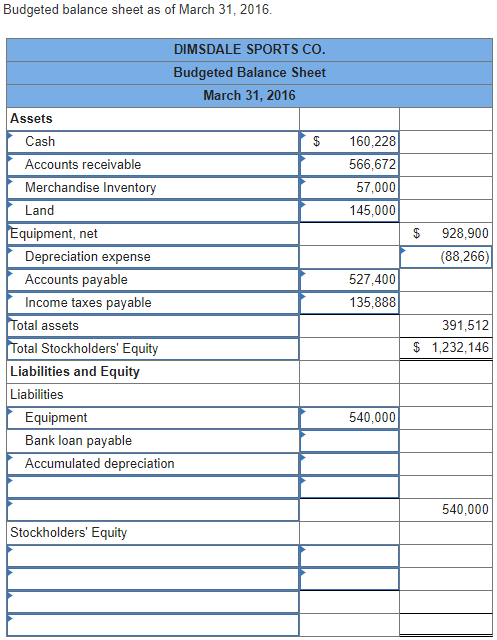

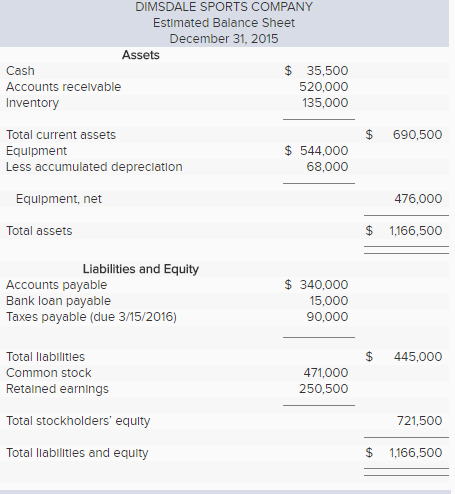

| Near the end of 2015, the management of Dimsdale Sports Co., a merchandising company, prepared the following estimated balance sheet for December 31, 2015.

