Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need 1 and 2 asap thanks 1. Following is an inventory acquisition schedule for ABC CO. for 2020: Unit Units Cost Beg. Inventory 500 $

need 1 and 2 asap thanks

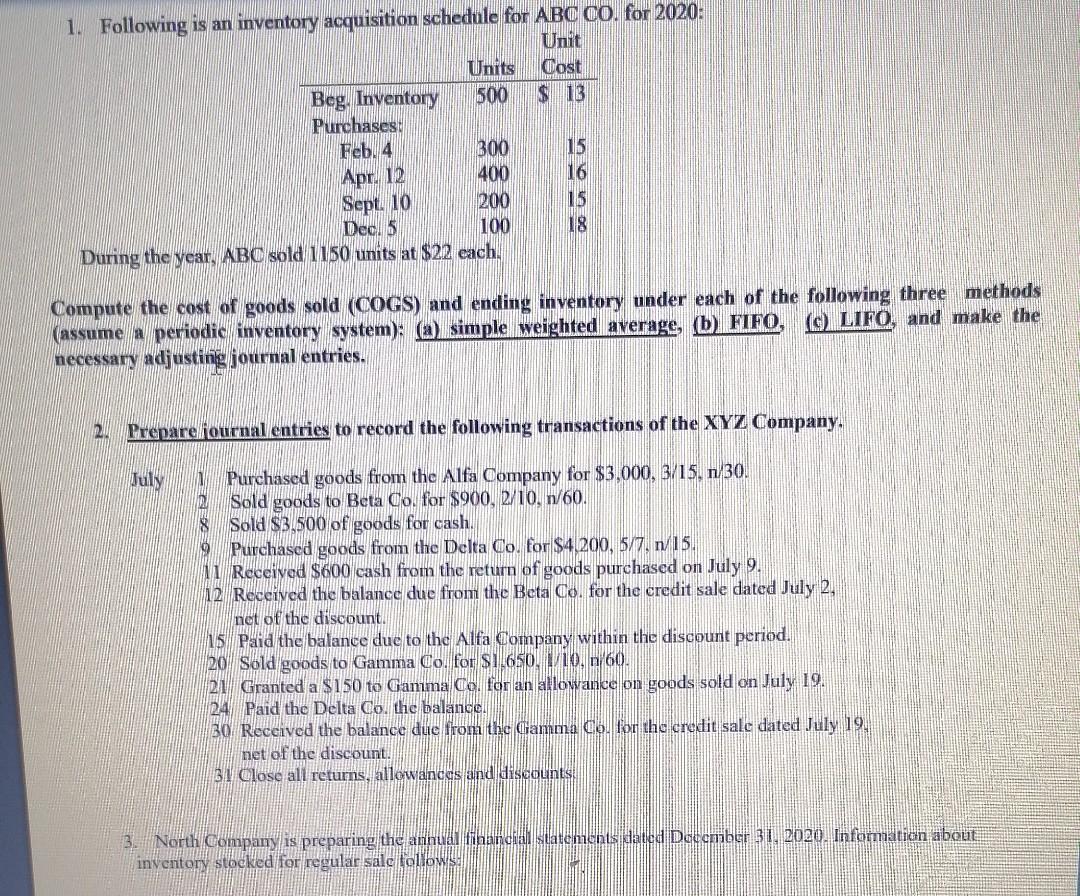

1. Following is an inventory acquisition schedule for ABC CO. for 2020: Unit Units Cost Beg. Inventory 500 $ 13 Purchases: Feb. 4 300 15 400 16 Sept. 10 200 15 Decl 5 100 18 During the year, ABC sold 1150 units at $22 each Apr. 12 Compute the cost of goods sold (COGS) and ending inventory under each of the following three methods (assume a periodic inventory system): a simple weighted average, b) FIFO, CLIFO, and make the necessary adjusting journal entries. 2. Prepare fournal entries to record the following transactions of the XYZ Company. July Purchased goods from the Alfa Company for $3,000, 3/15, n 30. Sold goods to Beta Co, for $900, 2/10, n/60. Sold $3.500 of goods for cash. Purchased goods from the Delta Co, for $4 200, 5/7. n/15. II Received $600 cash from the return of goods purchased on July 9. 12 Received the balance due from the Beta Co. for the credit sale dated July 2, net of the discount 15 Paid the balance due to the Alfa Company within the discount period. 20 Sold goods to Gamma Co, for $1.650. O. n 60. 21 Granted a $150 to Gamma Col for an allowance on goods sold on July 19. 24 Paid the Delta Co. the balance B0 Received the balance due from the Gamme Co. Tor the credit sale dated July 19, net of the discount BT Close all returns, allowances and discounts 3. North Company is preparing the annuan financial statements dated December 31, 2020. Information about inventory stocked for regular sale follows: 1. Following is an inventory acquisition schedule for ABC CO. for 2020: Unit Units Cost Beg. Inventory 500 $ 13 Purchases: Feb. 4 300 15 400 16 Sept. 10 200 15 Decl 5 100 18 During the year, ABC sold 1150 units at $22 each Apr. 12 Compute the cost of goods sold (COGS) and ending inventory under each of the following three methods (assume a periodic inventory system): a simple weighted average, b) FIFO, CLIFO, and make the necessary adjusting journal entries. 2. Prepare fournal entries to record the following transactions of the XYZ Company. July Purchased goods from the Alfa Company for $3,000, 3/15, n 30. Sold goods to Beta Co, for $900, 2/10, n/60. Sold $3.500 of goods for cash. Purchased goods from the Delta Co, for $4 200, 5/7. n/15. II Received $600 cash from the return of goods purchased on July 9. 12 Received the balance due from the Beta Co. for the credit sale dated July 2, net of the discount 15 Paid the balance due to the Alfa Company within the discount period. 20 Sold goods to Gamma Co, for $1.650. O. n 60. 21 Granted a $150 to Gamma Col for an allowance on goods sold on July 19. 24 Paid the Delta Co. the balance B0 Received the balance due from the Gamme Co. Tor the credit sale dated July 19, net of the discount BT Close all returns, allowances and discounts 3. North Company is preparing the annuan financial statements dated December 31, 2020. Information about inventory stocked for regular sale followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started