Question

- Near the end of the current year, Sylvia Portman's only capital transaction realized during the year resulted in a $500 net short- term

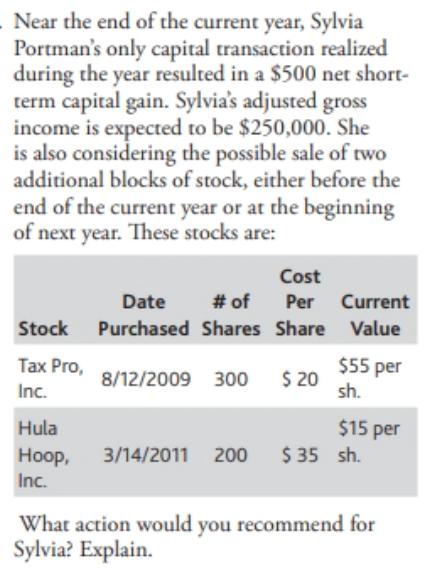

- Near the end of the current year, Sylvia Portman's only capital transaction realized during the year resulted in a $500 net short- term capital gain. Sylvia's adjusted gross income is expected to be $250,000. She is also considering the possible sale of two additional blocks of stock, either before the end of the current year or at the beginning of next year. These stocks are: Stock Tax Pro, Inc. Hula Hoop, Inc. Cost Per Current Value Date # of Purchased Shares Share 8/12/2009 300 $ 20 $55 per sh. $15 per 3/14/2011 200 $35 sh. What action would you recommend for Sylvia? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To recommend the best course of action for Sylvia regarding the possible sale of her stocks we need to consider several factors including the potentia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App