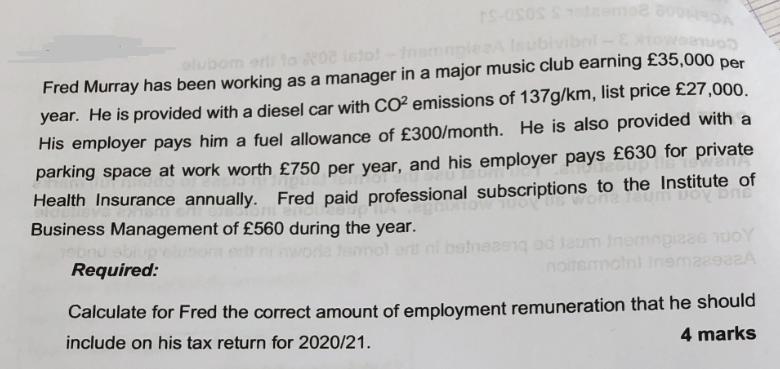

Neamu NOC isto! Fred Murray has been working as a manager in a major music club earning 35,000 per year. He is provided with a diesel car with CO emissions of 137g/km, list price 27,000. His employer pays him a fuel allowance of 300/month. He is also provided with a parking space at work worth 750 per year, and his employer pays 630 for private Health Insurance annually. Fred paid professional subscriptions to the Institute of Business Management of 560 during the year. batnaasn od Jaum Inemogizas 00 noitem ema2982A Required: Calculate for Fred the correct amount of employment remuneration that he should 4 marks include on his tax return for 2020/21.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the employment remuneration that Fred should include on his tax return for 202021 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Federal Income Taxation In Canada

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

33rd Edition

1554965020, 978-1554965021

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App