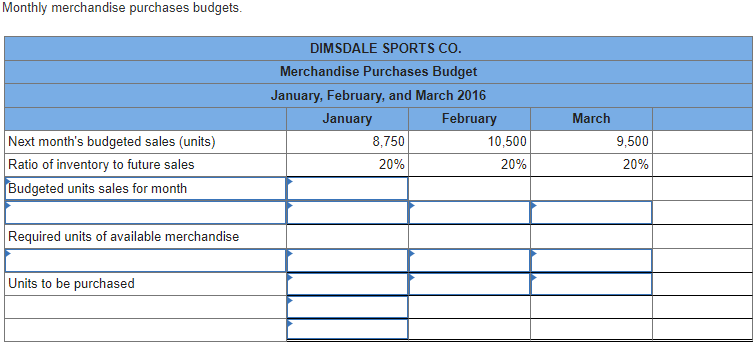

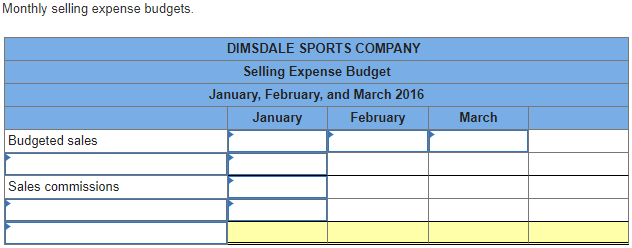

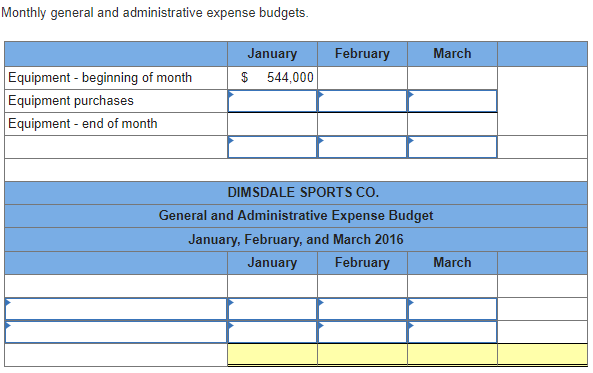

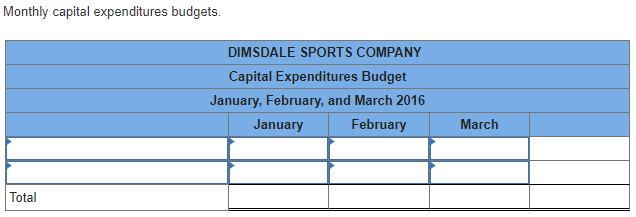

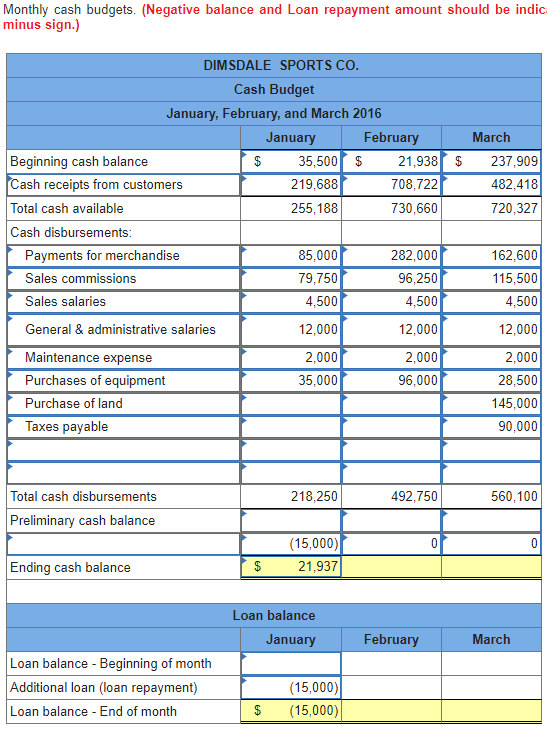

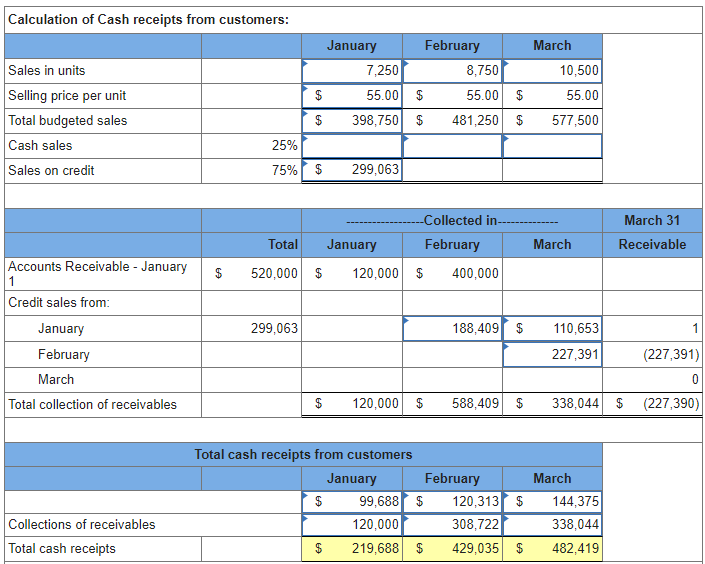

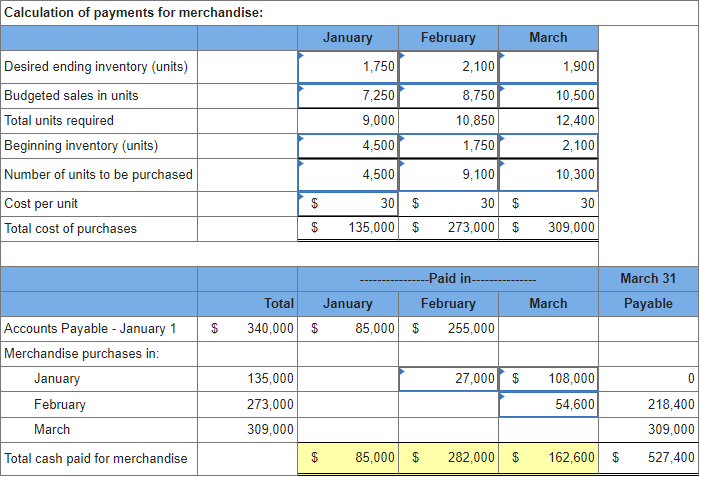

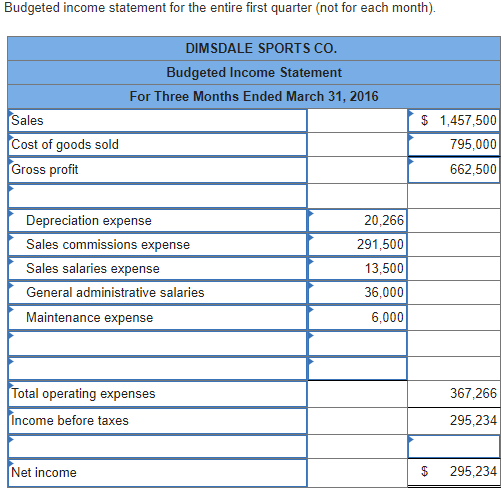

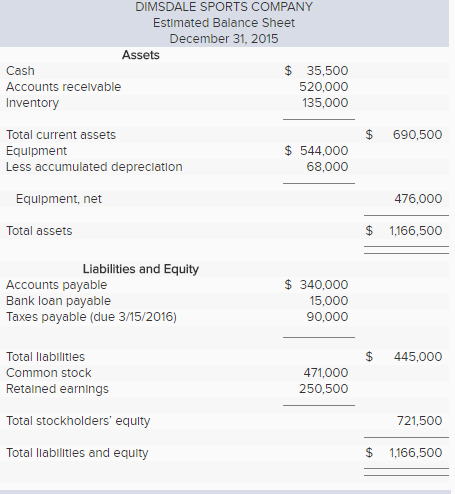

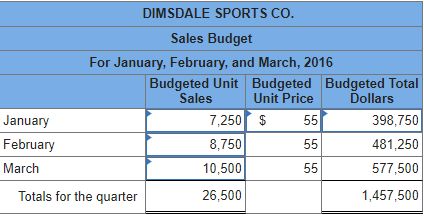

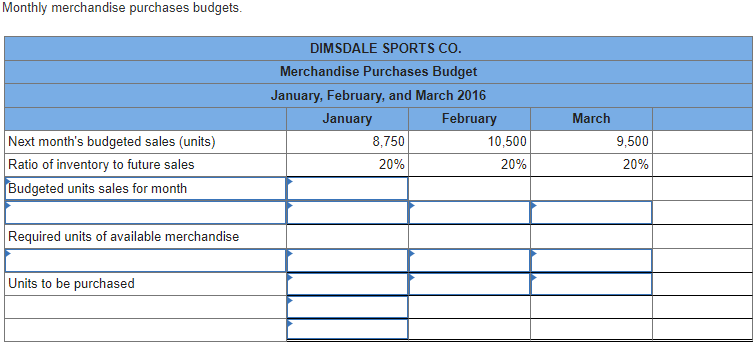

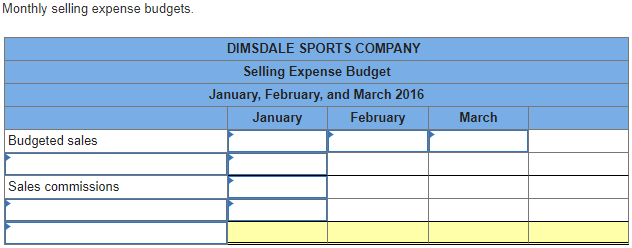

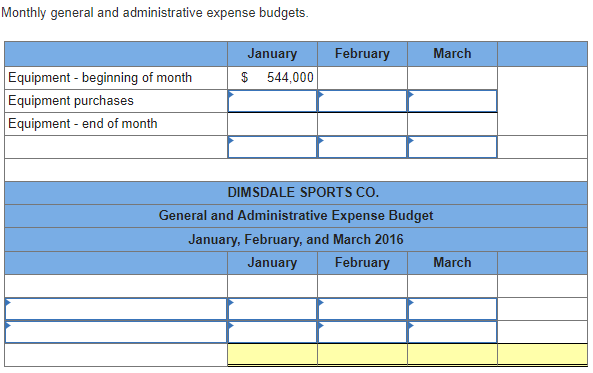

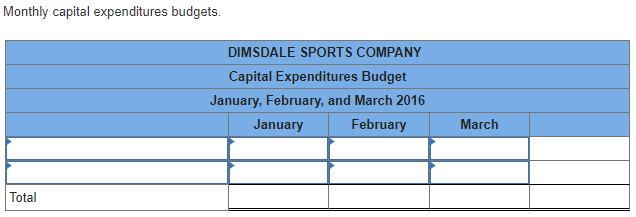

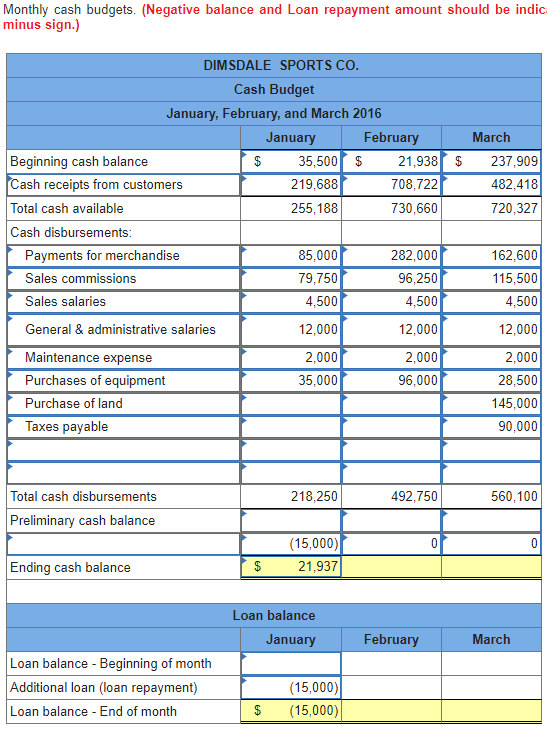

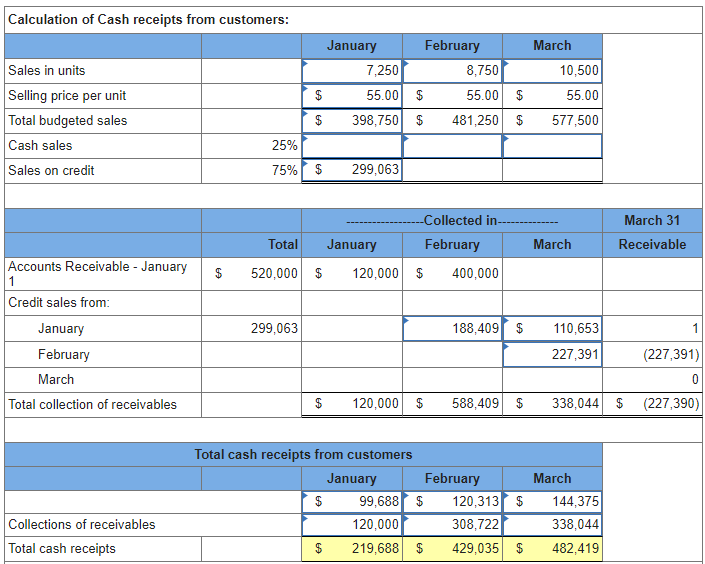

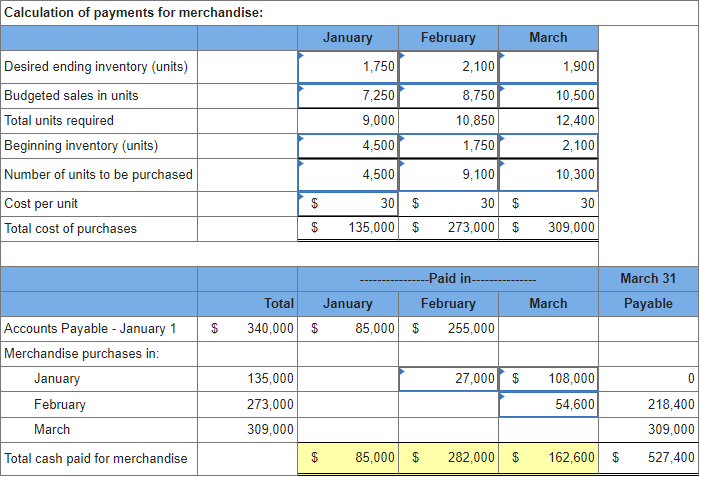

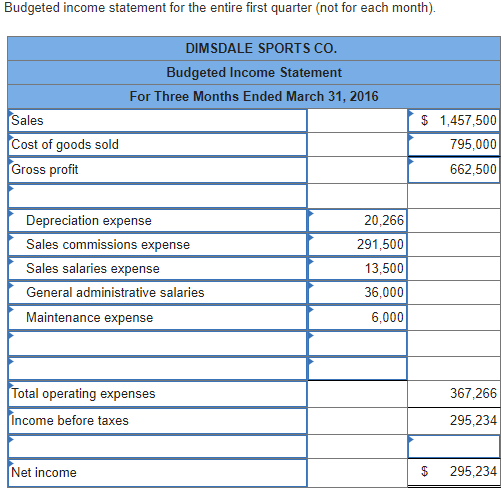

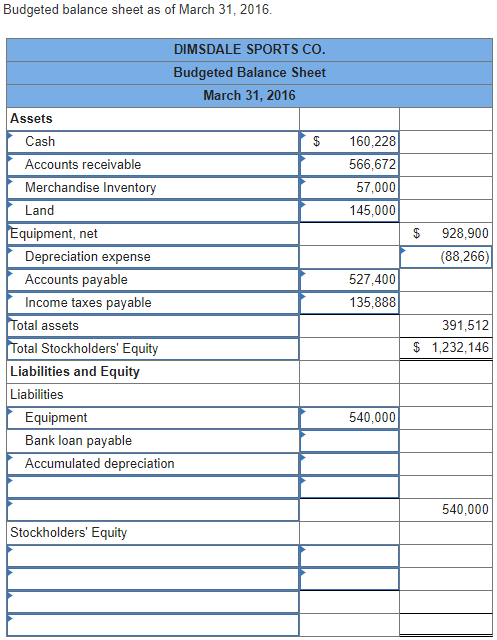

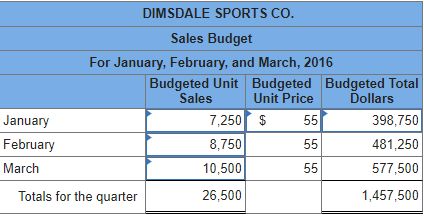

