Answered step by step

Verified Expert Solution

Question

1 Approved Answer

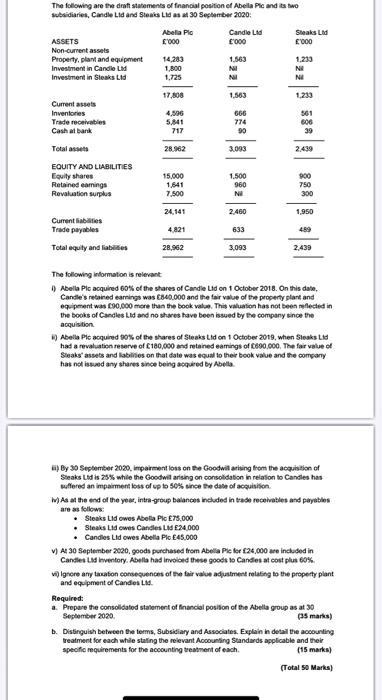

The following are the draft statements of financial position of Abella Pic and its two subsidiaries, Candle Lid and Steaks Lid as at 30

The following are the draft statements of financial position of Abella Pic and its two subsidiaries, Candle Lid and Steaks Lid as at 30 September 2020: Abela Pio Candie Ltd Sleaks Lid ASSETS L000 f'000 E'000 Non-current assets 1.233 Property, plant and equipment Investment in Candie Lid Investment in Steaks Lid 14,203 1,563 1,800 NI NI 1,725 N N 178 1,233 1,563 Current assets 561 Inventories Trade receivables Cash at bark 4,506 SM1 666 774 90 717 39 Total assets 28.962 3.003 2,439 EQUITY AND LIABILITIES Equity shares Retained eamings Revaluation surplus 15,000 1,641 7,500 1,500 960 900 750 300 NI 24,141 2400 1,950 Current labities Trade payables 4.821 633 489 Total equity and liabilies 28,962 3,093 2,439 The following information is relevant ) Abella Pic acquired 60% of the shares of Candie Lid on 1 October 2018. On this date, Cande's retained earmings was C840.000 and the fair value of the property plant and equipment was 90,000 more than the book value. This valuation has not been neflected in the books of Candles Lid and no shares have been issued by the company since the acquisition ) Abella Pic acquired 90% of the shares of Steaks Lid on 1 October 2019, when Sleaks Lid had a revaluation reserve of C180,000 and retained eamings of Co90,000, The fair value of Seaks' assets and kabiliies on that date was equal to their book value and the oompany has nol issued any shares since being acquired by Abella By 30 September 2020, impairment loss on the Goodwill arising from the acquisition of Steaks Lid is 25% while the Goodwi arising on consolidation in relation to Candles has suffered an impairment loss of up to 50% since the date of acquisiton. MAs at the end of the year, intra-group balances included in trade receivables and payebles are as follows Steaks Lid owes Abela Pic E75,000 Steaks Lid owes Candles LId E24,000 Candles Lid owes Abella Pio E45.000 V) At 30 September 2020, goods purchased from Abela Pic for 24,000 are included in Candles Lid inventory. Abella had invoioed these goods to Candes at cost plus 60%. v lgnore any taxaton consequences of the fair value adjustment relating to the property plant and equipment of Candes Ltd. Required: a. Propare the consolidatod statement of financial positon of the Abella group as at 30 September 2020. (a5 marks) b. Distinguish betwcen the terms, Subsidiary and Associates. Explain in detail the accounting treatment for each while stating the reievant Accounting Standards applicable and their specific requirements for the accounting treatment of each. (15 marks) (Total 50 Marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer a CONSOLIDATED FINANCIAL STATEMENT OF ABELLA PLC AS OF 30 SEPTEMBER 2020 PARTICULARS AMOUNT ASSETS NonCurrent Assets Property Plant and Equipme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started