| To prepare a master budget for January, February, and March of 2016, management gathers the following information. | | a. | Dimsdale Sports single product is purchased for $30 per unit and resold for $55 per unit. The expected inventory level of 4,500 units on December 31, 2015, is more than managements desired level for 2016, which is 20% of the next months expected sales (in units). Expected sales are: January, 7,250 units; February, 8,750 units; March, 10,500 units; and April, 9,500 units. | | b. | Cash sales and credit sales represent 25% and 75%, respectively, of total sales. Of the credit sales, 63% is collected in the first month after the month of sale and 37% in the second month after the month of sale. For the December 31, 2015, accounts receivable balance, $120,000 is collected in January and the remaining $400,000 is collected in February. | | c. | Merchandise purchases are paid for as follows: 20% in the first month after the month of purchase and 80% in the second month after the month of purchase. For the December 31, 2015, accounts payable balance, $85,000 is paid in January and the remaining $255,000 is paid in February. | | d. | Sales commissions equal to 20% of sales are paid each month. Sales salaries (excluding commissions) are $54,000 per year. | | e. | General and administrative salaries are $144,000 per year. Maintenance expense equals $2,000 per month and is paid in cash. | | f. | Equipment reported in the December 31, 2015, balance sheet was purchased in January 2015. It is being depreciated over eight years under the straight-line method with no salvage value. The following amounts for new equipment purchases are planned in the coming quarter: January, $35,000; February, $96,000; and March, $28,500. This equipment will be depreciated under the straight-line method over eight years with no salvage value. A full months depreciation is taken for the month in which equipment is purchased. | | g. | The company plans to acquire land at the end of March at a cost of $145,000, which will be paid with cash on the last day of the month. | | h. | Dimsdale Sports has a working arrangement with its bank to obtain additional loans as needed. The interest rate is 12% per year, and interest is paid at each month-end based on the beginning balance. Partial or full payments on these loans can be made on the last day of the month. The company has agreed to maintain a minimum ending cash balance of $21,788 in each month. | | i. | The income tax rate for the company is 37%. Income taxes on the first quarters income will not be paid until April 15. | | Required: | | Prepare a master budget for each of the first three months of 2016; include the following component budgets: Monthly sales budgets.  I have completed this ^ I have completed this ^

I've completed some of this ^

I submitted this same question earlier today only to get a partial answer. The previous answer was missing several steps. Can I please have this completed in it's entireity? Thanks! | |

I have completed this ^

I have completed this ^